CAN is again above the $1 mark after buying and selling beneath it for months. With a landmark 50,000-unit ASIC order and new partnerships with SLNH and Luxor, sentiment is shifting quick. So is that this a wise entry level now?

The next visitor put up comes from BitcoinMiningStock.io, a public markets intelligence platform delivering knowledge on corporations uncovered to Bitcoin mining and crypto treasury methods. Initially printed on Oct. 15, 2025, by Cindy Feng.

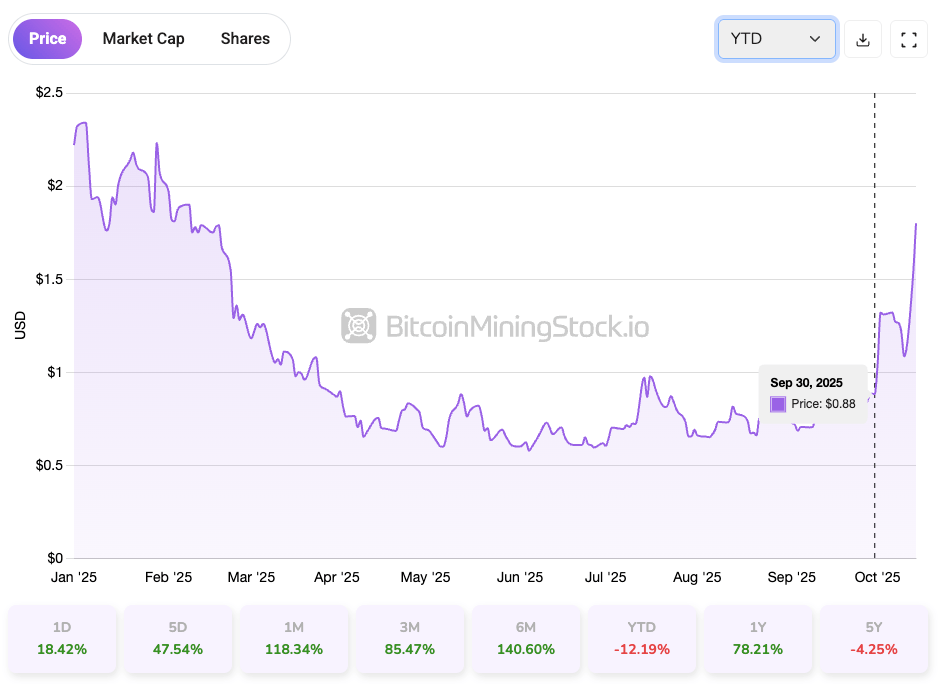

Just a few weeks in the past, a few of my followers pinged me about Canaan Inc. (NASDAQ: CAN). They argued its share value was a cut price in comparison with its OG friends – lots of whom have posted triple-digit positive factors this 12 months. Whereas these names have dominated headlines, Canaan has been quietly staging a comeback since final week.

Identified primarily for its Avalon ASIC mining machines, Canaan spent most of 2025 out of sync with the market’s fixation on HPC and AI infrastructure. On high of that, the continuing U.S.-China tariff battle pushed its inventory beneath $1 for months, elevating actual issues a few potential Nasdaq delisting.

However one thing shifted just lately. Since September 30, the inventory has clawed its manner again above $1 and stored climbing, due to a wave of company developments. Regardless of nonetheless exhibiting a -12.19% YTD efficiency, the momentum is clearly turning. So the true query is whether or not that is the sensible time to leap in. Let’s break it down.

Firm Overview: Extra Than Simply an ASIC Maker

Based in 2013, Canaan Inc. is a expertise firm headquartered in Singapore, with deep roots in China’s semiconductor ecosystem. Greatest identified for designing and manufacturing Avalon-branded ASIC Bitcoin mining machines, Canaan has step by step remodeled from a pure-play {hardware} supplier right into a extra diversified participant within the crypto mining sector.

