Bitcoin miner IREN has posted its greatest quarter of earnings up to now, bringing in $187.3 million final quarter, which contributed to a report $501 million income for the fiscal yr, sending its replenish almost 14% in after-hours buying and selling.

Quarterly income for the month ended June 30 was up 226% year-on-year, serving to the corporate swing again into profitability with $176.9 million in web revenue, IREN stated in a report on Thursday.

The surge was pushed by progress in its Bitcoin (BTC) mining enterprise, however the firm has additionally made strikes to deepen its footprint within the AI area as a brand new “Most popular Accomplice” to AI big Nvidia.

IREN shares closed up at almost 3.1% to $23.04 on Thursday and rose one other 13.9% in after-hours following the outcomes, Google Finance knowledge reveals. The inventory has been steadily climbing this month, repeatedly setting new highs.

IREN’s change in value on Thursday. Supply: Google Finance

IREN’s AI enlargement displays a broader business pattern, as Bitcoin miners proceed to navigate the current enhance in mining problem that has pushed up vitality use and squeezed revenue margins — forcing a lot of them to undertake extra environment friendly tools, discover cheaper vitality sources, or develop into AI.

IREN has been a high Bitcoin miner in 2025

IREN recorded $1 billion in annualized income “below present mining economics” and beat business heavyweight MARA Holdings in BTC mining manufacturing in July, mining 728 BTC in comparison with MARA’s 703 BTC.

IREN additionally notched 50 exahashes per second in put in Bitcoin mining capability, however paused additional enlargement to concentrate on AI.

IREN companions with business big Nvidia

IREN elevated its GPU depend to 1,900 in the course of the quarter, rising 132% year-on-year because it grew to become a “Most popular Accomplice to Nvidia,” enabling extra direct entry to Nvidia’s {hardware}.

IREN makes income from its AI enterprise by renting GPU energy for machine studying duties, coaching massive language fashions and supporting companies needing high-performance AI computation.

IREN plans to spend one other $200 million to spice up its GPU depend to 10,900 within the coming months to succeed in its goal of $200 million to $250 million in annualized AI income by December.

This could characterize an eight-to ten-fold enhance in AI income in comparison with what it made between April and June, which introduced round $25 million month-to-month.

Over the long run, IREN is trying to set up 60,000 of Nvidia’s Blackwell GPUs at its British Columbia web site in Canada.

IREN as soon as pegged as “overvalued”

IREN’s robust efficiency of late comes a few yr after short-selling agency Culper Analysis stated IREN was “wildly overvalued” and criticized the corporate for speaking “massive sport” about high-performance computing with out investing sufficient to compete significantly in AI.

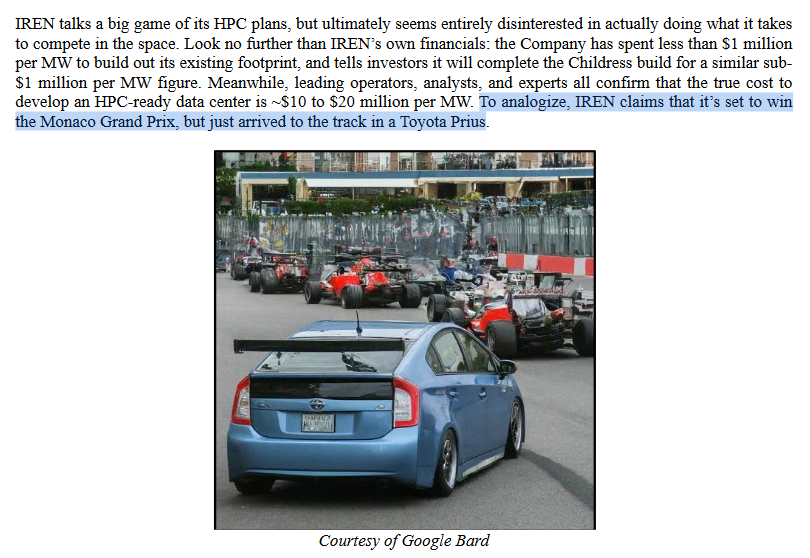

Culper in contrast IREN’s efforts to competing to win the Monaco Grand Prix, however arriving on the monitor in a Toyota Prius.

Excerpt from Culper Analysis’s report on IREN in July 2024. Supply: Culper Analysis

Since then, IREN shares fell from $12.31 to as little as $5.59 in April, however have rallied 312.2% previously 4 months.

In the meantime, IREN just lately reached a confidential settlement with creditor NYDIG, wrapping up an almost three-year authorized battle over $105 million in defaulted tools loans tied to round 35,000 Antminer S19s.