Bitcoin’s mining issue surged to an all-time excessive of 127.6 trillion in August 2025. The transfer displays a continued growth of worldwide computational energy, securing the community.

Nonetheless, regardless of the elevated technical problem, miner profitability is quietly climbing, a uncommon dynamic analysts say might sign a brand new part within the Bitcoin (BTC) market cycle.

Bitcoin Mining Issue Hits Document Excessive

The subsequent mining issue adjustment, anticipated on August 9, is projected to decrease the metric barely to round 124.71 trillion.

Bitcoin Mining Issue. Supply: Coinwarz

This adjustment goals to convey the common block time again to the 10-minute goal, down from the present 10 minutes and 23 seconds.

These periodic recalibrations are elementary to Bitcoin’s design. They keep constant issuance and community stability regardless of fluctuations in hash price.

The anomaly, nevertheless, is that larger Bitcoin mining issue has not translated into squeezed margins for miners.

Fairly the alternative, community information displaying miner revenues have reached a post-halving peak of $52.63 million per exahash day by day.

Bitcoin Miner Income. Supply: ycharts.com

“Bitcoin Miners Income Per Day is at a present degree of 52.63M, down from 56.35M yesterday and up from 25.64M one yr in the past. This can be a change of -6.61% from yesterday and 105.3% from one yr in the past,” analysts at ychart.com indicated.

This can be a robust sign, contemplating rising power prices and an more and more aggressive mining taking part in subject.

In a latest publish, Blockware Intelligence, a Bitcoin mining analytics agency, highlighted this divergence.

“The bull case for Bitcoin mining? BTC/USD growing sooner than mining issue. Over the previous 12 months: > BTC/USD +75% > Mining Issue: +53%. Revenue margins for Bitcoin miners are growing,” the agency said in a latest publish.

Rising Revenue Margins Sign Bullish Shift

Traditionally, such a dynamic, the place the Bitcoin worth rises sooner than mining issue, has occurred through the early phases of bullish market cycles. Comparable patterns have been noticed in 2016 and once more in mid-2020, which preceded main worth rallies.

The rising profitability additionally displays deeper demand dynamics, with information displaying the present Kimchi premium in South Korea stands at +0.6%. Notably, this means a powerful regional urge for food for BTC.

Korean Kimchi Premium. Supply: CryptoQuant

Kimchi premium represents the value distinction between native exchanges and international spot markets.

That, paired with the deployment of extra environment friendly ASIC machines and rising institutional mining investments, suggests the mining sector is each wholesome and optimistic about Bitcoin’s medium-term trajectory.

Past miner margins, Bitcoin’s shortage narrative stays intact. With over 94% of the overall 21 million BTC already mined, the pioneer crypto’s stock-to-flow ratio now stands at roughly 120, double that of gold.

This long-term shortage positions Bitcoin as a hedge in opposition to inflation and financial debasement, at the same time as short-term worth motion stays subdued.

