Picture supply: Getty Photographs

The FTSE 250 index of mid-cap shares has risen 5% in worth in 2025. That’s not dangerous, nevertheless it’s under the efficiency of different main international indexes. The FTSE 100 as an example is up 12% over the interval.

This underperformance displays a bleak outlook for the UK economic system, together with rising pessimism over rate of interest cuts as inflation rises. Roughly 40%-45% of the FTSE 250‘s earnings come from Britain, far larger than the internationally flavoured Footsie.

A few of the index’s high quality constituents have truly fallen sharply since 1 January, which I consider represents a possible dip-buying alternative. Listed below are two such shares I believe demand critical consideration at this time.

Bloomsbury Publishing

Bloomsbury Publishing‘s (LSE:BMY) shares have dived 29% within the 12 months thus far. Whereas its Harry Potter franchise stays as in style as ever, weak point in different elements of the enterprise has pulled the e book producer sharply decrease.

Extra particularly, poor gross sales at its tutorial publishing division have taken the shine off the agency’s different operations. Natural gross sales right here dropped 10% within the final monetary 12 months, it introduced in Might, due partially to budgetary pressures within the UK and US. The corporate’s did not recuperate floor since then.

Whereas these troubles might persist, I believe there’s so much to love at Bloomsbury that makes it price a detailed look. The long-term outlook for its tutorial publishing unit remians sturdy, helped by its gamechanging acquisition of high-margin operator Rowan & Littlefield.

However what actually attracts me in is the standard of its client division, and extra particularly its pedigree within the fast-growing fantasy and sci-fi fiction markets. Harry Potter isn’t the one star collection in its portfolio — Sarah J Maas’s A Courtroom of Thorns and Roses is one other one in every of its bestselling collection, with 75m gross sales and extra books contracted to return down the pipeline.

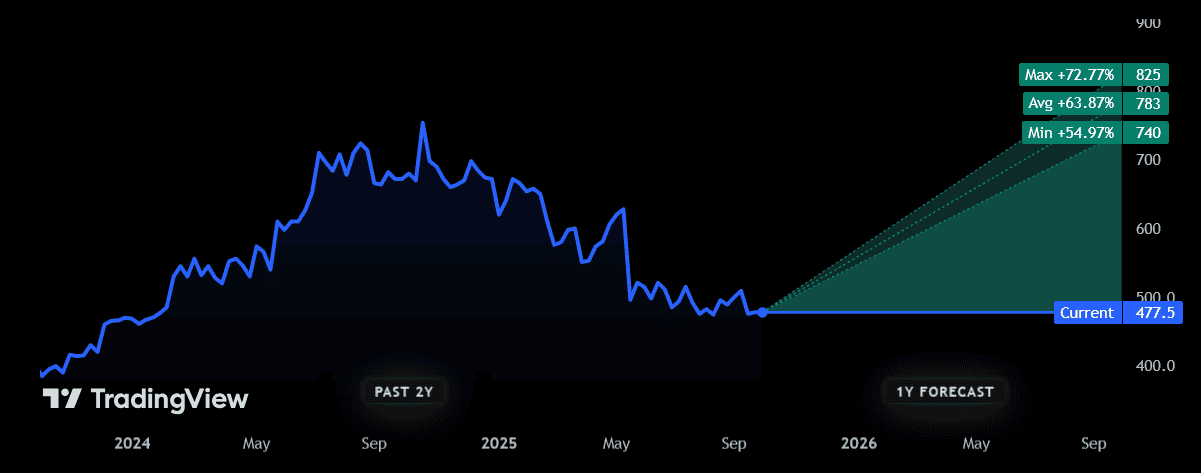

Metropolis analysts are united of their view that Bloomsbury shares will rebound over the following 12 months. The consensus view is for a 64% rise from present ranges, to 783p per share.

Ibstock

Ibstock‘s (LSE:IBST) share worth has dropped 21% since 1 January. It’s fallen on fears that the latest housing market restoration could possibly be flagging because the UK economic system struggles and inflation rises.

For long-term traders, nevertheless, I believe the brick producer’s funding case stays a strong one. It’s why I maintain the corporate in my very own Shares and Shares ISA.

Regardless of excessive competitors, the calls for of a rising inhabitants might supercharge product gross sales over the following decade. The federal government plans to construct 3m new houses to 2029 alone. Properly, Ibstock’s invested closely in capability to satisfy future demand.

However that’s not all that’s attracted me, as I believe the corporate may also anticipate sturdy off-take from the restore, upkeep and enchancment (RMI) sector. The UK housing inventory is likely one of the oldest on the earth, so there ought to be regular demand right here for years to return.

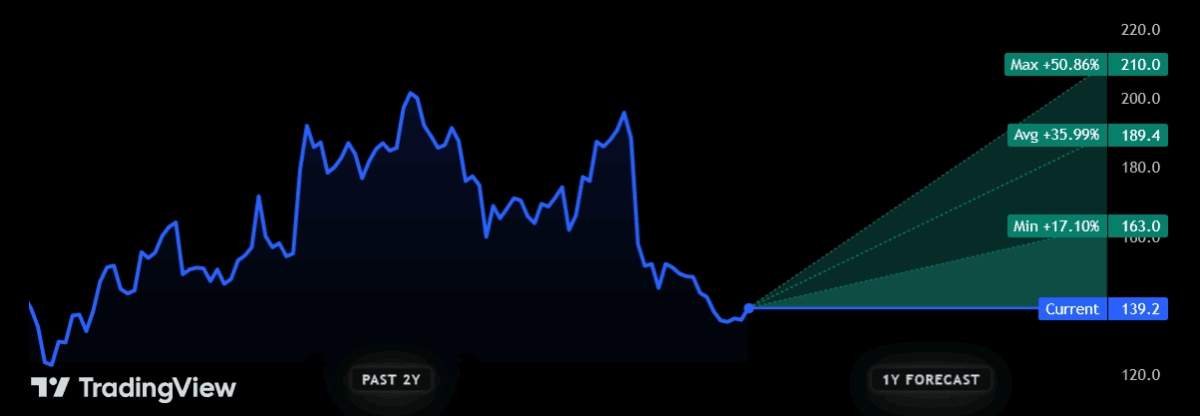

As with Bloomsbury, Metropolis brokers are united of their perception Ibstock shares will rebound over the following 12 months. The common share worth goal amongst them is 189.4p, representing a 36% premium from at this time’s ranges.