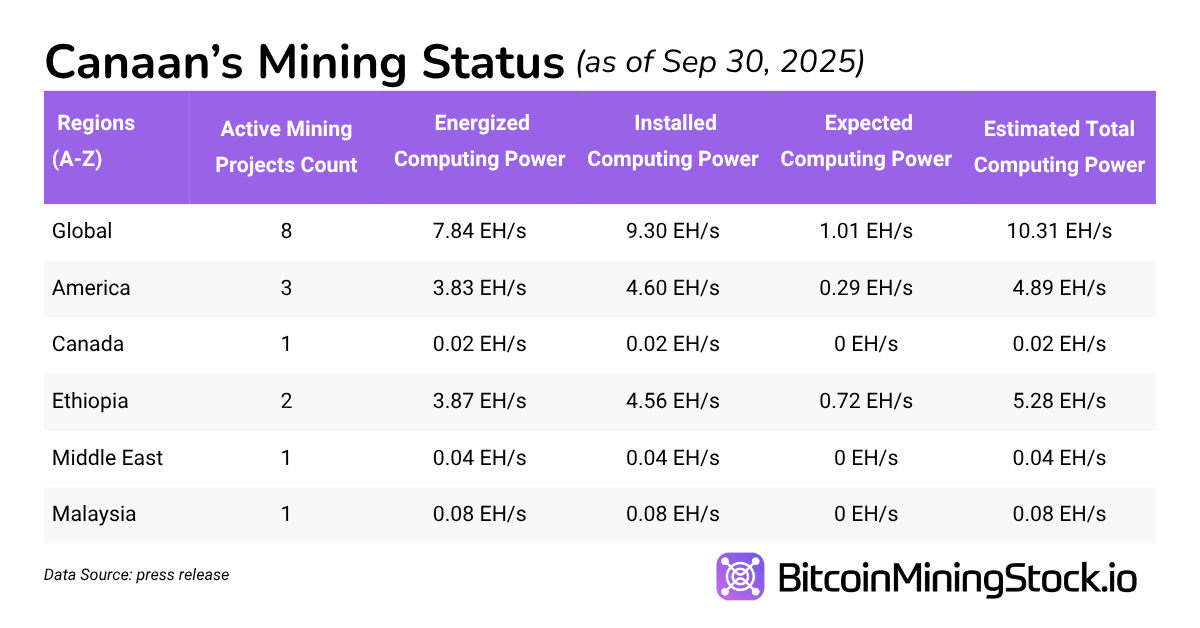

Self-Mining

As of September 2025, Canaan operates 9.30 EH/s of hash charge, primarily within the U.S. and Ethiopia. The self-mining capability can scale to 10.31 EH/s as soon as pending ASICs deliveries are put in. Since January this 12 months, Canaan reported ~87 bitcoin mined per thirty days. The income from this enterprise phase has been rising constantly since Q2 2024.

Bitcoin Treasury

Canaan holds 1,582 BTC as of September 30, 2025. In response to its Q2 incomes presentation, BTC is accrued by a combine of self-mining, {hardware} gross sales funds, and spot market purchases. The corporate additionally actively makes use of its Bitcoin holdings as collateral to fund R&D and {hardware} manufacturing, and even allocates a portion to short-term interest-bearing accounts to generate yield. Its Bitcoin treasury remains to be within the early levels, per CFO James Jin Cheng. Anyway, its Bitcoin treasury already ranks because the thirty fifth largest amongst public corporations globally on our web site. By way of publicity, Canaan’s Bitcoin holdings signify 20.29% of its market cap, a ratio that’s much like some bigger gamers like Riot Platforms and CleanSpark.

Retail Dwelling Mining Gear

Canaan has just lately launched pre-assembled Avalon Miner kits focused at residence miners and small-scale operations. These kits are designed for simple deployment and embrace plug-and-play containerized models. Whereas present income from this line stays marginal, it might strengthen model visibility and assist cut back reliance on risky institutional demand cycles.

