Picture supply: Getty Pictures

Incomes passive revenue by a FTSE 100 ETF has develop into a vastly common technique. So I made a decision to dig into the dividend yields of two main tracker funds to see how a lot an investor would really want to succeed in £1,000 a month in passive revenue.

Tracker funds

First up, the iShares UK Dividend UCITS ETF gives a 4.9% yield, whereas the Vanguard FTSE U.Okay. Fairness Revenue Index Fund yields 4.2%.

The iShares fund is comparatively concentrated, holding simply 51 shares. Vanguard spreads its publicity over 104 holdings.

Regardless of the distinction in breadth, each are dominated by FTSE 100 heavyweights akin to BP, Rio Tinto, Authorized & Common, HSBC, and Shell. A handful of FTSE 250 names additionally seem, however with a lot smaller weightings.

Calculations

I do maintain the Vanguard fund myself, however I don’t solely depend on it to construct passive revenue. One motive is that a number of of its largest holdings aren’t high-yield names, so the revenue stream is of course restricted.

If the objective is £1,000 a month (£12,000 a yr), the 4% rule provides us a easy goal: you’d want roughly £300,000 in your pot.

And that is the place issues get fascinating.

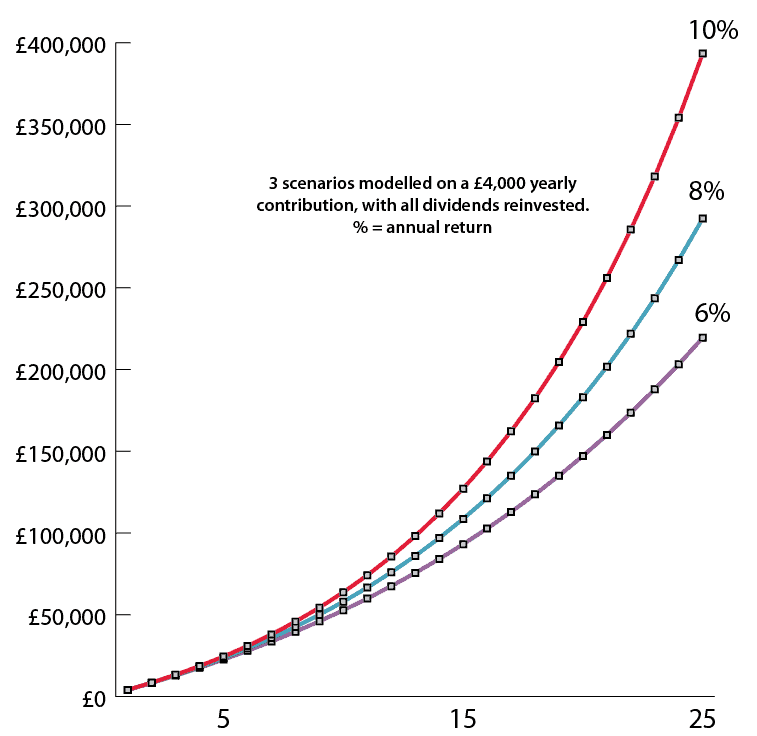

Because the chart reveals, utilizing mounted yearly contributions of £4,000 and simple compounding at at the moment’s yields, neither ETF will get near that £300,000 goal over 25 years. The revenue ranges simply aren’t excessive sufficient for the pot to develop on the tempo required.

Chart generated by creator

That’s why I want pairing a tracker fund with particular person dividend shares that supply increased, extra significant yields.

Revenue and progress

One massive FTSE 100 title lacking from each ETFs’ prime 10 lists is Aviva (LSE: AV.). Its share value has jumped 32% in a yr, which naturally pushed the dividend yield down from 8% to five.5%.

However right here’s the important thing distinction with proudly owning particular person shares: while you reinvest dividends into a powerful firm, your holding grows a lot sooner than the sluggish, spread-out progress you get from an ETF.

Refreshed targets

In its newest replace, Aviva laid out three daring targets for 2028: develop working earnings per share at an 11% compound annual charge, ship an IFRS return on fairness above 20%, and generate greater than £7bn in cumulative money remittances.

To hit these formidable objectives, the corporate is doubling down on its shift to a capital-light mannequin. Inside a number of years, it expects over 75% of working revenue to return from areas like Common Insurance coverage and Wealth, which require far much less capital to develop.

If it could easily combine Direct Line, enhance flows by Succession Wealth, and proceed scaling by way of main partnerships akin to Nationwide, then these targets begin to look genuinely achievable.

No funding is risk-free. For Aviva, falling insurance coverage premiums, regulatory modifications, or interest-rate swings may stress income and dividends. Sudden claims or slower progress in capital-light divisions may additionally restrict money technology, which is essential for sustaining payouts.

Backside line

For me, it’s all about constructing a dependable stream of passive revenue. Reinvesting dividends from sturdy, cash-generating shares has quietly constructed a rising revenue stream in my ISA through the years. Whereas the FTSE 100 spreads threat broadly, I’ve discovered that fastidiously monitoring a number of high-yield names can flip regular payouts into a robust compounding engine. And there are many different high-income shares to select from.