Microsoft’s $9.7 billion contract with a Texas miner reveals the brand new math pushing crypto infrastructure towards AI, and what it means for the networks left behind.

IREN’s November 3 announcement collapses two transactions right into a single strategic pivot. The primary is a five-year, $9.7 billion cloud companies contract with Microsoft, whereas the second is a $5.8 billion tools cope with Dell to supply Nvidia GB300 programs.

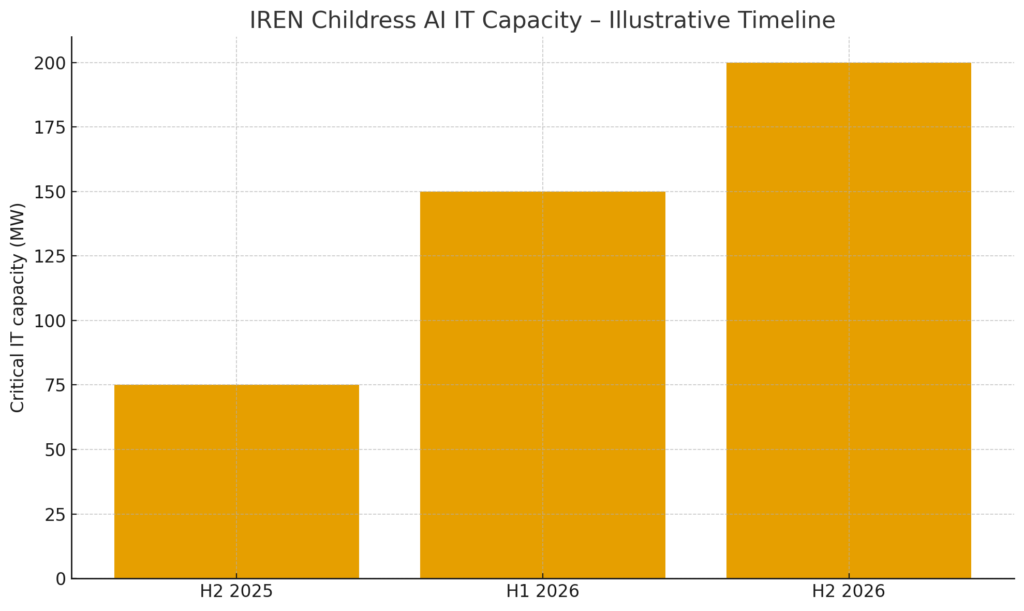

The mixed $15.5 billion dedication converts roughly 200 megawatts of important IT capability at IREN’s Childress, Texas campus from potential Bitcoin mining infrastructure into contracted GPU internet hosting for Microsoft’s AI workloads.

Microsoft included a 20% prepayment, roughly $1.9 billion upfront, signaling urgency round a capability constraint the corporate’s CFO flagged as extending a minimum of by means of mid-2026.

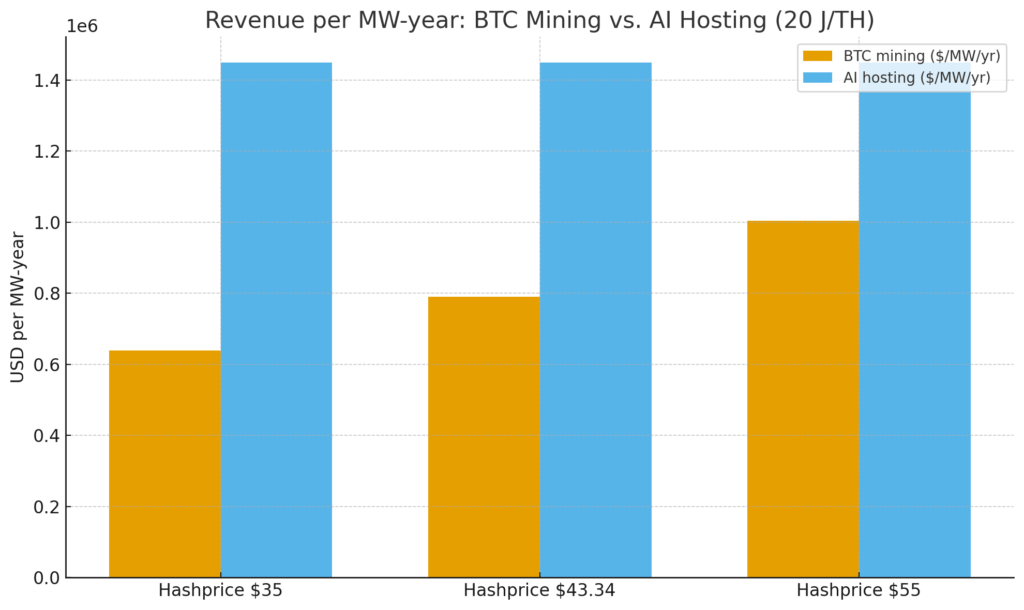

The deal’s construction makes express what miners have been calculating quietly. On the present ahead hash worth, each megawatt devoted to AI internet hosting generates roughly $500,000 to $600,000 extra in annual gross income than the identical megawatt hashing Bitcoin.

