When you’re a current school graduate trying to launch your profession or a mid-level skilled prepared for a pivot, you is perhaps out there for an entry-level job — and questioning how a lot you may anticipate to receives a commission.

Lower than half (48%) of People say they’ve emergency or wet day funds that will cowl their bills for 3 months, and about 20% of them report not having sufficient cash to pay hire or a mortgage, in line with Pew Analysis Heart.

Associated: Younger U.S. Employees Count on $200,000 Salaries By Age 30. Here is What They Really Earn — How Do Your Stats Examine?

Whether or not or not your subsequent gig affords a snug life-style has loads to do with its location.

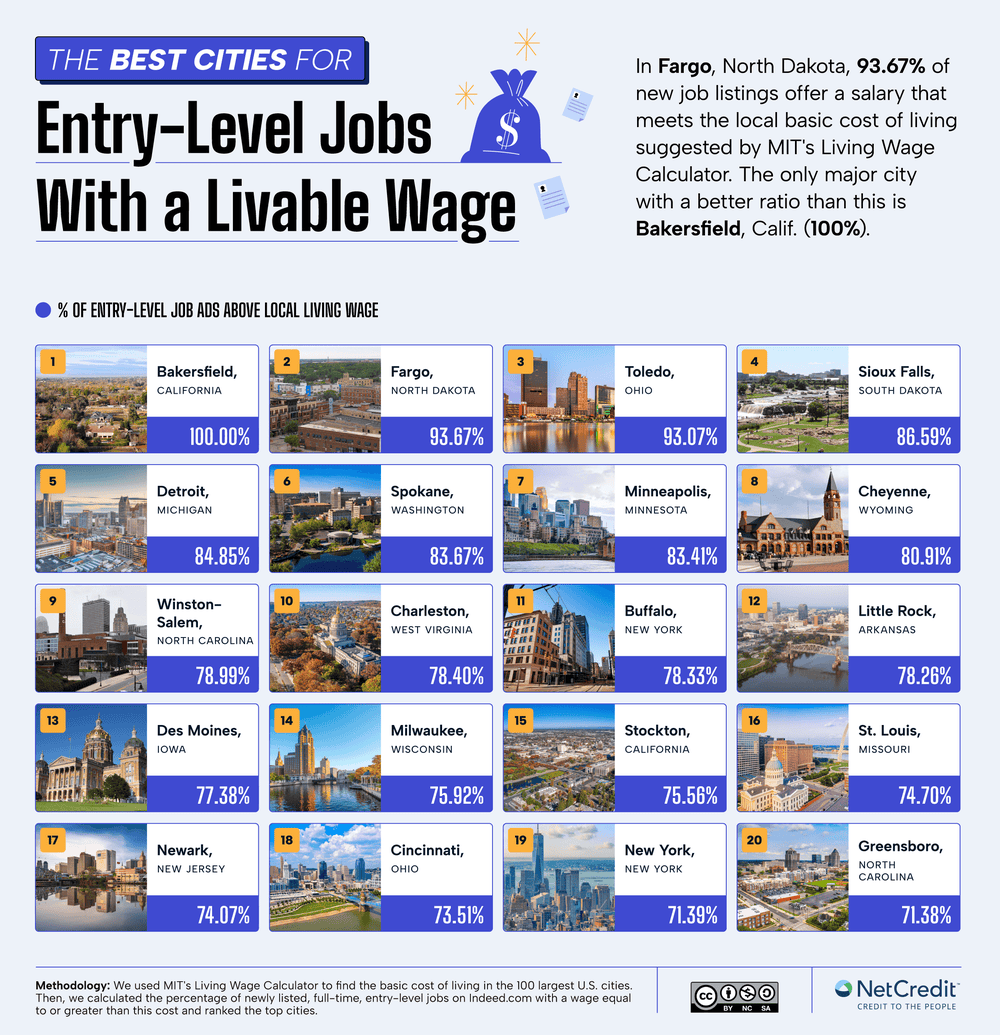

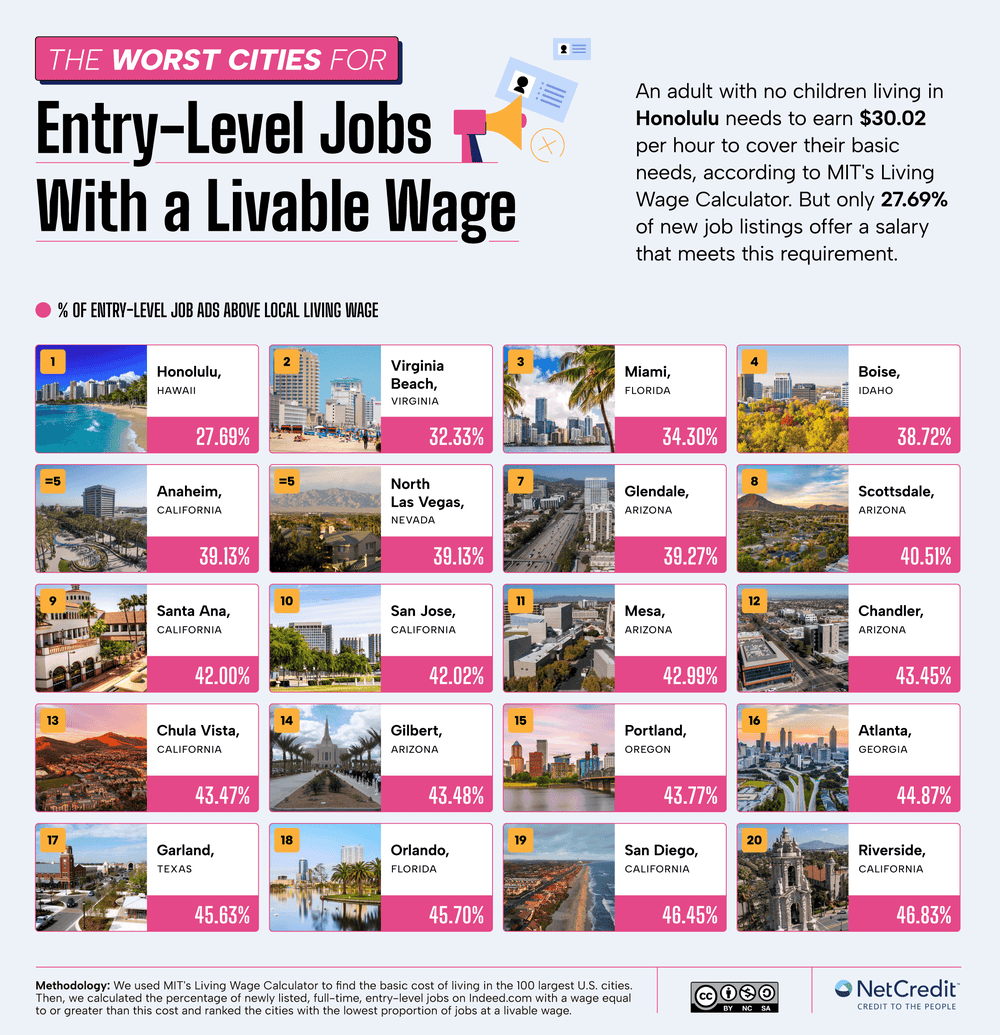

On-line lender NetCredit in contrast native entry-level job wages to native prices of dwelling utilizing MIT’s Residing Wage Calculator and ranked states and cities based mostly on the proportion of job advertisements with salaries surpassing the native dwelling wage to determine the place individuals have one of the best probability at success.

Because it seems, Bakersfield, California, comes out on prime, with 100% of entry-level job advertisements on Certainly promoting wages above the native dwelling wage, and Fargo, North Dakota, follows in second, with a 93.67% ratio, per the information.

Associated: U.S. Employees Have Discovered a Technique to Improve Their Salaries Quick. However the Technique May Harm Them in Retirement.

Entry-level job candidates in Honolulu, Hawaii, might fare the worst. Simply 27.69% of recent job posts checklist a wage according to the dwelling wage, in line with NetCredit. The analysis additionally confirmed low ratios in Virginia Seashore, Virginia (32.33%); Miami, Florida (34.3%); and Boise, Idaho (38.72%).

Try NetCredit’s infographics under for a fuller image of the analysis and livable wages throughout the U.S.:

Picture Credit score: Courtesy of NetCredit

Picture Credit score: Courtesy of NetCredit

Picture Credit score: Courtesy of NetCredit

Picture Credit score: Courtesy of NetCredit