Picture supply: Getty Pictures

UK shares have been struggling this month after the early April announcement of contemporary US commerce tariffs. The stunning information wiped as a lot as 30% off sure shares and nearly 1,000 factors off the FTSE 100.

However on account of the chaos, there may very well be some profitable alternatives for buyers. Many dividend shares have seen their yields soar as costs fall. I’ve uncovered two particularly that look engaging proper now – MAN Group (LSE: EMG) and Greencoat UK Wind (LSE: UKW).

For buyers in search of dependable dividends, these two may very well be price contemplating.

MAN Group

MAN Group is down 27% this 12 months, regardless of a good set of 2024 outcomes. They included a share buyback announcement and dividend improve. Nevertheless, though income and earnings elevated by 23% and 27%, respectively, earnings per share (EPS) missed expectations. Worst of all, the asset supervisor minimize its steerage for the approaching 12 months.

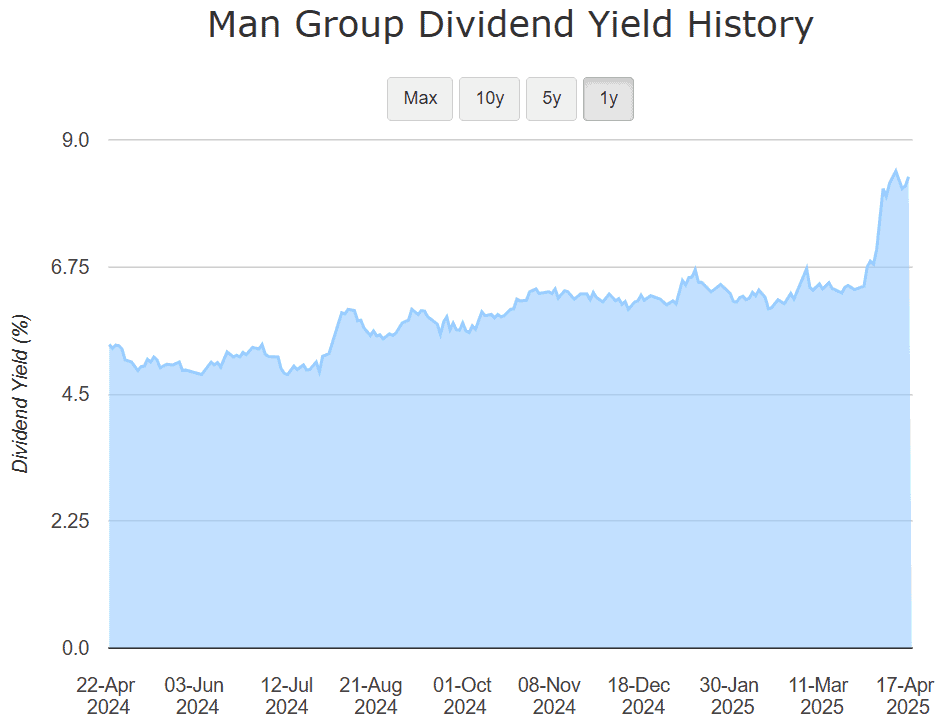

The outcomes didn’t initially have a big unfavourable impact on the inventory. However after the announcement of a ten% commerce tariff on UK items, it took a tumble. Now down 27% 12 months to this point, the inventory’s dividend yield has soared from 6% to eight.3%. At this stage, it appears like a horny possibility for revenue buyers.

The corporate has an extended observe document of returning money to shareholders by means of each dividends and buybacks. In actual fact, it has returned over $2bn to shareholders since 2018. Plus, the dividend is properly lined by earnings and supported by a strong stability sheet, with web money of $700m on the finish of 2024. That gives a cushion towards any short-term volatility in earnings.

That stated, there are dangers. The agency’s future efficiency is carefully tied to market sentiment and international fund flows, each of which may be hit onerous throughout unsure instances. If volatility spikes or investor urge for food fades, property below administration (AUM) might fall, placing stress on earnings and distributions.

