Picture supply: Getty Pictures

I’m scouring the London inventory marketplace for the very best dividend shares and exchange-traded funds (ETFs) to purchase immediately. And I believe I’ve discovered a few distinctive candidates for a long-term passive revenue.

Not solely do the next have FTSE 100-beating dividend yields proper now. I count on them to supply a big and rising dividend over time.

Right here’s why I’d purchase them if I had spare £20,000 prepared to take a position. Based mostly on present dividend yields, they may make me £1,200 in further revenue this yr alone if I break up my funding 50-50.

An affordable ETF

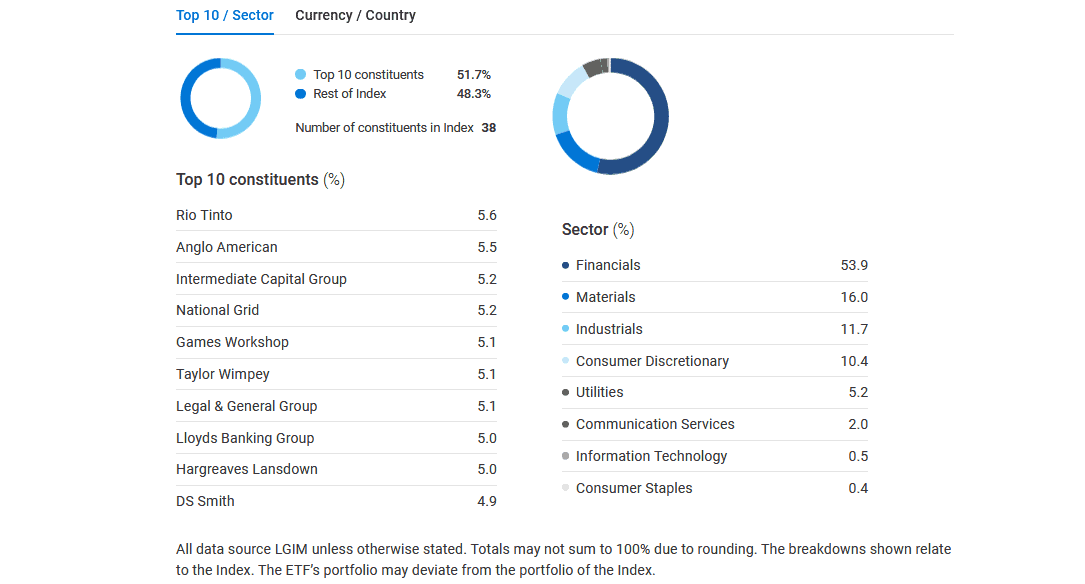

As its identify implies, the L&G High quality Fairness Dividends ESG Exclusions UK ETF (LSE:LDUK) focuses on British firms with sturdy information from an environmental, social and governance (ESG) standpoint.

It invests in a basket of shares — 38 on the final rely — excluding those who have “essentially poor stability sheet, revenue assertion and/or ESG traits“. Whereas dividends are by no means assured, the primary two could make the fund a reliable supply of passive revenue.

Main holdings right here embrace miners Rio Tinto and Anglo American, monetary companies suppliers Lloyds and ICG, and utilities enterprise Nationwide Grid. This broad diversification may help it to supply a clean return over time.

One disadvantage with this fund is its low liquidity in comparison with different ETFs. This may make it trickier and extra pricey for buyers to enter and exit positions.

That mentioned, I nonetheless suppose it’s price an in depth look proper now. Its dividend yield’s presently 4.5%, round a proportion level increased than the broader Footsie common.

A FTSE 100 dip purchase

Insurance coverage large Aviva (LSE:AV.) is a FTSE 100 share I already personal in my portfolio. I’m contemplating upping my stake once I subsequent have money to take a position too, owing to its sensible worth.

You see, Aviva’s share value has fallen sharply from above 500p prior to now six weeks. I believe this represents a lovely dip-buying alternative.

Because the chart beneath exhibits, its dividend yield is double the FTSE 100 common of three.6%. And it rises steadily over the next two years amid Metropolis predictions of dividend hikes.

| Yr | Dividend per share | Dividend development | Dividend yield |

|---|---|---|---|

| 2024 | 35.43p | 6% | 7.4% |

| 2025 | 38.11p | 8% | 7.9% |

| 2026 | 40.83p | 7% | 8.3% |

On high of this, Aviva shares commerce on an undemanding ahead price-to-earnings (P/E) ratio of 10.5 instances. And its price-to-earnings development (PEG) a number of sits beneath the worth watermark of 1, at simply 0.5.

The monetary companies agency generates enormous quantities of money, which makes it a lovely goal for dividend buyers. With a powerful Solvency II ratio (205% as of June), it seems to be in fine condition to satisfy the payout forecasts proven above.

I count on Aviva to ship a big and rising dividend over time as a rising aged inhabitants drives demand for retirement and safety merchandise. Having mentioned that, intense competitors in its markets may affect the agency’s means to capitalise on this. However I prefer it all the identical.