Picture supply: Getty Pictures

The FTSE 100‘s again the place it was earlier than the US administration introduced a ten% commerce tariff on UK items. When the stunning information hit in early April, the index fell nearly 1,000 factors in a couple of days.

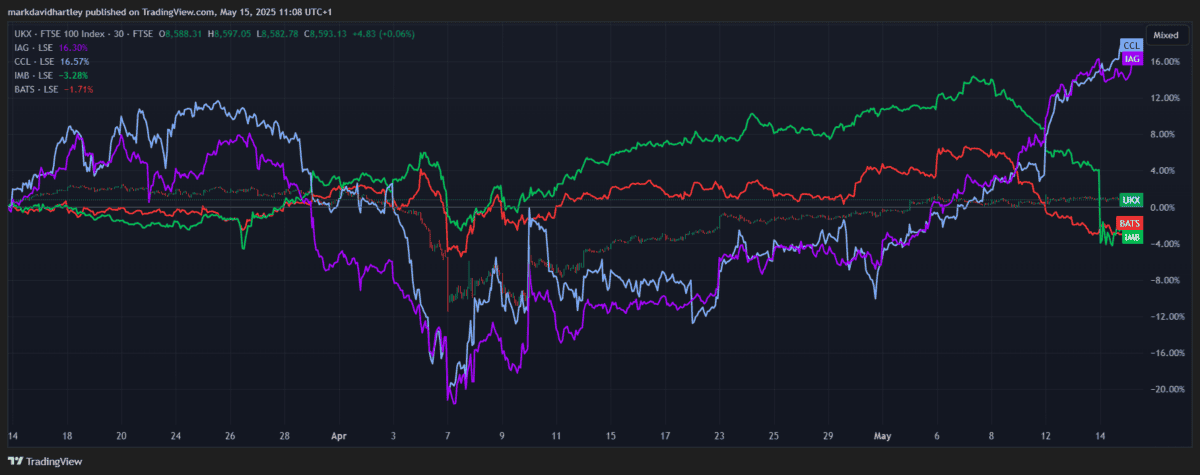

Now again to round 8,500 factors, it’s close to the identical stage it was in mid-March. The variation in efficiency of shares over this era is an effective indication of how totally different industries are affected by tariffs.

FTSE 100 inventory efficiency

On this occasion, there are clear sector-specific winners and losers. Journey-related shares have been among the many hardest hit by tariffs, whereas tobacco shares, which skilled minimal losses on the time, have since suffered worse losses.

Worldwide Consolidated Airways Group fell sharply when the tariffs have been introduced, however is now up nearly 16% since earlier than the announcement. The FTSE 250 inventory Carnival Cruises suffered comparable losses however has loved even higher good points since. The almost certainly clarification for that is falling gas costs — the most important expense these two corporations face.

In the meantime, tobacco giants Imperial Manufacturers and British American Tobacco (LSE: BATS) are each down by 2%-3% since mid-March.

So why’s tobacco struggling now, and the way is it associated to tariffs? I made a decision to seek out out.

Commerce warfare tensions

The almost certainly issue contributing to the latest drop in tobacco inventory costs is the announcement of tariff reductions between the US and China. The 2 nations agreed to decrease reciprocal tariffs by 115% for 90 days, aiming to de-escalate ongoing commerce tensions. Whereas this led to a web constructive acquire in most world markets, defensive industries like tobacco took a success.

Why? The atmosphere supplies a chance for risk-hardy traders to take advantage of the ensuing value fluctuations. Subsequently, many are shifting funds out of secure defensive shares to benefit from these extra delicate to tariff adjustments.

And it’s not simply tobacco — different standard defensive shares corresponding to Unilever, Reckitt and AstraZeneca additionally suffered minor losses this week.

These benefiting most from the adjustments are sectors together with expertise and shopper items which might be extra instantly impacted by commerce insurance policies.

A chance?

British American Tobacco’s falling share value may look engaging to worth traders — however does it have long-term potential?

The corporate’s been grappling with a number of operational challenges not too long ago, which provides cause for pause. In its newest annual report, it outlined expectations of decrease first-half earnings, attributed to macroeconomic pressures and the rise of unlawful vapor merchandise within the US. Moreover this, its enterprise into the vapor market has confronted extra setbacks. Authorized challenges have been a key concern, together with elevated competitors from disposable merchandise in Europe and patent disputes within the US.

These issues have raised considerations in regards to the firm’s means to efficiently transition to next-gen product classes.

However with a persistently excessive yield and probably the greatest dividend observe information on the FTSE 100, it nonetheless presents important worth. At present, with a yield round 8%, dividends have grown at a median annual fee of 5%, with no cuts or reductions in a long time.

That’s why it stays one of many top-earning dividend shares in my passive earnings portfolio. There are actually challenges forward, however for income-focused traders, I believe it’s nonetheless one value contemplating.