Over the previous week, knowledge reveals that the Bitcoin blockchain has witnessed the departure of practically 100 exahash per second (EH/s) of hashrate. A lot of that exodus unfolded after issue climbed to 123.23 trillion on April 19.

Will the Upcoming Retarget Restore Bitcoin’s Equilibrium on Could 4?

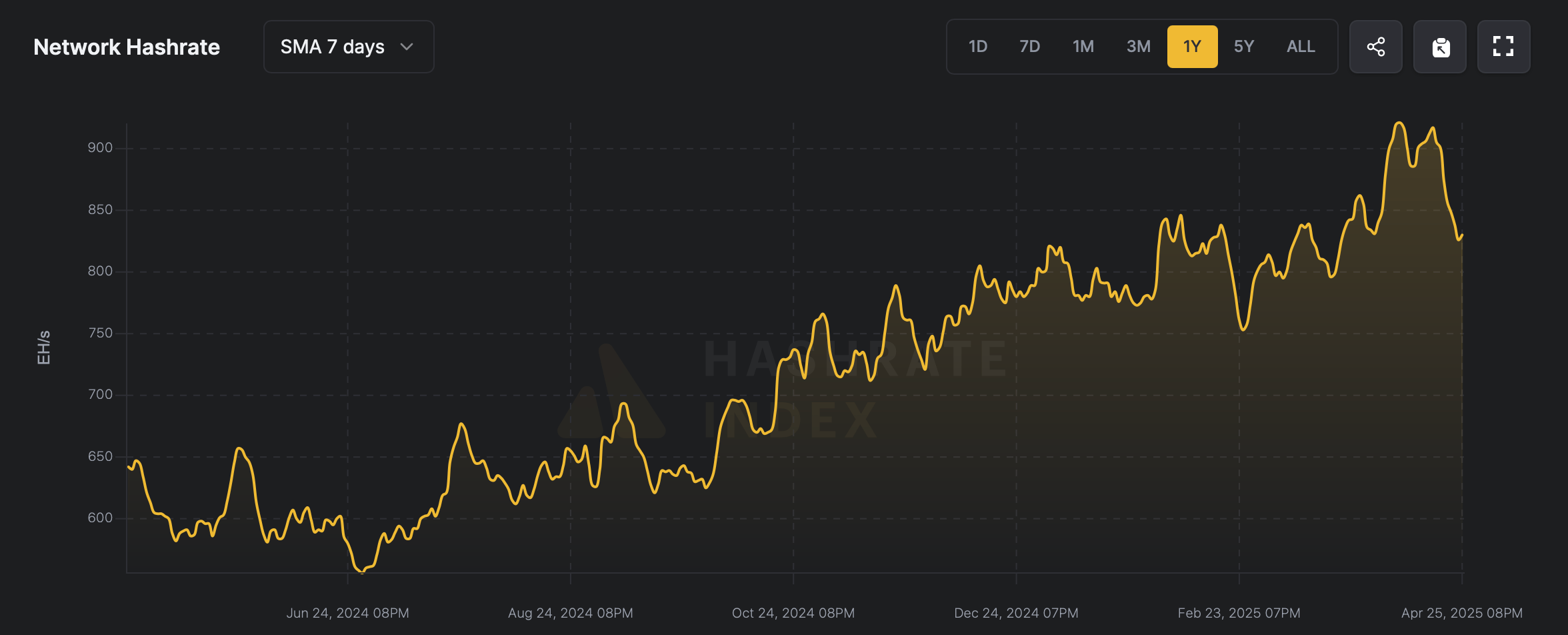

Information from hashrateindex.com reveals that 91 EH/s has departed the community since April 17, 2025, when it was cruising at 917 EH/s. The community lately hit an all-time peak of 926 EH/s on April 8, as measured by the seven-day easy transferring common (SMA). Nonetheless, starting on April 17 and over the next 9 days, figures reveal a pronounced decline in computational energy.

From April 17 till April 26, the community misplaced 91 EH/s.

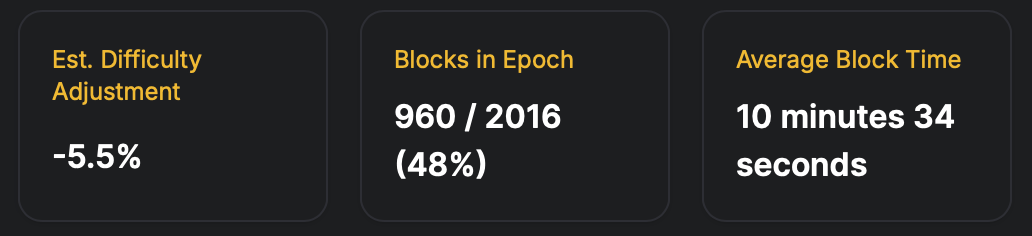

Most of this drop coincided with a 1.42% issue rise on April 19. That particular adjustment elevated issue to 123.23 trillion and marked the fourth consecutive enhance. That rise in issue, which instigated a hashrate exodus, has stretched block intervals past the 10-minute norm. Blocks now common 10 minutes, 34 seconds.

Since slower block occasions sometimes immediate a problem discount, the following retarget on Could 4 tasks a 5.5% drop. This shift coincides with improved miner income, because the hashprice—the anticipated every day worth of 1 petahash per second (PH/s)—jumped markedly final week. On April 19, it was $44.06 per PH/s; immediately it registers $48.70, a ten.53% acquire.

Bitcoin’s current hashrate retreat illustrates the community’s dynamic equilibrium, as rising issue triggers miner departures and briefly slows block occasions. Hashprice features amid this ebb trace at heightened rivalry amongst remaining miners, easing profitability pressures. The looming issue retarget embodies the protocol’s self-correcting nature, poised to realign incentives and probably lighten the load for miners this cycle.