Nonetheless, with the shares buying and selling at simply eight instances forecast earnings and yielding over 8%, the risk-reward stability may very well be compelling for long-term revenue seekers to think about.

Greencoat UK Wind

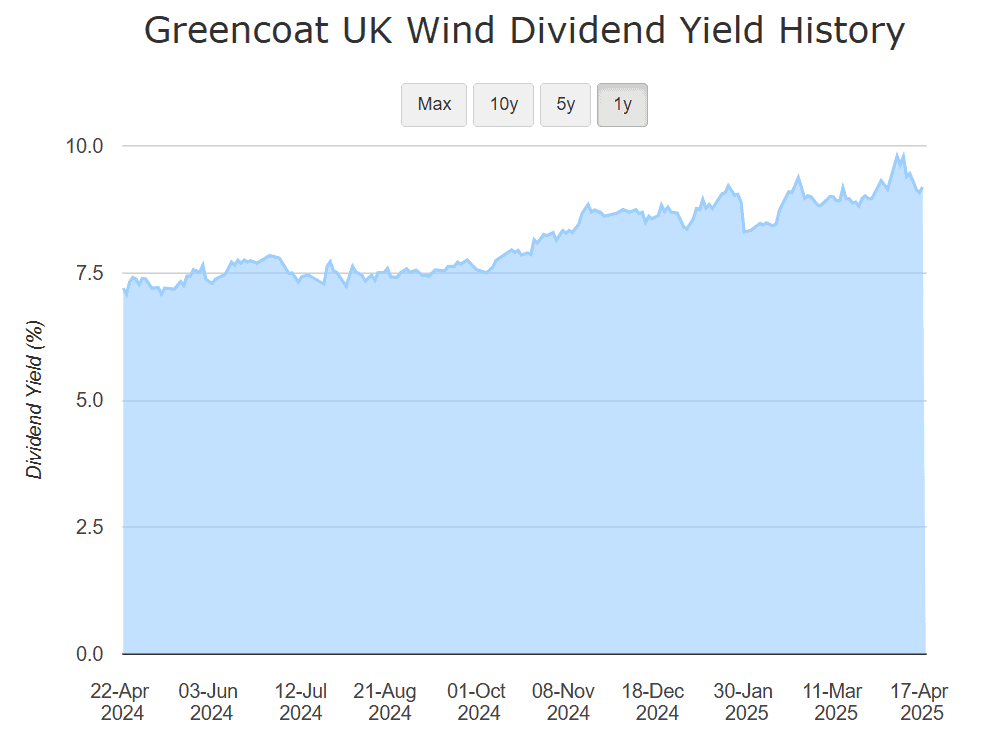

Greencoat UK Wind is a inexperienced vitality inventory that has seen its share value drop considerably (down 15% up to now 12 months) pushing its dividend yield to an attractive 9.2%. As a renewable infrastructure funding belief, Greencoat owns a diversified portfolio of operational UK wind farms.

Its revenues are largely inflation-linked, and its money flows are supported by long-term energy buy agreements. This makes it a comparatively defensive revenue play.

The belief has delivered constant dividend progress since itemizing in 2013 and stays dedicated to rising its payout in keeping with inflation. Its 2024 annual outcomes confirmed strong efficiency, with web asset worth (NAV) per share steady and money move era sturdy sufficient to assist its goal dividend for 2025.

Nevertheless, the latest sell-off has been pushed by a wider de-rating throughout the renewables sector, partly as a consequence of rising rates of interest. As charges have climbed, income-focused buyers have shifted in the direction of gilts and different fixed-income property, placing stress on listed infrastructure trusts.

That stated, with rates of interest anticipated to fall later this 12 months, it may very well be well-positioned for a re-rating. Within the meantime, buyers are being paid a wholesome yield to attend so it may very well be price additional analysis.