Bitcoin (BTC) has been persistently hitting new all-time highs (ATH) lately. Coinciding with this surge, Bitcoin mining issue has additionally reached a file excessive, reflecting the community’s improvement.

Total, the mix of BTC’s ATH, elevated mining issue, and Lengthy-Time period Holders (LTH) habits paints an optimistic image, although dangers stay.

ATH Worth, ATH Mining Issue

Based on information from Blockchain.com, Bitcoin mining issue has elevated by 7.96%, reaching 126.27 T, with a seven-day common community hashrate of 908.82 EH/s. This determine exhibits the rising computational energy of miners, particularly as Bitcoin‘s worth lately touched $122,000.

If this pattern persists, it may scale back miners’ effectivity, notably given the lackluster mining leads to June.

Bitcoin community issue. Supply: Blockchain

Nevertheless, a notable upcoming adjustment is the following Bitcoin mining issue change, projected to lower by 6.69% on July 27, 2025. This may very well be a optimistic sign for miners, optimizing their operational effectivity.

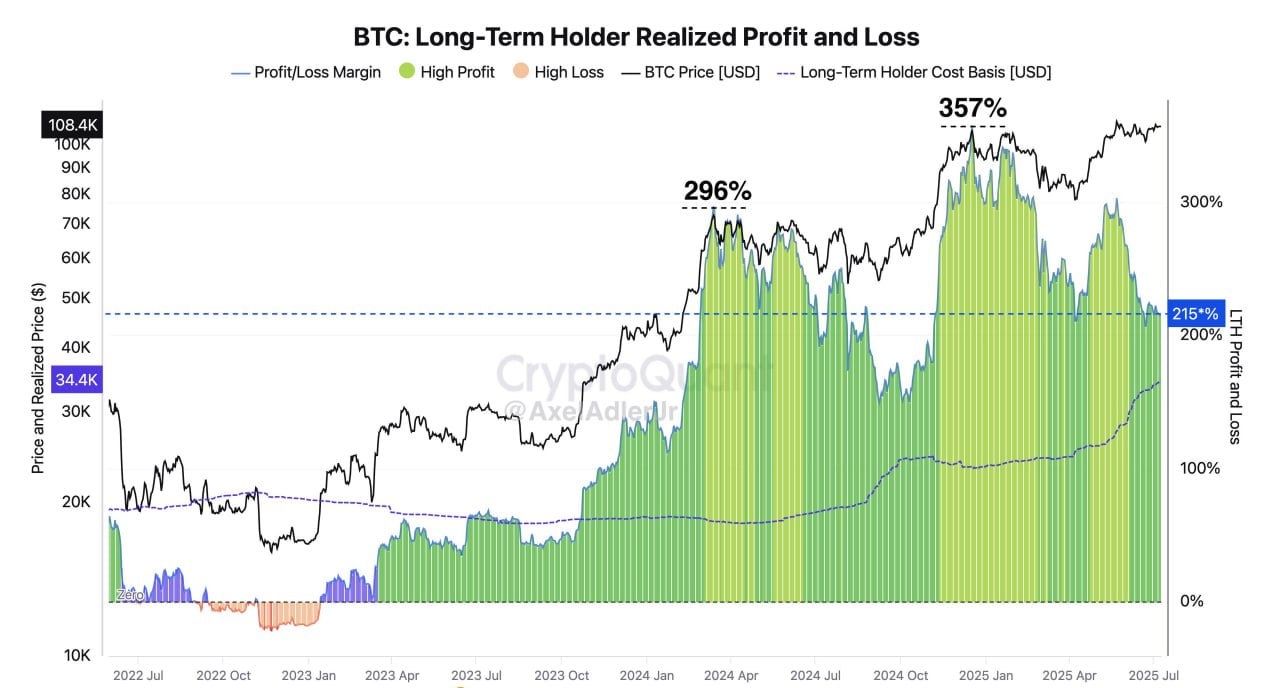

Moreover, the Glassnode chart, shared by NekoZ on X, provides deep insights into Lengthy-Time period Holders (LTH) habits. Their realized revenue has surged to $108,400, with a revenue ratio of 357% in July 2025. Their common price foundation stays considerably decrease than the present worth.

Conduct of long-term holders (LTH). Supply: NekoZ

This implies that almost all LTHs haven’t any intention of promoting off, whilst BTC reaches ATHs. From 2022 to now, the chart signifies that high-profit phases (resembling 296% in mid-2024) usually accompany sustainable worth rallies. This reinforces the view that the present market just isn’t but saturated.

