Bitmain’s cloud mining firm BitFuFu revealed the state of Bitcoin mining in late 2024. After a file hashrate and issue, most miners now need to spend greater than double the bills to mine one BTC.

In keeping with the most recent quarterly report by BitFuFu, the breakeven value for mining one BTC is $59,452, leaving a comparatively huge margin even at present costs. BitFuFu is without doubt one of the rising cloud mining corporations, constructed with an early funding from Bitmain.

BTC invited extremely aggressive mining even at ranges simply above $75,000, displaying some confidence in an even bigger future rally. In late 2023, BitFuFu cloud and self-miners had a price foundation of solely $25,618, permitting them to carry a number of the cash.

The outcomes of BitFuFu arrive at a time when Bitcoin achieved a brand new file of mining exercise, in addition to peak issue ranges. The mining facility has managed to search out electrical energy prices of $0.04 per KW/h on common, a lot decrease than the same old charge used to compute mining profitability. BitFuFu managed to supply viable rented hashing energy even in late 2024, displaying there may be more room for aggressive mining. Typically, some operations may fit at a loss, because the value foundation could go above $70K in some circumstances.

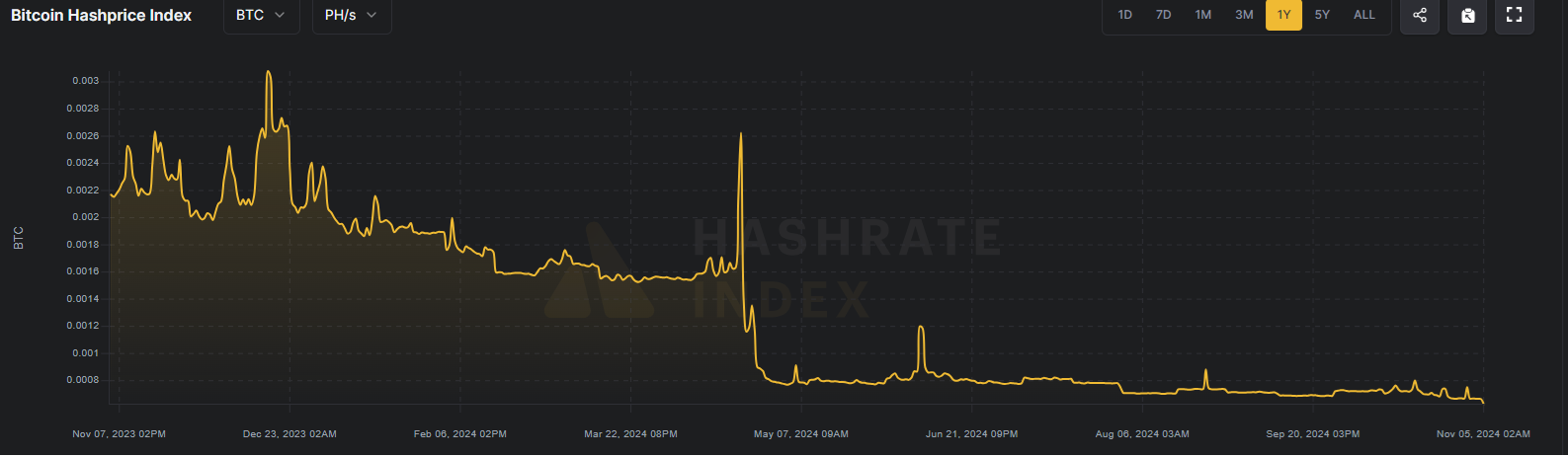

The quarterly outcomes mirror the low hashprice index, which is now at a continually low degree after the 2024 halving of the reward. Nonetheless, the underperformance has not stopped mining farms from constructing extra services, tapping the most recent mining machines from Bitmain for larger effectivity.

The hashprice index exhibits Bitcoin miners have lowered their productiveness after the Halving in 2024. | Supply: Hashrate Index

After the current hashrate file, BTC even continued its regular sample of value motion following mining growth. BTC recovered above $70,000 after the information of the mining file. Mining farms have an extended time-frame and are sitting on BTC produced throughout earlier durations.

BitFuFu drew in additional cloud-mining contracts

BitFuFu is without doubt one of the fastest-growing providers, as mining requires extra critical technical data. With economies of scale, the service gives decrease mining prices for its contract consumers.

In Q3 resulted in September, BitFuFu achieved a hashrate of 26.2 EH/s, surpassing most minor mining swimming pools. BitFuFu can be closing in on Binance Poool, which aggregates round 48 EH/s as of November 5. BitFuFu expanded its capability from 13.9 EH/s in Q3, 2024.

Previously yr, BitFuFu noticed an influx of purchasers for cloud mining providers. Regardless of the demand, consumers of cloud providers additionally noticed their BTC manufacturing shrink by 40% in competitors with different swimming pools. The purchasers of BitFuFu produced 957 BTC for themselves in Q3, down from 1,614 BTC for a similar interval in 2023.

Yr-on-year, demand rose by greater than 75%. The mining facility solely produced 340 BTC from self-mining operations, down from 515 BTC in the identical interval of 2023. The self-mining revenues elevated in fiat phrases, as a consequence of toe 114% improve in BTC market costs for the previous yr. In Q3, BitFuFu acknowledged $2.2M in good points from BTC gross sales, retaining most of its cash for additional capital good points.

On account of extra mining demand, BitFuFu deserted its low-asset technique. In October, the power acquired a 51.25% stake in a mining capability in Ethiopia, with an 80MW energy capability. Even with out the most recent buy of a brand new facility, the cloud mining group sat on a portfolio of 556 MW of dependable energy, up from 339 MW in Q3, 2023.

Cloud mining boosted BitFuFu’s backside line

Even with fewer BTC produced, BitFuFu expanded its revenues and EBITDA earnings. Complete revenues reached $90.3M, up from $61.2M for Q3, 2023.

BitFuFu achieved EBITDA of $5.8M, although a web loss after inventory compensation of $5M. The corporate additionally elevated its reserves to $147.2M, up from $76M as of December 2023.

The optimistic outcomes arrived within the first full quarter following the 2024 BTC halving. BitFuFu had secured cloud mining purchasers earlier than the occasion, counting on recurring revenues. In Q3, recurring revenues contributed to 61.3% of the overall, with the rest coming from new prospects acquired from September onward. The income combine exhibits no indicators of cloud miner capitulation, blended with important new demand.