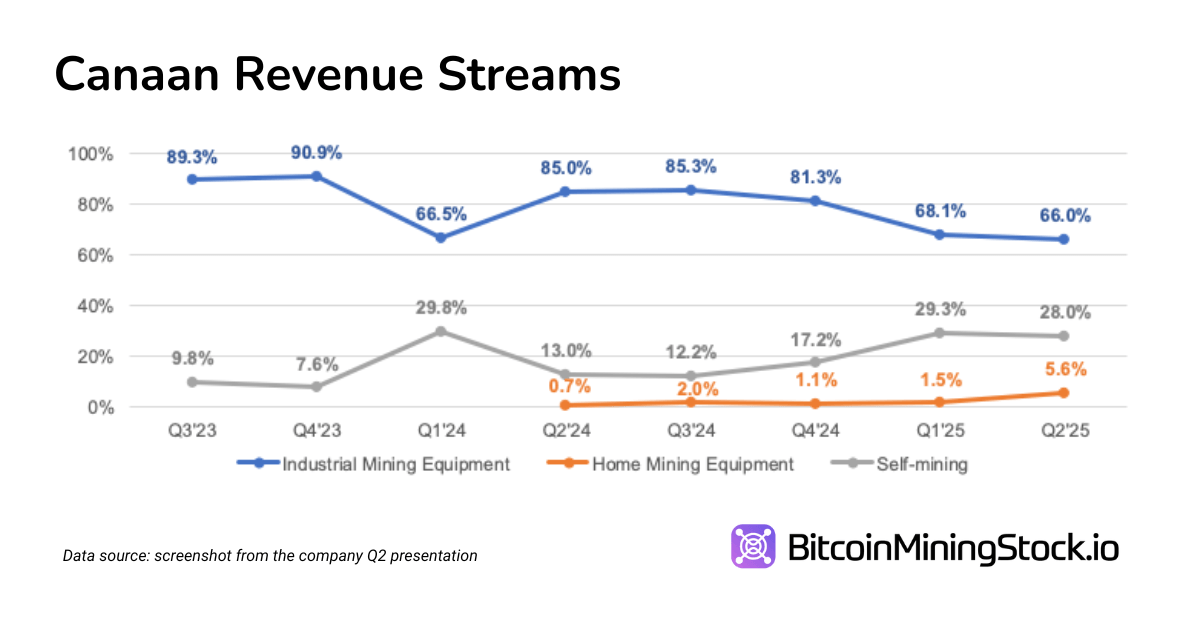

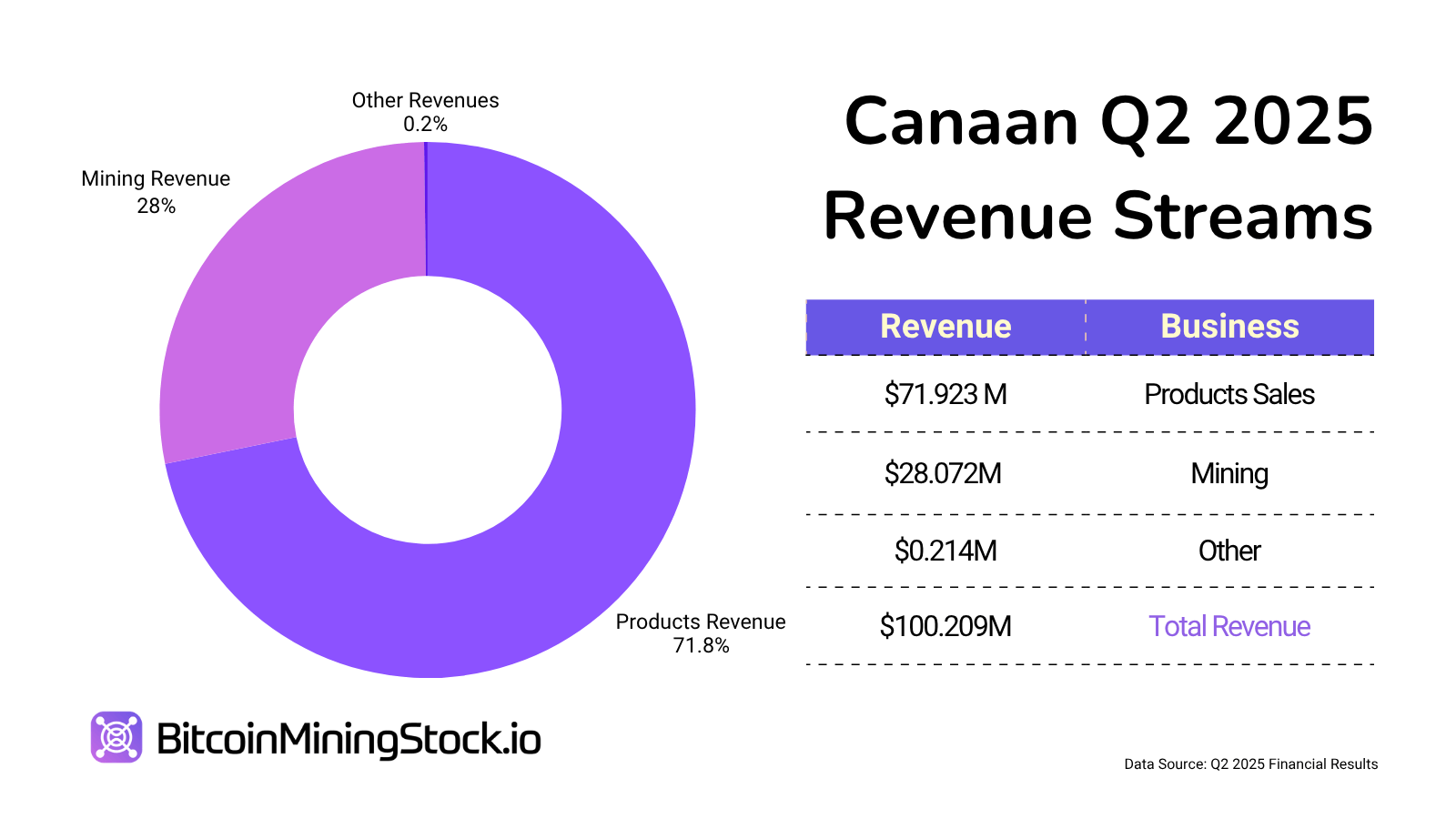

In Q2 2025, Canaan generated $73.9M in complete income. Of that, 71.7% got here from {hardware} gross sales, 28.1% from mining operations, and fewer than 1% from different companies.

