Picture supply: Getty Photos

ISAs stay one of the highly effective instruments for constructing passive earnings, as a result of each penny of curiosity, dividends, and capital beneficial properties is totally tax free. However with money charges drifting decrease, counting on a Money ISA alone makes it more and more troublesome to generate significant earnings.

Please observe that tax remedy depends upon the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is supplied for info functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are chargeable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

Crunching the numbers

So how a lot would I would like invested in an ISA to earn £2,317 a month? That’s equates to £27,804 a 12 months – roughly 75% of the typical UK wage – sufficient to meaningfully exchange a part of a full-time earnings.

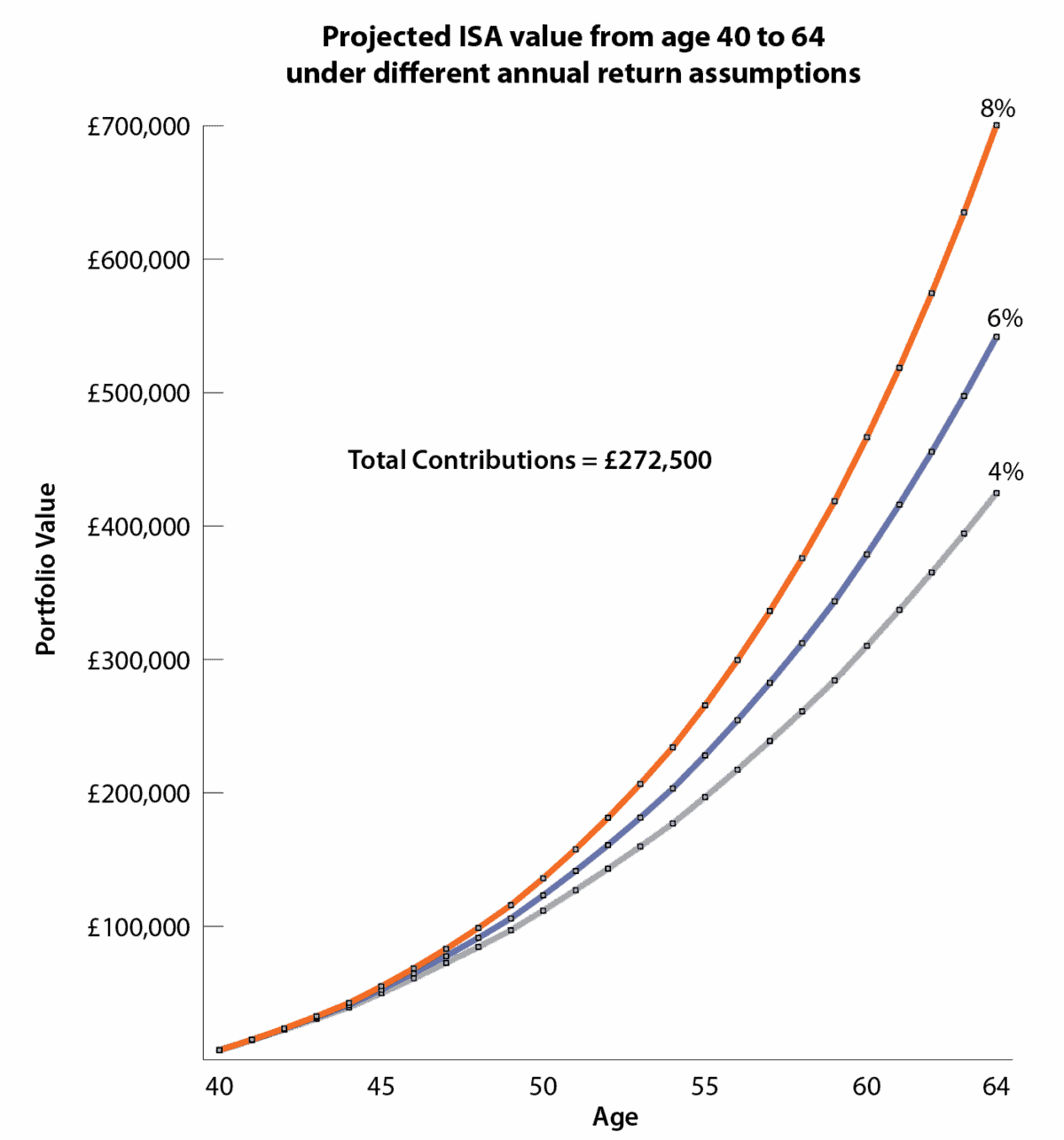

Utilizing the 4% rule, which already accounts for inflation, a portfolio would should be value round £700,000 in at the moment’s cash to generate this earnings.

Put one other approach, that is the buying energy you’d need at age 65; you don’t want £700k sitting in your account at the moment. As a substitute, disciplined investing over time builds a portfolio that grows to this goal in actual phrases, adjusting naturally for inflation alongside the best way.

The chart beneath exhibits how tiered contributions totalling £272,500 over a 25-year investing horizon (age 40 to 64) might construct an ISA portfolio beneath three totally different annual return assumptions.

- 4%: a cash-like baseline the place progress is regular, however even disciplined contributions fall properly wanting the £700,000 goal in actual phrases.

- 6%: a balanced long-term return that builds a considerable pot, however nonetheless leaves a noticeable hole to totally exchange 75% of the typical wage.

- 8%: a stronger fairness return the place compounding accelerates in later years, permitting the portfolio to achieve the £700,000 goal by age 64.

Chart generated by writer

Progress inventory

Many traders assume that constructing passive earnings means proudly owning high-yield shares from day one. I don’t take that view. In the course of the contribution part, long-term development may be much more highly effective – particularly when dividends are reinvested.

That’s why Prudential (LSE: PRU) earns a spot in my Shares and Shares ISA. Its present dividend yield of round 2% isn’t the attraction. As a substitute, I see it as a compounding development alternative throughout in Asian markets, the place insurance coverage penetration stays within the low single digits. The area’s safety hole is estimated at properly over $100trn, offering a structural backdrop for many years of development.

In 2025, the shares are up round 75%, making the corporate the strongest performer amongst its FTSE 100 insurance coverage friends. Even after that rally, I’d argue the inventory stays underappreciated, partly as a result of lingering considerations round China proceed to dominate the narrative.

The insurer’s capital-light mannequin provides it important flexibility. Between 2024 and 2027, the group expects to return greater than $5bn to shareholders, combining regular dividend development with a sizeable share buyback programme. Extra broadly, Asia’s increasing center class is driving rising demand for monetary safety, financial savings, and well being merchandise – companies many Western traders take without any consideration.

The principle dangers are regulatory or coverage modifications in China, forex swings, and uneven financial development throughout Asia, which might trigger short-term volatility. However, in my view, these components don’t alter the long-term development thesis.

Backside line

Reaching a £700k goal over a 25-year investing horizon requires not solely self-discipline and persistence, but in addition a give attention to development alternatives that the market could also be overlooking. Prudential is an instance that illustrates this strategy, which is why it options in my Shares and Shares ISA – although it’s removed from the one inventory I’ve my eye on.