Picture supply: Getty Photographs

The previous decade hasn’t been sort for ITV (LSE:ITV) shares. As a standard business broadcaster, the FTSE 250 firm’s relevance in an more and more digital age is a rising trigger for concern.

At 78.8p per share, ITV’s share value has slumped 69.1% from 254.71p 10 years in the past. It means a £10,000 funding within the firm again then would now be price £3,078.

A stream of dividend revenue has helped soften the blow, although this wasn’t uninterrupted — payouts have been suspended for a short interval throughout the pandemic. In whole, the enterprise has delivered money rewards of 61.6p for every share.

Nevertheless, this nonetheless means a £10k funding a decade in the past would have offered a return of £5,503, or -45%.

ITV’s ejection from the FTSE 100 three years in the past capped a very horrible time for the corporate. However I’m questioning whether or not the broadcaster might now be a high restoration play for share buyers to contemplate.

Blended outlook

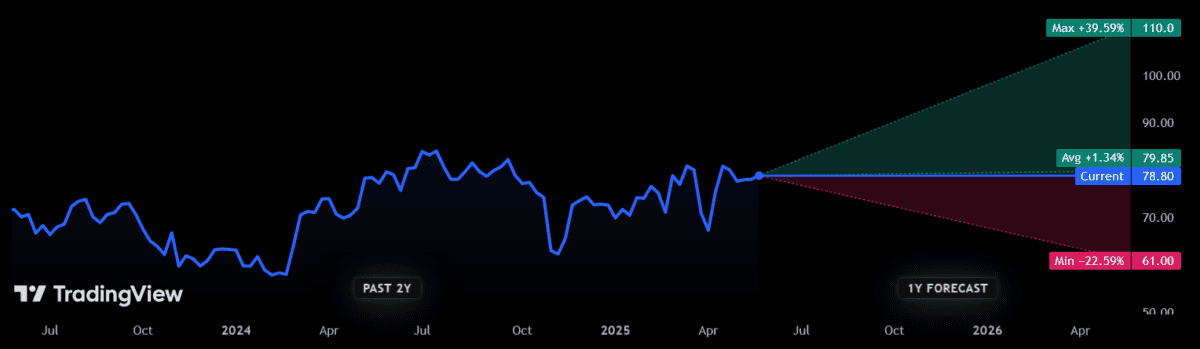

Sadly, share value forecasts are unavailable for ITV shares for the subsequent decade. Metropolis analysts have offered numbers for the next 12 months, although. And on stability they’re taking a optimistic place.

That mentioned, there’s nothing right here to get buyers too excited. The consensus opinion from the seven analysts with rankings on ITV inventory predict solely a fractional enhance over the subsequent yr, to round 79.9p.

There are additionally some giant variations between these value forecasts. One forecaster thinks the broadcaster will soar nearly 40% in worth over the subsequent yr. One other believes it is going to sink by a determine approaching 23%.

Bulls and bears

Broadcasters are extremely cyclical companies, so predicting share value actions throughout unsure occasions like these is loaded with peril. ITV’s personal share value has been extraordinarily unstable in 2025, reflecting conflicting indicators on US commerce coverage and the differing situations for financial progress and rates of interest.

Thus far this yr, promoting revenues have matched forecasts (down 2% in quarter one). However they may probably go into freefall if worsening financial circumstances trigger advertising and marketing budgets to be slashed.

Regardless of this menace, I consider ITV shares might nonetheless be a sexy restoration inventory to contemplate. Whereas streaming giants like Netflix pose important long-term risks, additionally they carry large alternatives for the corporate’s ITV Studios arm.

Exterior revenues right here rose 20% in quarter one, the corporate mentioned, because of “sturdy demand from, and the timing of deliveries to, international streaming platforms“. ITV Studios is on the right track to ship common yearly natural income progress of 5% between 2021 and 2026, forward of the broader market.

The broadcaster is making an enormous mark on the streaming panorama, too, by its personal massively in style ITVX platform. It was the fastest-growing UK service in 2023 and 2024, and within the first quarter, whole streaming hours rose 12% yr on yr.

The success of ITVX can also be anticipated to supercharge digital promoting revenues to £750m by 2027. That’s up from £482m final yr.

Strong worth

At the moment the enterprise trades on a ahead price-to-earnings (P/E) ratio of simply 9.2 occasions. It additionally carries a 6.2% corresponding dividend yield.

On stability, I feel it’s a high restoration inventory for worth buyers to contemplate.