Picture supply: Getty Photographs

A chunky month-to-month earnings with out working for it sounds nice. However realistically, it could require £480,000 invested within the inventory market in an effort to earn, say, £2,000 a month as a second earnings. That’s constructed on proudly owning a portfolio invested in shares or bonds that collectively delivers a 5% yield.

After all, until completely deliberate, these shares are unlikely to truly ship £2,000 each month. Shares usually pay their dividends a few times a 12 months, and this may end up in traders receiving extra in some months and fewer in others.

Nonetheless, the trail to reaching £24,000 a 12 months is lifelike. It’s simply not part of a get-rich-quick scheme. This takes time and perseverance.

Ranging from scratch

So what’s the method? Nicely, it requires a would-be investor to open a Shares and Shares ISA via any main UK brokerage. This half’s easy. Subsequent, they’d must commit to creating an everyday contribution to this account. On this case, £500 a month can be good.

Many novices begin by investing in funds that search to trace the efficiency of world shares or particular indexes. That is arguably the bottom danger approach to put money into the inventory market.

Nonetheless, some traders might search to beat the market. And this may doubtless contain investing in a extra selective group of shares with excessive potential or missed valuations.

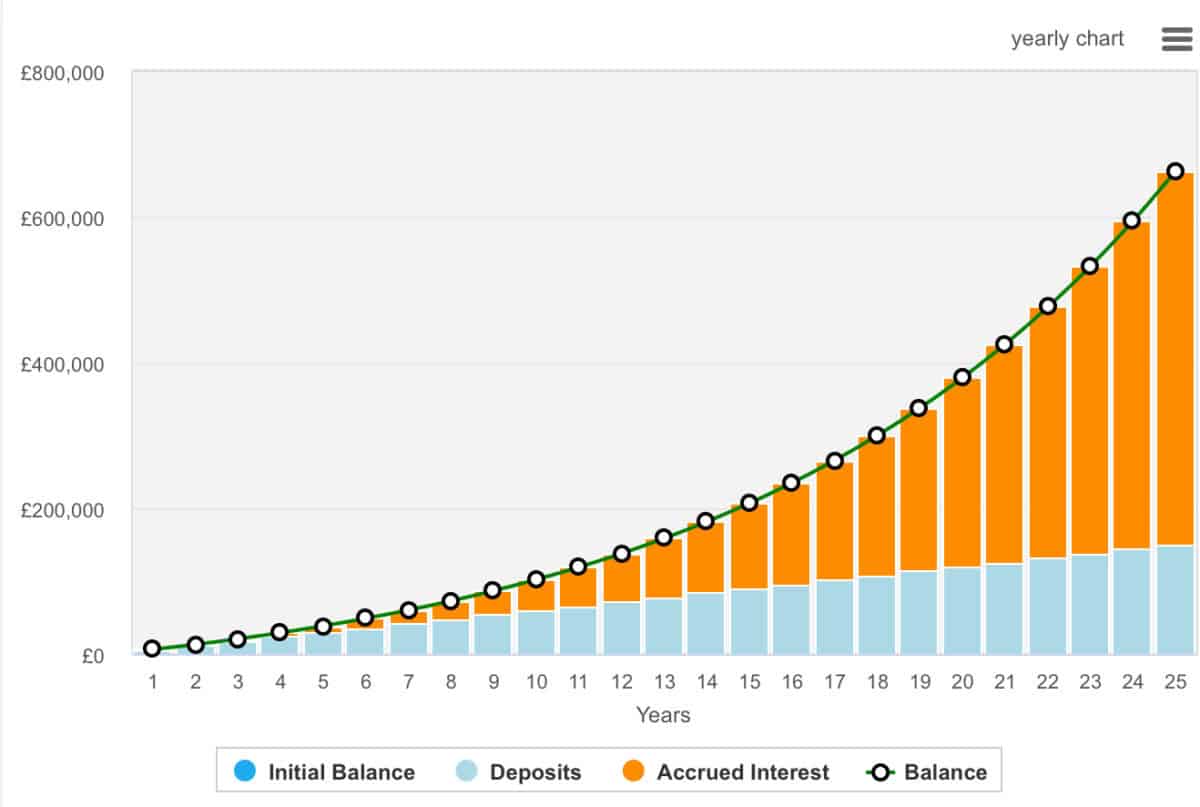

An skilled or well-informed investor might search to attain a ten% annualised return. Leveraging this £500 of month-to-month contributions, an investor might flip an empty portfolio into one price £480,000 in slightly over 22 years. Right here’s the way it compounds.

What’s extra, when achieved in a Shares and Shares ISA, the whole lot’s shielded from tax. There’s no capital good points to gradual our portfolio progress and no earnings tax to hammer our dividends.

Buyers merely should be conscious that poor choices may end up in them dropping cash.

Please word that tax therapy will depend on the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is offered for data functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Investing to beat the market

Scottish Mortgage Funding Belief‘s (LSE:SMT) a UK-based funding belief that goals to outperform the market by specializing in high-growth, modern firms worldwide.

Managed by Baillie Gifford, the belief invests in disruptive industries comparable to synthetic intelligence (AI), electrical automobiles (EVs), and digital platforms, choosing companies which have the potential to reshape their sectors.

This strategy contains each public equities and personal firms like SpaceX, with a versatile, long-term funding horizon.

The belief takes a world perspective, unconstrained by geography or sector, permitting it to again firms that signify the way forward for their industries wherever they could be. Whereas it has lowered its publicity to China, the belief continues to speculate globally.

Nonetheless, traders must be cautious that the belief practices gearing (borrowing to speculate). And whereas this may also help the belief construct its portfolio, it additionally magnifies losses when the market goes into reverse.

Nonetheless, its forward-looking, growth-oriented technique helps clarify its historic means to outperform world benchmarks. And this is the reason it’s a core a part of mine and my daughter’s portfolios. I completely imagine it’s price contemplating.