Bitcoin miners face monetary strain because the hash value drops to costs which will drive them out of the market. The cryptocurrency mining sector is dealing with challenges stemming from declining Bitcoin costs, rising vitality prices, and rising community problem, leaving miners in a state of survival.

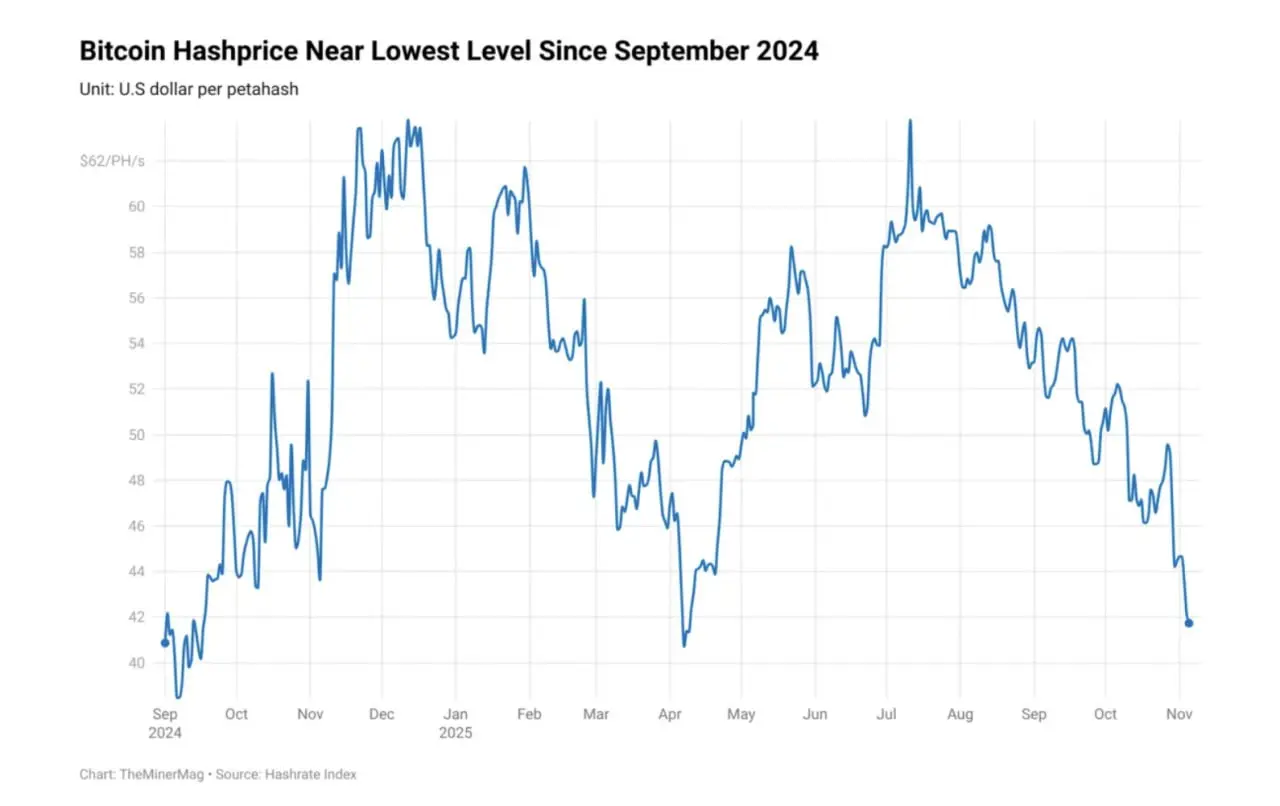

TheMinerMag confirmed that BTC mining hash value has declined to $42 per petahash per second (PH/s). The hasprice PH/s determine determines the anticipated day by day income earned per unit of computational energy, serving to miners to measure mining profitability. In July, PH/s was roughly $62, marking a decline of greater than 30% on the present price.

Some BTC miners shift focus to AI and knowledge heart infrastructure companies

Smaller miners could also be compelled out of the market as a result of excessive working prices. To this point, most miners are cutting down operations and exploring new avenues of income technology to behave as a buffer in opposition to potential losses.

Bitcoin hash value close to $40. Supply: TheMinerMag

The drop in hash value started to floor when mining {hardware} operators and suppliers began reporting fewer orders as a result of monetary pressure. The October crash elevated the impression, notably for miners who performed the gross sales in BTC.

Bitdeer, one of many mining corporations, has shifted its focus towards self-mining to generate income straight, reasonably than relying totally on {hardware} gross sales. Some analysts have warned that the technique is not going to be worthwhile within the long-term because the hashrate value is squeezed, affecting all the sector.

The prices of buying and upgrading high-performance application-specific built-in circuit (ASIC) {hardware} kind a part of the challenges affecting miners. One other problem is the surge in electrical energy prices, which leaves miners barely breaking even.

Some mining corporations have additionally shifted their focus to AI options, knowledge facilities, and high-performance computing (HPC) companies to realize entry to different income streams. AI and knowledge heart sectors depend on large-scale computing infrastructure that’s much like crypto mining.

As an example, Cipher Mining signed a $5.5 billion deal to produce Amazon Net Companies cloud infrastructure with computing energy for 15 years. IREN additionally signed a $9.7 billion GPU computing take care of Microsoft. Some analysts, nonetheless, have warned that counting on AI infrastructure companies requires giant upfront capital and specialised experience, which can restrict participation to giant mining corporations.

BTC community hashrate climbs above one zetahash per second

The Bitcoin halving occasion, which occurred in April 2024, elevated competitors amongst miners for the restricted block rewards, lowering from 6.25 BTC to three.125 BTC per block.

Primarily based on CryptoQuant evaluation, Bitcoin’s community whole hashrate, which measures the mixed computational energy required to safe the community, rose above one zetahash per second (ZH/s). The rise is because of important participation from industrial-scale miners and improved {hardware} effectivity.

Rising hashrates enhance the problem of mining new blocks; therefore, the fee to mine a single Bitcoin block is climbing, whatever the market value of BTC.

Hashrate climbs above one zetahash per second. Supply: CryptoQuant

Bitcoin mining has developed from CPU-based setups in 2009 to immediately’s large-scale ASIC-based operations, leaving the market to traders with important capital investments and substantial vitality assets.

Initially, mining a block would lead to a reward of fifty BTC, however this has regularly decreased to the present 3.125 BTC per block, creating financial strain that rewards solely probably the most environment friendly and capital-intensive operators.

BTC remained risky over the weekend, following a decline beneath $100,000 on Friday. To this point, the token is buying and selling above $102,000 with a development of 0.84% on the day by day chart. BTC has additionally misplaced 7.2% by way of the week, falling from a buying and selling value above the $104,000 assist stage to its present stage of $102,330.