Picture supply: Getty Pictures

Synthetic intelligence (AI) can do a whole lot of issues, however selecting dividend shares isn’t one in all them. The issue is that primary AI instruments can’t do actual evaluation — somewhat, they merely regurgitate info from their large knowledge sources.

Someplace in that knowledge could also be just a few good picks, however the info’s typically out-of-date or from an unreliable supply. Contemplating how a lot inaccurate info is on the web, as a rule the responses are riddled with errors.

For instance, after I requested ChatGPT what dividend shares I can purchase for retirement, one in all its picks was Royal Dutch Shell (RDSB). That’s a reputation and ticker Shell stopped utilizing years in the past. One other two of its picks had been tobacco shares, an trade which is dying out and should not be round after I retire.

Its fourth choose was Diageo, a inventory I nonetheless personal however one I’m more and more interested by promoting. The one actual first rate choose it got here up with was Authorized & General — and even it’s come into query currently after weak outcomes.

So what collection of shares would have impressed me?

5 dividend shares I’d choose

When pondering of retirement, the important thing issue I’m in search of is long-term sustainability. And I do imply lengthy, as a result of I’m not that previous but.

If there isn’t robust proof the enterprise will nonetheless be doing effectively in 30 years, I’m not .

With that in thoughts, my prime picks could be Lloyds, Unilever, Tesco, Nationwide Grid and GSK (LSE: GSK). These are all long-running, closely established companies which can be deeply entrenched within the day-to-day lifetime of the UK.

The possibilities of any of them failing within the subsequent 30 years are slim. I additionally suppose they’re among the many firms much less more likely to abscond to a US itemizing. Furthermore, all of them function in vastly totally different sectors, including diversification.

Let’s take a better have a look at why I believe GSK’s a inventory price contemplating for retirement.

Lengthy-term imaginative and prescient

Apart from having been round since 1715, I consider GSK may benefit a retirement portfolio on account of its defensive enterprise mannequin. It has sturdy money flows and an extended historical past of paying dividends even throughout risky market cycles.

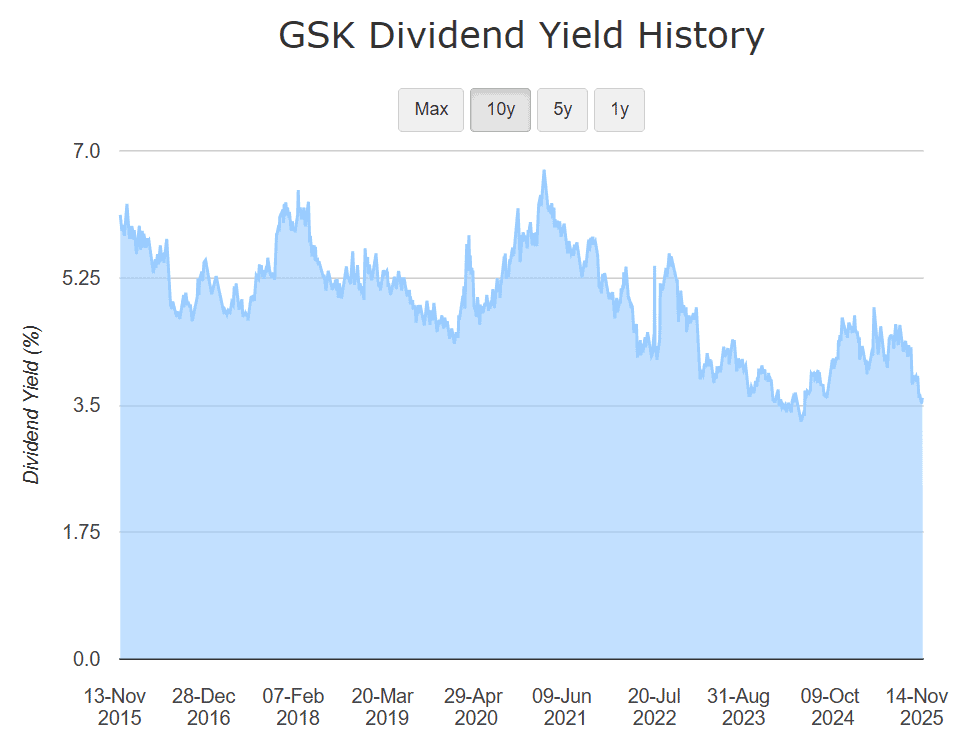

Working in prescribed drugs and vaccines offers it publicity to important healthcare, a sector with regular revenues that are inclined to help dependable shareholder payouts. Admittedly, the present 3.6% dividend yield is barely above common however, traditionally, it’s normally greater.

Extra importantly, its observe file and dedication to shareholder returns are what make it enticing. Plus, it has a diversified product portfolio and a verified pipeline of upcoming merchandise, including stability to retirement revenue planning.

Like every pharmaceutical firm, it’s in danger from patent expiries, trial failures and regulatory setbacks. Its dividend historical past is spectacular, however a lapse in earnings may nonetheless threat a minimize.

My verdict

There’s a whole lot of info on the market, however in the case of selecting shares, real-world information is important. No investor ought to ever depend on recommendation with out verifying the supply and knowledge. Ideally, the extra analysis undertaken ourselves, the higher knowledgeable we’re.

The day could come when AI understands markets higher than people, however till then, I’m going with what I do know.