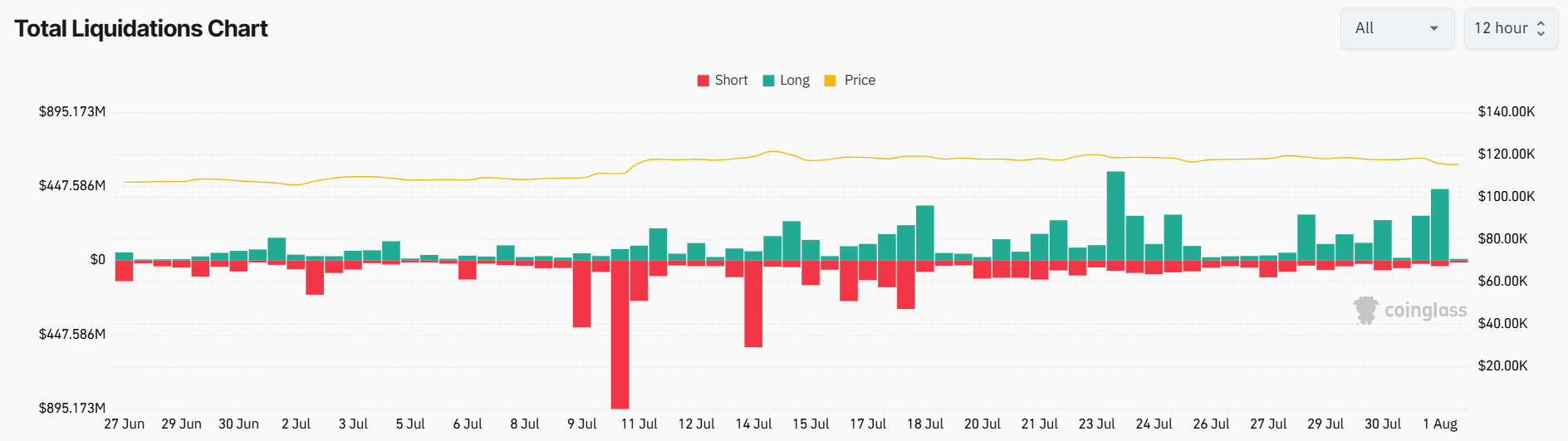

Nonetheless, the broader market has but to cost within the community’s enhancing fundamentals. After the July highs, Bitcoin retraced to ranges beneath $115,000, signaling a brief decoupling between on-chain technical well being and investor sentiment.

Bitcoin (BTC) Worth Efficiency. Supply: BeInCrypto

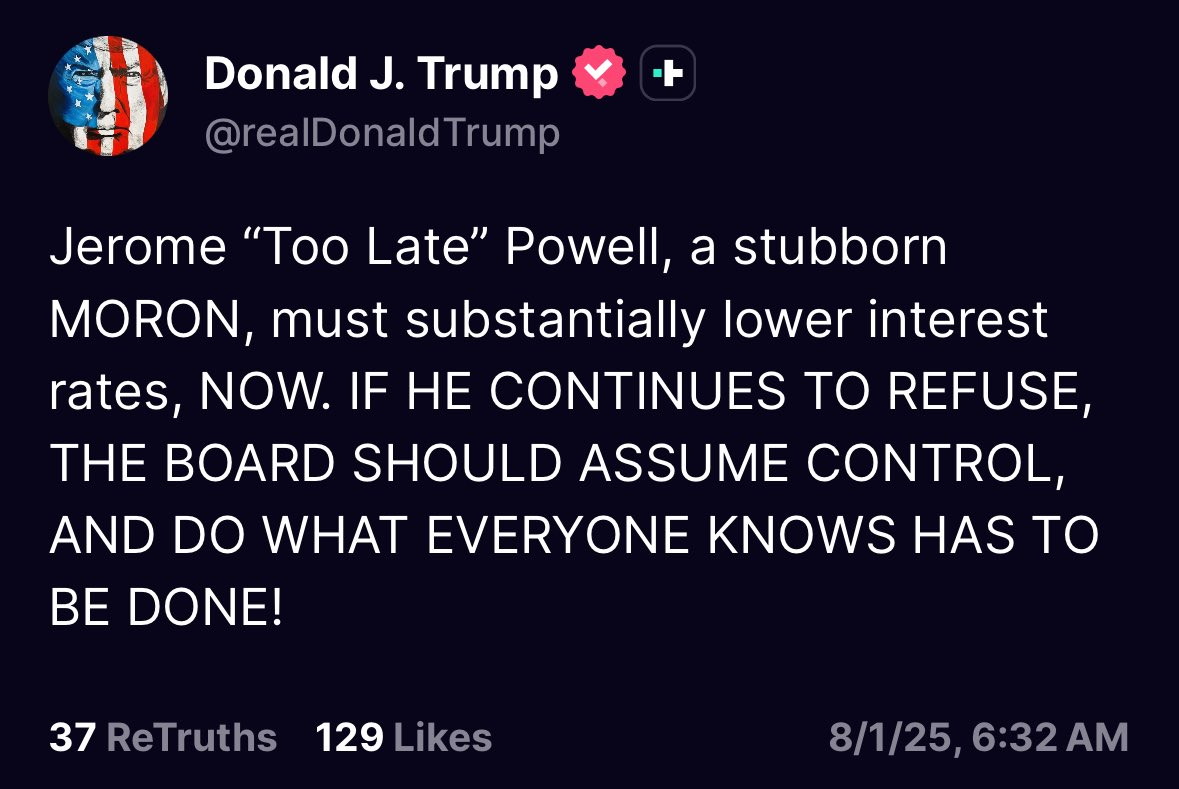

Analysts attribute this disconnect to macroeconomic headwinds, commerce insurance policies, and shifting capital flows. In the meantime, miners seem like front-running the remainder of the market.

The mixture of rising issue, growing margins, and robust regional demand might mark a turning level in mining economics and Bitcoin’s broader cycle. If historical past rhymes, the community’s rising power might quickly echo in worth.