Current Catalysts: The Momentum Is Constructing

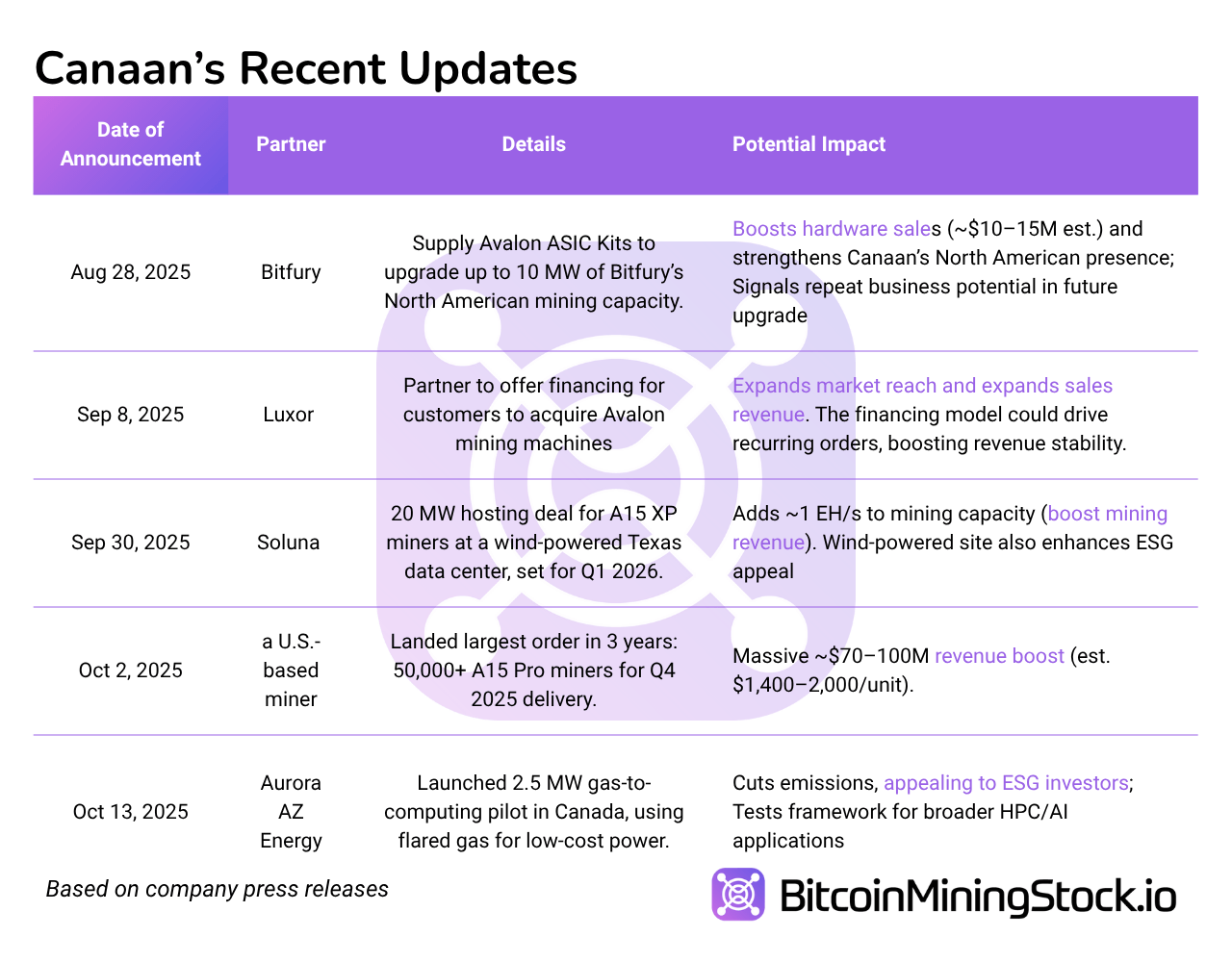

Investor sentiment round Canaan is shifting, due to a string of enterprise wins and strategic partnerships. The current updates paint an image of an organization gaining traction, every deal not solely provides to top-line potential but additionally helps gasoline renewed investor curiosity. To make issues simpler to trace, right here’s a timeline of key enterprise updates:

Considered collectively, these developments recommend that Canaan is doubling down on North America. A number of offers level to a renewable power pivot, which might attraction to ESG-focused traders. Most significantly, these strikes will present up within the numbers. The corporate is guiding for $125–145M in Q3 income, presenting 25%-45% QoQ progress.

Is CAN Inventory a Discount at $1.80?

At $1.80, Canaan’s valuation appears compelling in comparison with friends, however let’s see whether or not it’s nonetheless a cut price.

As of Oct 15, 2025, Canaan holds a market cap of $881.96 million. After adjusting for $179 million in Bitcoin (1582 BTC x $112,833) and 11.63 million in Ethereum (2830 ETH x $4111) , $65.9 million in money, and $268.5 million in debt, the enterprise worth (EV)* sits at round $894 million. This gives a cleaner view of the corporate’s core working worth, excluding treasury belongings.

*For my calculation: EV = Present Market Cap + Whole Debt – Money & Money Equivalents – Honest Worth of Bitcoin Holdings – Honest Worth of Ethereum Holdings. Debt and money figures are sourced from the most recent quarterly report, whereas the honest worth of crypto belongings relies on present spot costs and the corporate’s most up-to-date disclosed holdings.

Canaan has a guided Q3 2025 income between $125–145 million, implying an annualized income run charge of $500–580 million. Primarily based on these projections, the corporate trades at an EV/income a number of of 1.5x–1.8x, beneath the two.5x–4x vary typically seen amongst U.S.-listed friends throughout bullish cycles.

