Picture supply: Getty Photos

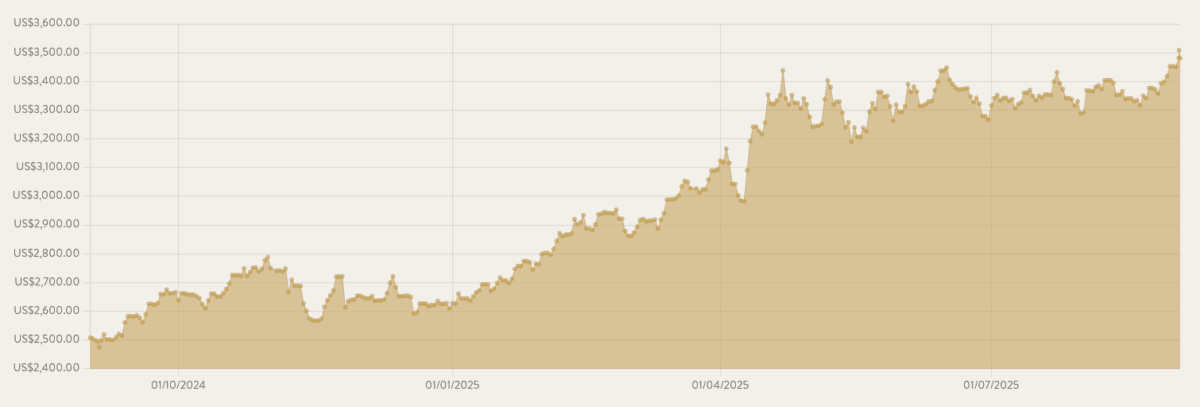

Gold costs are surging once more, hitting new document highs above $3,509 per ounce earlier on Tuesday (2 September). After falling within the wake of gold’s earlier peak in April, gold shares and exchange-traded funds (ETFs) are again on the cost.

The yellow metallic’s newest upswing is being pushed by hypothesis over Federal Reserve rate of interest cuts and the longer term independence of the US central financial institution. Additional positive aspects are extensively anticipated — JPMorgan has tipped gold costs to common $3,675 by the fourth quarter, and $4,000 by the center of 2026.

The omens look good for gold shares and funds, though in fact, additional value rises can’t be assured. Listed here are three to think about within the present market.

The simple route

The only manner is to buy an ETF that owns bodily gold (on this case, bars which might be locked up in vaults). This protects buyers the difficulty of getting to retailer and promote the metallic themselves. It additionally removes the necessity for them to purchase gold-producing shares to get publicity to the valuable metallic.

The iShares Bodily Gold (LSE:SGLN) is one I believe calls for severe consideration. It’s the UK’s largest gold fund, with complete property above $18.7bn, and enjoys distinctive liquidity, making it simpler for buyers to open and shut positions.

Moreover, its complete expense ratio is a really enticing 0.12%. Solely the Xtrackers Bodily Gold fund has a decrease value (0.11%).

However do not forget that costs might naturally fall if gold reverses course.

An affordable gold inventory

As I say, people may capitalise on buoyant gold costs by contemplating shares in metallic producers. Brazilian miner Serabi Gold (LSE:SRB) is one which’s caught my eye.

Holding gold shares is riskier than bodily metallic or bullion-backed ETFs. They’ll fall when gold costs fall, and likewise if operational issues happen. Serabi, as an example, might retrace if its drive to double manufacturing over the subsequent few years encounters points.

Nonetheless, this technique may imply larger returns, as producer income can rise way more sharply than the gold value throughout bull markets. What’s extra, holding gold shares may present an added bonus of dividend earnings. The dividend yield at Serabi is a strong 3.8%.

Immediately the shares commerce on a ahead price-to-earnings (P/E) ratio of three.9 instances. This cheapness offers substantial scope for additional value rises, for my part.

Better of each worlds

There are clearly benefits and drawbacks to purchasing gold-tracking funds and bullion-producing shares. I believe one enticing option to steadiness the danger and reward of each choices is to search for an ETF than holds shares in many various gold corporations.

This can be a technique I’ve really chosen myself by shopping for the L&G Gold Mining ETF (LSE:AUCP). This fund holds shares in 37 totally different gold corporations, which helps cut back the influence of shocks skilled by particular person corporations on shareholder returns. Nevertheless it doesn’t get rid of these dangers, in fact.

I like this specific fund due to its concentrate on bigger mining corporations like Newmont Mining and AngloGold Ashanti. These companies are usually way more secure than junior miners, whereas nonetheless offering the potential for substantial capital positive aspects.

It’s delivered an 80.6% return during the last 12 months. That’s considerably higher than the 38.9% enhance that gold costs have loved over the interval.