That margin, an roughly 80% uplift, creates the financial logic driving essentially the most important infrastructure reallocation in crypto’s historical past.

The income math that broke

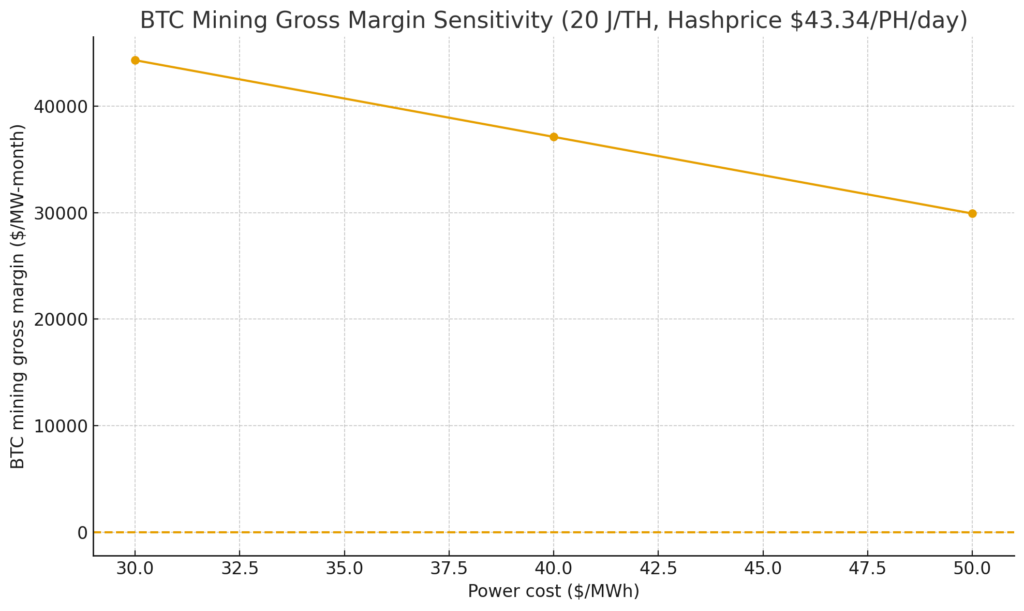

Bitcoin mining at 20 joules per terahash effectivity generates roughly $0.79 million per megawatt-hour when the hash worth is $43.34 per petahash per day.

Even at $55 per petahash, which requires both sustained Bitcoin worth appreciation or fee-spike exercise, mining income climbs solely to $1.00 million per megawatt-year.

AI internet hosting, against this, benchmarks round $1.45 million per megawatt-year primarily based on Core Scientific’s disclosed contracts with CoreWeave. This equates to $8.7 billion in cumulative income throughout roughly 500 megawatts over a 12-year interval.

The crossover level the place Bitcoin mining matches AI internet hosting economics sits between $60 and $70 per petahash per day for a 20 joule-per-terahash fleet.

For the majority of the mining trade, which runs 20-to-25 joule tools, the hash worth would wish to rise 40% to 60% from present ranges to make Bitcoin mining as profitable as contracted GPU internet hosting.

That situation requires both a pointy Bitcoin worth rally, sustained price strain, or a significant drop in community hashrate, none of which operators can financial institution on when Microsoft gives assured, dollar-denominated income beginning instantly.

Why Texas gained the bid

IREN’s Childress campus is located on ERCOT’s grid, the place wholesale energy costs averaged $27 to $34 per megawatt-hour in 2025.

These numbers are decrease than the US nationwide common of practically $40 and considerably cheaper than these in PJM or different jap grids, the place information heart demand drove capability public sale costs to regulatory caps.

Texas advantages from fast photo voltaic and wind enlargement, protecting baseline energy prices aggressive. However ERCOT’s volatility creates extra income streams that amplify the financial case for versatile compute infrastructure.

Riot Platforms demonstrated this dynamic in August 2023 when it collected $31.7 million in demand response and curtailment credit by shutting down mining operations throughout peak pricing occasions.

The identical flexibility applies to AI internet hosting if contract buildings are structured as a pass-through: operators can curtail operations throughout excessive pricing occasions, gather ancillary service funds, and resume operations when costs normalize.

PJM’s capability market tells the opposite aspect of the story. Knowledge heart demand pushed capability costs to administrative caps for ahead supply years, signaling constrained provide and multi-year queues for interconnection.

ERCOT operates an energy-only market with no capability assemble, which means interconnection timelines compress and operators face fewer regulatory hurdles.

IREN’s 750-megawatt campus already has the facility infrastructure in place; changing from mining to AI internet hosting requires swapping ASICs for GPUs and upgrading cooling programs somewhat than securing new transmission capability.

The deployment timeline and what occurs to miners

Knowledge Heart Dynamics flagged IREN’s “Horizon 1” module within the second half of 2025: a 75-megawatt, direct-to-chip liquid-cooled set up designed for Blackwell-class GPUs.