But, a thought-provoking issue is the low Google search curiosity in Bitcoin, which stays subdued and exhibits little enchancment in comparison with earlier bull markets. This might replicate investor maturity, shifting from Concern of Lacking out (FOMO) to a long-term technique moderately than short-term hypothesis.

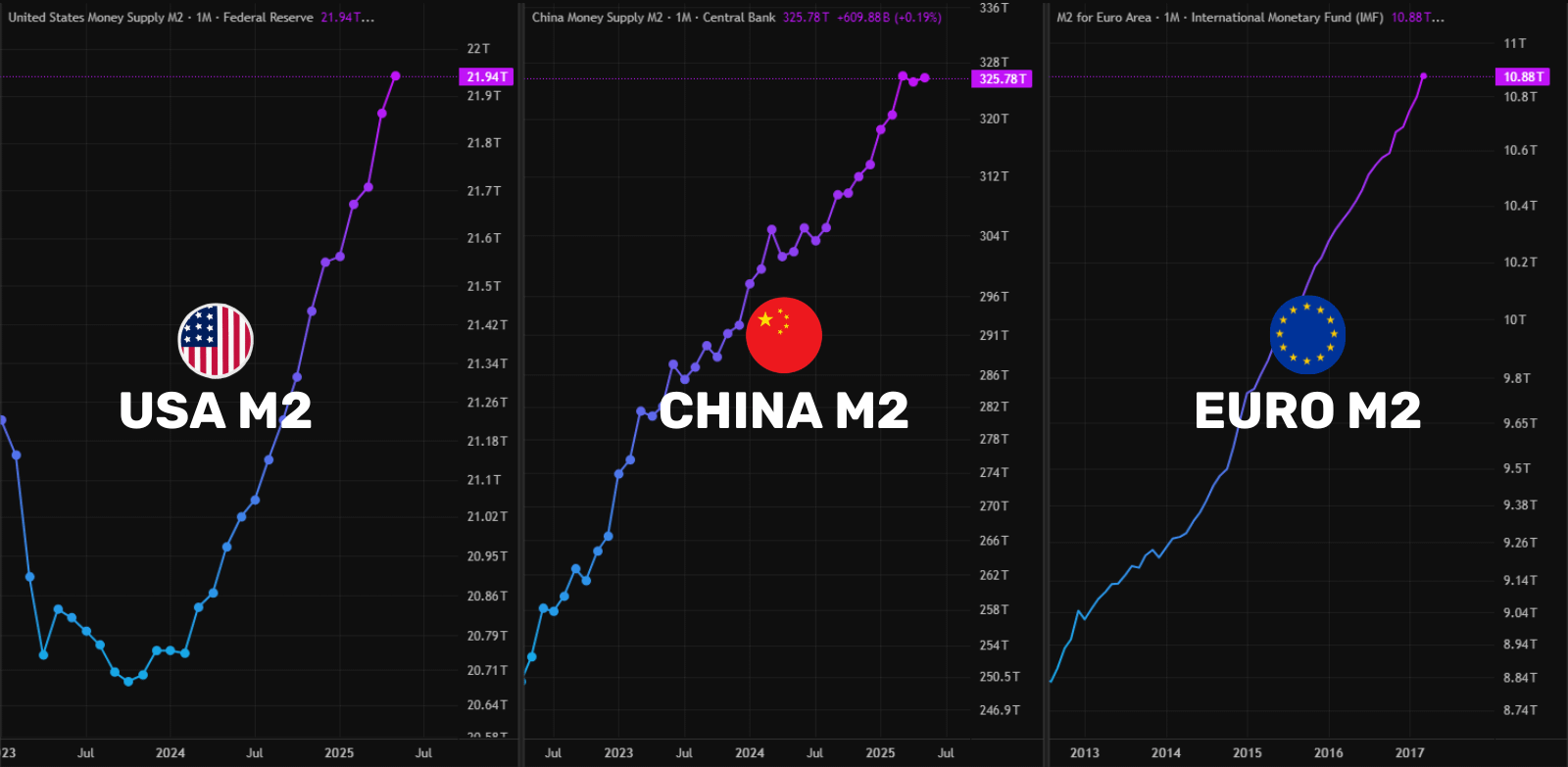

Total, the synergy of BTC’s ATH, excessive Bitcoin mining issue, and LTH holding habits creates an encouraging but dangerous outlook. With world liquidity rising (as M2 within the US, China, and Europe additionally hits an ATH), Bitcoin holds vital short-term potential.

World liquidity. Supply: Rekt Fencer

Nevertheless, buyers ought to intently monitor key indicators like hashrate, Bitcoin mining issue changes, and market sentiment to mitigate dangers from potential worth corrections.