Picture supply: Domino’s Pizza Group plc

It’s at all times fascinating to see what big-name buyers within the US have been doing. Each quarter, we get to peek backstage by ‘13F’ regulatory filings, which present what they had been shopping for and promoting within the earlier quarter. Unsurprisingly, Warren Buffett’s Berkshire Hathaway may be very intently watched.

In Q3, one huge transfer made by Buffett — or extra doubtless one in every of his investing lieutenants, Ted Weschler and Todd Combs — was the acquisition of Domino’s Pizza (NYSE: DPZ).

Berkshire scooped up 1.27m shares of the pizza restaurant chain, price roughly $550m.

The inventory has been an enormous long-term winner, rising 5,520% prior to now 15 years (excluding dividends).

What’s so engaging about this inventory?

I see plenty of issues that make this a basic Buffett/Berkshire purchase. For starters, Domino’s is the world’s main pizza firm, with greater than 20,500 places worldwide.

Crucially, it has an immediately recognisable model. Buffett loves robust manufacturers, as his 36-year holding in Coca-Cola proves. Prime manufacturers usually take pleasure in pricing energy, enabling them to lift costs with out shedding clients, thereby enhancing profitability.

Each corporations function a franchising mannequin (Coca-Cola for bottling and distribution, and Domino’s for its eating places, although it nonetheless runs just a few itself right here and there).

This implies it generates income by royalties and costs paid by franchisees, in addition to substances and tools provided to those retailer house owners by its provide chain operations enterprise (61% of income).

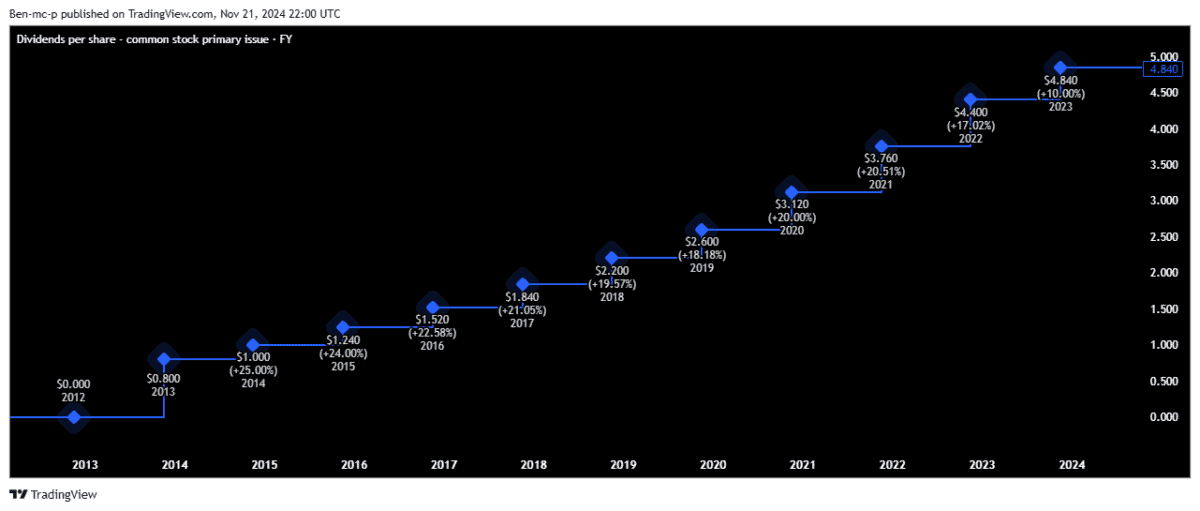

Buffett additionally loves dividends, and Domino’s pays one. Whereas the yield is just one.35%, the payout has grown at a median of about 19% per 12 months over the previous decade.

Lastly, Buffett stated: “It’s much better to purchase a beautiful firm at a good worth than a good firm at a beautiful worth“. This merely means it’s higher to spend money on a enterprise that’s each great and pretty priced than a good one buying and selling at a premium.

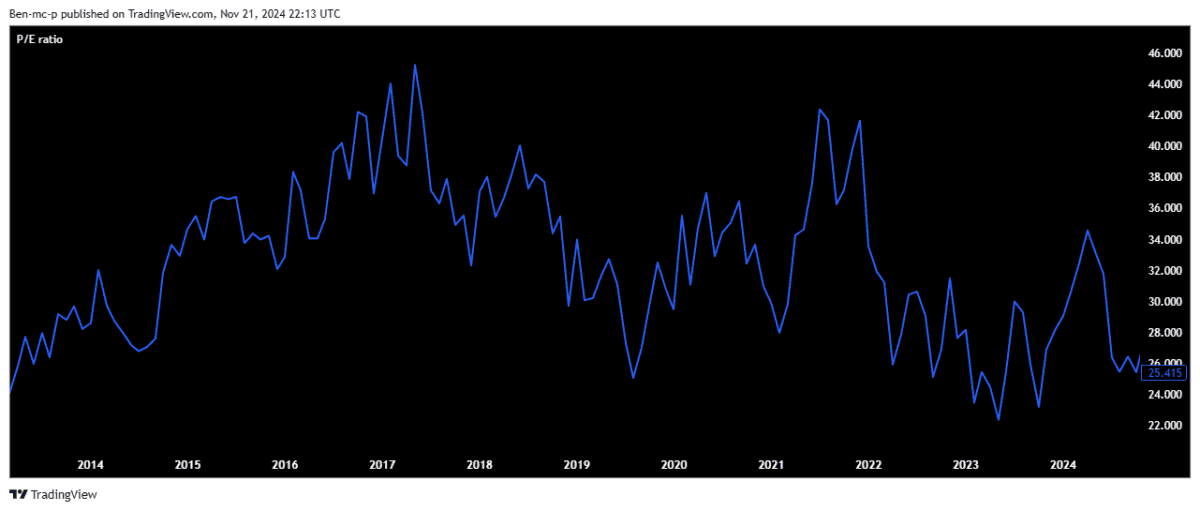

Proper now, the inventory’s price-to-earnings (P/E) ratio is about 25. This locations it on the decrease finish of its 10-year historic P/E vary, as illustrated within the chart beneath.

This implies we’re taking a look at a high-quality firm that’s pretty valued.

Mature and aggressive market

One threat right here is that the pizza market is extraordinarily aggressive. Talking personally, I get the odd Domino’s, however I additionally use my native pizza store (which is method cheaper however nonetheless tasty).

In the meantime, Greggs does a incredible pizza field deal, delivered virtually as shortly as Domino’s. So I’m spoilt for alternative, a lot to the detriment of my waistline.

It’s additionally fairly a mature market, and analysts count on the pizza maestro’s income to develop at about 6% over the following few years. Working revenue a bit increased, at round 8%.

UK-listed options

The FTSE 250 has a Domino’s Pizza, which is the grasp franchisee for the model within the UK and the Republic of Eire. That inventory is just a little cheaper, buying and selling on a P/E ratio of 17.7.

One other one is DP Poland, which holds unique rights to the model in Poland and Croatia. This can be a loss-making penny inventory, making it by far the riskiest alternative right here.

Nonetheless, that is the one I’ve chosen over the opposite two. The agency is rising quickly and transferring in direction of a sub-franchise mannequin. I believe it has numerous potential at 10p.