Picture supply: Getty Photos

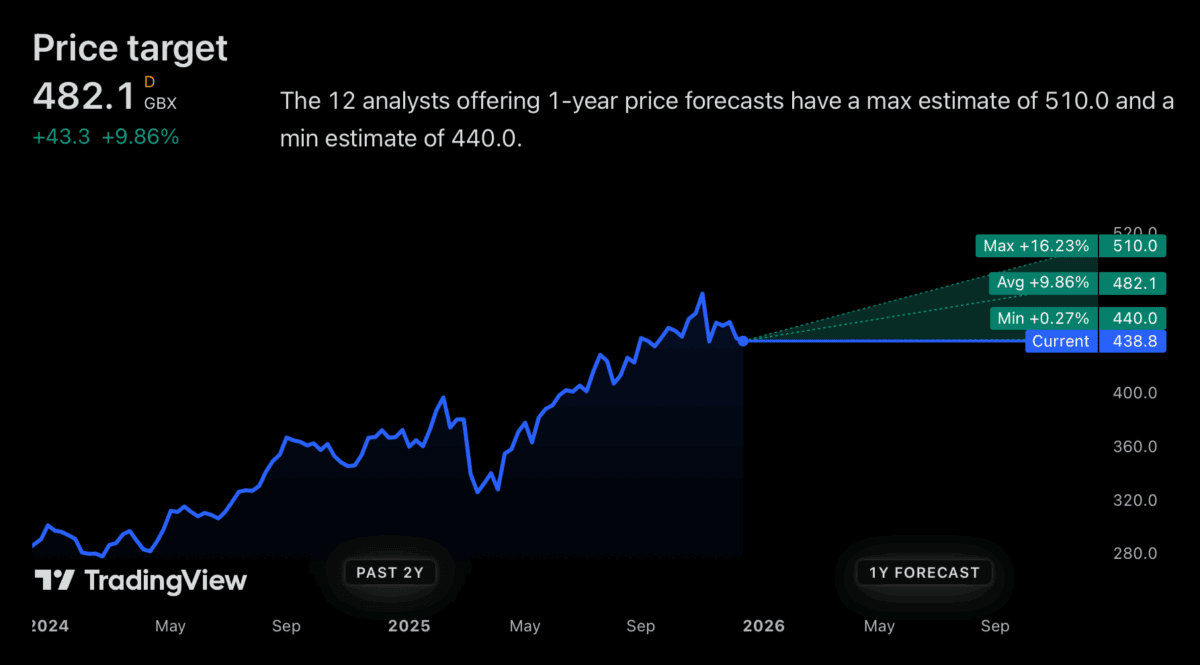

Analysts are fairly optimistic about Tesco (LSE:TSCO) shares in 2026. Worth targets aren’t a lot larger than the present degree, however no one overlaying the inventory thinks it’s taking place.

A giant a part of investing within the inventory market is minimising danger and avoiding losses so far as potential. So does that make Tesco a no brainer funding for the 12 months forward?

Analyst estimates

Analysts are – apparently with out exception – anticipating Tesco shares to go up subsequent 12 months. With that being stated, the bottom value goal is lower than 1% above the present share value.

Even mixed with a 3.25% dividend yield, that’s not an thrilling return in 2026, nevertheless it’s greater than acceptable as a worst-case situation. Sadly, that’s not the way it works.

The Tesco share value completely will be decrease in a 12 months’s time. The obvious danger is an financial downturn within the UK, which may trigger households to attempt to pull again their spending.

Investing, although, is about what’s prone to occur past the following 12 months. And there’s truly rather a lot to love about Tesco from this attitude.

Supermarkets

The grocery store business is a difficult one for buyers. The largest difficulty is that – loyalty programmes however – prospects can simply swap the place they do their weekly store.

Meaning just about no enterprise has an enormous skill to extend costs. And that leads to low margins for nearly all operators, which leaves earnings very weak to larger prices or theft.

The one actual benefit in an business the place prospects are price-sensitive comes from having decrease prices than rivals. This permits wider margins with out charging larger costs.

Regardless of the character of the grocery business, Tesco does even have a robust place on this regard. And that’s why it’s the UK grocery store that I feel is value contemplating as a possible funding.

Aggressive benefit

What Tesco has over different corporations is scale. With 2,965 shops, it has greater than twice the variety of shops as Sainsbury (1,478).

This can be a huge benefit for 2 causes. The obvious is {that a} larger retailer depend means there’s typically one close to customers once they’re in search of comfort.

Better scale additionally places the agency in a stronger place in the case of negotiating with suppliers. To achieve the widest buyer base, corporations must undergo Tesco.

This can be a key purpose the agency has been capable of preserve its market share by competing with Aldi and Lidl on costs. And this sort of sturdy aggressive benefit makes the inventory value contemplating.

Funding technique

I don’t assume low costs will ever lose their enchantment with customers. However in an effort to supply worth, corporations want to have the ability to management their very own enter prices.

This isn’t simple in a grocery store business with low switching prices, however Tesco’s scale provides it a novel benefit over rivals. And I feel that makes the inventory value contemplating.

I don’t know what 2026 will deliver for the inventory. I’m unsure if it’s ‘simple cash’, however I do assume the corporate’s scale places it in a robust place and that’s what I search for firstly in an funding.