Reviews confirmed that the phased deployment will lengthen by means of 2026, scaling to roughly 200 megawatts of important IT load.

That timeline aligns exactly with Microsoft’s mid-2026 capability crunch, making third-party capability instantly priceless even when hyperscale buildouts ultimately catch up.

The 20% prepayment features as schedule insurance coverage. Microsoft locks supply milestones and shares a few of the supply-chain threat inherent in sourcing Nvidia’s GB300 programs, which stay supply-constrained.

The prepayment construction suggests Microsoft values certainty over ready for doubtlessly cheaper capability in 2027 or 2028.

If IREN’s 200 megawatts represents the vanguard of a broader reallocation, community hashrate progress moderates as capability exits Bitcoin mining. The community lately surpassed one zettahash per second, reflecting regular will increase in problem.

Eradicating even 500 to 1,000 megawatts from the worldwide mining base, a believable situation if Core Scientific’s 500 megawatts combines with IREN’s pivot and related strikes from different miners, would gradual hashrate progress and supply marginal reduction on hash worth for remaining operators.

Problem adjusts each 2,016 blocks primarily based on precise hashrate. If mixture community capability declines or stops rising as shortly, every remaining petahash earns barely extra Bitcoin.

Excessive-efficiency fleets with hash charges under 20 joules per terahash profit most as a result of their price buildings can maintain decrease hash price ranges than older {hardware}.

Treasury strain eases for miners that efficiently pivot capability to multi-year, dollar-denominated internet hosting contracts.

Bitcoin mining income fluctuates with worth, problem, and price exercise; operators with skinny stability sheets typically face compelled promoting throughout downturns to cowl mounted prices.

Core Scientific’s 12-year contracts with CoreWeave de-link money stream from Bitcoin’s spot market, changing unstable income into predictable service charges.

IREN’s Microsoft contract achieves the identical end result: monetary efficiency relies on uptime and operational effectivity somewhat than whether or not Bitcoin trades at $60,000 or $30,000.

This de-linking has second-order results on Bitcoin’s spot market. Miners symbolize a structural supply of promote strain as a result of they need to convert some mined cash to fiat to cowl electrical energy and debt service.

Decreasing the mining base removes that incremental promoting, marginally tightening Bitcoin’s supply-demand stability. If the development scales to a number of gigawatts over the following 18 months, the cumulative influence on miner-driven promoting turns into materials.

The danger situation that reverses the commerce

Hash worth doesn’t stay static. If Bitcoin’s worth rallies sharply whereas the community’s hashrate progress moderates as a result of capability reallocation, the hashprice may climb above $60 per petahash per day and method ranges the place mining rivals AI internet hosting economics.

Add a price spike from community congestion, and the income hole narrows additional. Miners who locked capability into multi-year internet hosting contracts can’t simply pivot again, since they’ve dedicated to {hardware} procurement budgets, website designs, and buyer SLAs round GPU infrastructure.

Provide-chain threat sits on the opposite aspect. Nvidia’s GB300 programs stay constrained, liquid-cooling parts face lead occasions measured in quarters, and substation work can delay website readiness.

If IREN’s Childress deployment slips past mid-2026, the income assure from Microsoft loses a few of its instant worth.

Microsoft wants capability when its inner constraints chunk hardest, not six months later when the corporate’s personal buildouts come on-line.

Contract construction introduces one other variable. The $1.45 million per megawatt-year determine represents service income, and margins rely upon SLA efficiency, availability ensures, and whether or not energy prices move by means of cleanly.

Some internet hosting contracts embrace take-or-pay energy commitments that defend the operator from curtailment losses however cap upside from ancillary companies.

Others depart the operator susceptible to ERCOT’s worth fluctuations, creating margin threat if excessive climate drives energy prices above pass-through thresholds.

What Microsoft truly purchased

IREN and Core Scientific aren’t outliers, however somewhat the seen fringe of a re-optimization enjoying out throughout the publicly traded mining sector.

Miners with entry to low cost energy, ERCOT or related versatile grids, and present infrastructure can pitch hyperscalers on capability that’s quicker and cheaper to activate than greenfield information heart building.

The limiting components are cooling capability, direct-to-chip liquid cooling requires completely different infrastructure than air-cooled ASICs, and the power to safe GPU provide.

What Microsoft purchased from IREN wasn’t simply 200 megawatts of GPU capability. It purchased supply certainty throughout a constraint window when each competitor faces the identical bottlenecks.

The prepayment and five-year time period sign that hyperscalers worth pace and reliability sufficient to pay premiums over what future capability may cost.

For miners, this premium represents an arbitrage alternative: redeploy megawatts towards the higher-revenue use case whereas the hash worth stays suppressed, then reassess when Bitcoin’s subsequent bull cycle or price surroundings modifications the maths.

The commerce works till it doesn’t, and the timing of that reversal will decide which operators captured one of the best years of AI infrastructure shortage and which of them locked in simply earlier than mining economics recovered.