Picture supply: Getty Pictures

When contemplating dividend shares on the FTSE 250, it may appear logical to spend money on the one with the very best yield. Nonetheless, the yield alone means little or no.

Shopping for a inventory with a ten% yield doesn’t assure it’ll pay out 10% on the funding. It’d solely pay 5% — or nothing in any respect. It’s because yields fluctuate continually however funds happen only some instances a yr.

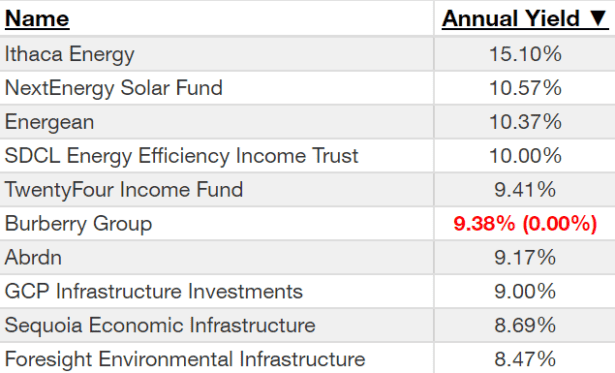

The desk under reveals the present prime 10 yielders on the index.

Some buyers goal to purchase a inventory on the ex-dividend date to safe a payout at that share. However the yield might be lowered or reduce fully earlier than the following one, negating the inventory’s long-term worth.

So an excellent dividend inventory is one with an extended monitor file of constantly paying dividends to its shareholders.

Different elements to contemplate

A very good dividend inventory isn’t solely concerning the yield. Additionally think about:

- Payout Ratio: a sustainable ratio ensures the corporate can proceed paying future dividends. Something above 100% will not be sustainable

- Dividend Development: the perfect corporations have an extended historical past of accelerating annual dividend funds. Ten years or extra is preferable

- Monetary Stability: a powerful steadiness sheet and constant earnings are important for an organization to keep up its dividend funds

Figuring out worth

Within the FTSE 250 prime 10 by yield, solely Burberry, Abdn, GCP Infrastructure Fund and TwentyFour Revenue Fund (LSE: TFIF) have a 10-year or longer historical past of funds. Burberry reduce its dividends fully this yr and Abdn lowered them considerably after Covid. GCP has a comparatively steady fee historical past however a payout ratio of 406%.

That leaves TwentyFour Revenue Fund, which invests in securities backed by underlying property like loans.

Initially, this presents some dangers. If debtors default on these loans, it may negatively affect the fund’s efficiency. On the similar time, if debtors repay their loans early, the fund could obtain much less revenue than anticipated. Further dangers embody rate of interest fluctuations that would damage the value and low liquidity that would scale back promoting energy.

The fund’s value has been comparatively steady for the previous 10 years, fluctuating between 100p and 120p. It hasn’t supplied any important returns by way of share value however has maintained a yield above 6% for many of that interval. I feel that makes it sufficiently dependable to contemplate as an addition to a passive revenue portfolio.

After a foul 2022, it posted constructive full-year 2023 leads to July. These included a NAV complete return of 18.10% and a fourth-quarter dividend of three.96p per share. This introduced the whole dividend for the yr to a whopping 9.96 pence per share – a record-breaking excessive since its launch in 2013.

The corporate’s chairman attributed this success to its savvy funding technique, specializing in higher-yielding, floating-rate, asset-backed securities within the then rising rate of interest setting. Its dedication to sharing the wealth with shareholders is clear, because it constantly pays out just about all extra funding revenue yearly.

Whereas TwentyFour seems to be the perfect within the prime 10 dividend-payers on the FTSE 250 by yield, I feel there are higher choices. If I have been trying to purchase dividend shares on the index, I’d think about Greencoat UK Wind, Major Well being Properties or TP ICAP — every dependable shares with yields between 7% to eight%.