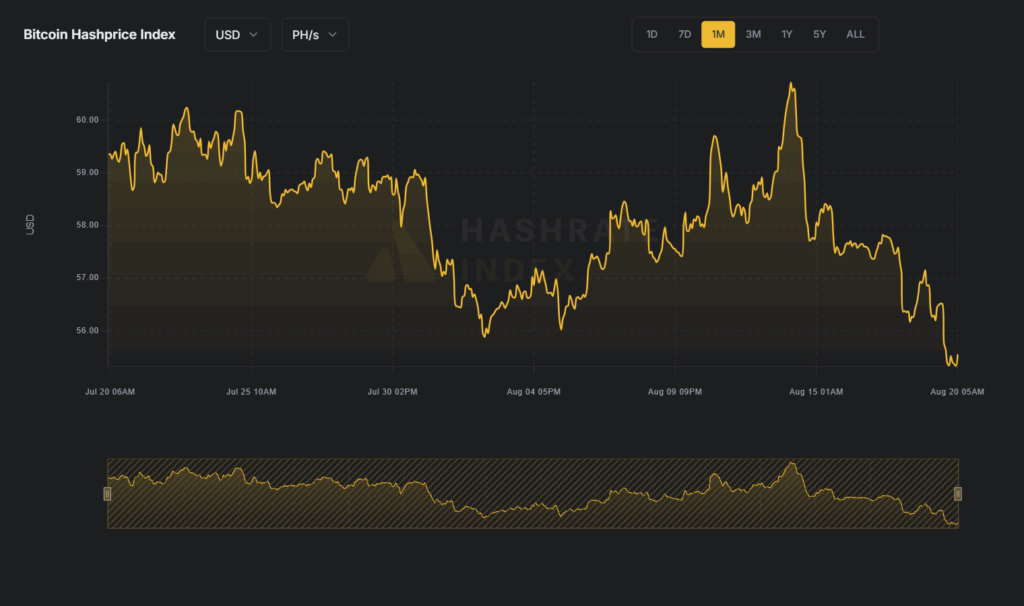

The issue of Bitcoin reaches a brand new all-time excessive, round 129 trillion, based on updates from August 2025. In parallel, the typical hashprice stays near $60/PH/s (estimates from Hashrate Index), whereas in america, {hardware} importers for mining face tariffs as much as 57.6% on ASICs. A context that tightens margins and forces many operators to rethink their methods.

Throughout our qualitative monitoring of company communications, regulatory reviews, and trade articles up to date to August 2025, we discovered {that a} vital variety of operators have revised their funding and procurement plans.

The analysts we consulted point out that top tariffs and file issue make a slowdown in new ASIC orders extra doubtless and a higher give attention to operational effectivity. These findings are in step with the general public knowledge and with the unbiased analyses accessible in trade literature.

Bitcoin Problem at 129T: which means and context

The issue signifies how “arduous” it’s to mine a brand new block: it will increase as the worldwide computing energy (hashrate) grows, so as to maintain the typical time between blocks round 10 minutes. The height at 129T displays the entry of extra environment friendly {hardware} and the growth of huge farms, with direct results on the unit manufacturing prices of every BTC.

In operational phrases, a better issue ends in decrease possibilities {that a} single hash is successful. On this context, with the BTC worth being equal, the revenues per unit of energy are likely to lower.

Hashprice at $60/PH/s: margins beneath strain

The hashprice is the estimated income per unit of hashrate (for instance, {dollars} per PH/s per day). With the problem at its peak, the indicator is round $60/PH/s, indicating a extra compressed profitability in comparison with earlier phases of the cycle.

This ends in a compression of margins: miners with excessive power prices or with much less environment friendly machines (excessive consumption in W/TH) are the primary to really feel the influence. It needs to be famous that, for a lot of operators, the break-even level shifts upwards, growing sensitivity to fluctuations within the spot worth of BTC.

Commissions lowering: price share beneath 1% in July 2025

Within the month of July 2025, the charges accounted for lower than 1% of the block revenues. Because of this the predominant share of miners’ revenue comes from the mounted reward (presently equal to 3.125 BTC, in step with the halving cycle), making money flows extra uncovered to modifications in issue and the spot worth.

When the charges stay depressed, the volatility of month-to-month revenues tends to extend: even small deviations in worth or issue can considerably influence total profitability.

Tariffs on ASICs at 57.6%: influence on CAPEX and provide chain

The latest commerce tightening in america introduces tariffs for importers of mining {hardware} that may attain as much as 57.6%. The impact is a extra burdensome CAPEX to resume or broaden the machine fleet, with potential logistical delays and higher capital immobilized alongside the provision chain.

Two latest instances spotlight the scope of the difficulty: CleanSpark reported a possible publicity of as much as $185 million, whereas Iris Power obtained a declare within the order of $100 million. Each corporations are difficult the calls for of the U.S. customs.

Sensible results of tariffs

- Enhance in unit value for the acquisition of latest ASICs and spare components

- Supply occasions longer and bigger shares to mitigate dangers

- Enlargement plans reshaped, with growing give attention to power effectivity per watt

- Contenziosi and accounting uncertainty on potential liabilities

Prospects 2025: break-even, consolidation, and dangers

In 2025, the profitability of miners will rely upon three central variables: the value of power, the community issue, and the hashprice. With issue at its peak and low charges, the break-even level shifts larger. Doable implications embody consolidation of the sector, a slowdown in ASIC orders, and elevated relocation to areas with extra aggressive power.

A lower in issue or a restoration of the hashprice might provide momentary aid; nevertheless, structural components – persistent tariffs and excessive power prices – require deeper strategic responses. An fascinating side is the completely different resilience amongst operators, linked to power combine and contract construction.

The strikes of the miners: effectivity, hedging, and suppleness

- Power optimization: renewal with extra environment friendly machines, immersion cooling, participation in demand response applications

- Provide chain: diversification of suppliers, nearshoring options, and renegotiation of contracts

- Hedging: protection on BTC and devices linked to the hashrate (e.g., specialised indices and derivatives, like these supplied by Hashrate Index)

- Power combine: higher share of renewables and use of in any other case wasted power

Impression in the marketplace and situations

The strain on revenues might set off a pure choice: operators with excessive OPEX would possibly cut back exercise or divest property, leaving room for extra environment friendly gamers. In case of a rise within the BTC worth or a lower in issue, margins can enhance; nevertheless, visibility stays restricted till tariffs and power prices converge to extra favorable ranges.

Associated Insights

- How Bitcoin mining works: hashrate, issue, and rewards

- Halving Bitcoin: what modifications for miners and for the market

- Bitcoin worth at the moment: quotations and market components

Abstract

Abstract: issue at 129T, hashprice round $60/PH/s, price share beneath 1% in July 2025, and tariffs as much as 57.6% on ASICs within the USA. The 2025 outlook stays difficult for miners, coping with compressed margins and growing CAPEX. The longer term steadiness will rely upon the worth of BTC, the price of power, and regulatory developments.

Transparency notice: the info offered relies on public and up to date sources (Hashrate Index, Blockchain.com Charts, Cambridge Bitcoin Electrical energy Consumption Index).