From a profitability lens, Canaan posted $25.3 million in adjusted EBITDA in Q2, annualizing to roughly $100 million. This interprets to an EV/EBITDA a number of of ~8.9x, modest in comparison with top-tier miners buying and selling at 10–20x below favorable market situations. That leaves room for a number of growth, if margins maintain or investor sentiment strengthens.

On an asset foundation, the corporate reported ~$484.5 million in web belongings excluding crypto and $592.1 million together with its crypto holdings. This leads to a price-to-book (P/B) ratio of two.7x to 4x relying on therapy of digital belongings. These are usually not deep-value ranges, however they’re additionally not overstretched, particularly provided that a lot of Canaan’s current partnership offers haven’t absolutely hit the financials.

Finally, at $1.80, the inventory will not be deeply discounted but additionally not aggressively priced. The market is recognizing improved fundamentals and near-term income visibility, however has not but assigned a premium for progress or broader strategic upside.

Closing Ideas

Canaan is evolving from a {hardware} provider to a extra vertically built-in crypto mining participant, with rising self-mining operations, a significant crypto treasury (1,582 BTC and a pair of,830 ETH), and increasing international partnerships. The current 50,000-unit miner order ought to enhance income meaningfully within the coming quarters and assist enhance valuation metrics..

That stated, challenges stay. Canaan posted an $11.1 million web loss in Q2, and except Bitcoin costs keep elevated or price efficiencies kick in, bottom-line profitability could stay below strain. Excessive working prices and depreciation proceed to weigh on margins.

Geopolitical dangers additionally linger, significantly round U.S. tariffs on Chinese language tech exports. Whereas Canaan is working to mitigate this by new manufacturing traces within the U.S. and Malaysia, execution threat stays.

Finally, the subsequent few quarters-particularly Q3 outcomes (guiding $125–145M), Bitcoin value route, and community problem developments, will probably decide whether or not Canaan earns a market rerating. For traders betting on a broader crypto bull cycle, this inventory affords potential-but not with out its dangers.