Bitcoin (BTC) mining is the subsequent sector to really feel the consequences of the US-China tariff warfare. Miners are searching for workarounds, because the standing of ASICs and mining rigs stays unclear.

Bitcoin mining is reacting to the US-China tariff warfare, because the standing of machines and their elements stays unclear. The SHA-256 aggressive mining nonetheless depends on Bitmain’s machines, that are both shipped to areas or use rented mining services abroad.

The tariff wars flared up simply as Bitmain introduced new shipments of a few of its strongest ASIC rigs. The S21, presently probably the most highly effective Bitcoin mining machine, is beginning to ship this month.

🔔Spot sale of ANTMINER S21e Hyd.

A Value-effective Choice for #BTC #Mining✅288T

✅4896W

✅17J/T

Solely 💲12/T⏰Gross sales begin on April fifteenth, 9:00AM(EST)

📦Cargo obtainable from April to Could pic.twitter.com/jMgq0uaeKW— BITMAIN (@BITMAINtech) April 15, 2025

The 90-day tariff grace interval might result in elevated demand for transport ASIC. Miners may double down on US-based services, with the potential to purchase as a lot hashrate as attainable earlier than any cargo obstacles come up.

Tariffs might trigger a rush to ship ASICs to the USA

The most important query is whether or not the promised electronics and mining gear might be shipped. The US tariffs have an effect on not solely China, but in addition Malaysia, Thailand, and Vietnam, that are a part of the mining ASIC provide chain.

A number of the mining startups that use elements from these nations scrambled to ship as a lot as attainable earlier than tariffs got here into impact.

“We began chartering cargo planes out of Malaysia and Thailand to get shipments into the US earlier than the unique deadline,” mentioned Vishnu Mackenchery, Director of World Logistics and Providers at Compass Mining.

Primarily based on the most recent classification, ASIC miners don’t fall below the exempted electronics, and could also be shipped with prohibitive tariffs if the commerce warfare just isn’t resolved by the point the grace interval ends. Compass Mining is likely one of the corporations bracing for affect, with restricted recourse for exemptions primarily based on the present US tariff system and classification.

🚨 Tariffs & Bitcoin Mining {Hardware} 🚨

Following up on the White Home’s April eleventh, 2025, replace concerning tariff exceptions below EO 14257, let’s dive into the implications for ASIC miners imported into the U.S.

In 2018, U.S. Customs and Border Safety (CBP) labeled…

— Compass Mining 🧭 (@compass_mining) April 15, 2025

Luxor Expertise, one other mining gear vendor, plans to maintain customers knowledgeable, but in addition hinted that tariffs could also be coming to new gear. As with different electronics, not all provide chains undergo China, with smaller tariffs for a number of the machines and elements.

The US continues to dominate hashrate

Till just lately, all mining ASICs from China have been nonetheless taxed at 25% for entry into the USA. The merchants circumvented this requirement by transport from different nations. Now, these areas may also be hit by reciprocal tariffs, leaving miners to seek out new potential routes for rigs and provides. Indonesia, Malaysia, and Thailand will be the most important markets to be affected.

At the moment, the USA stays one of many main nations by uncooked hashrate. Prime mining companies like Mara Holdings are increasing their hashrate and constructing new services.

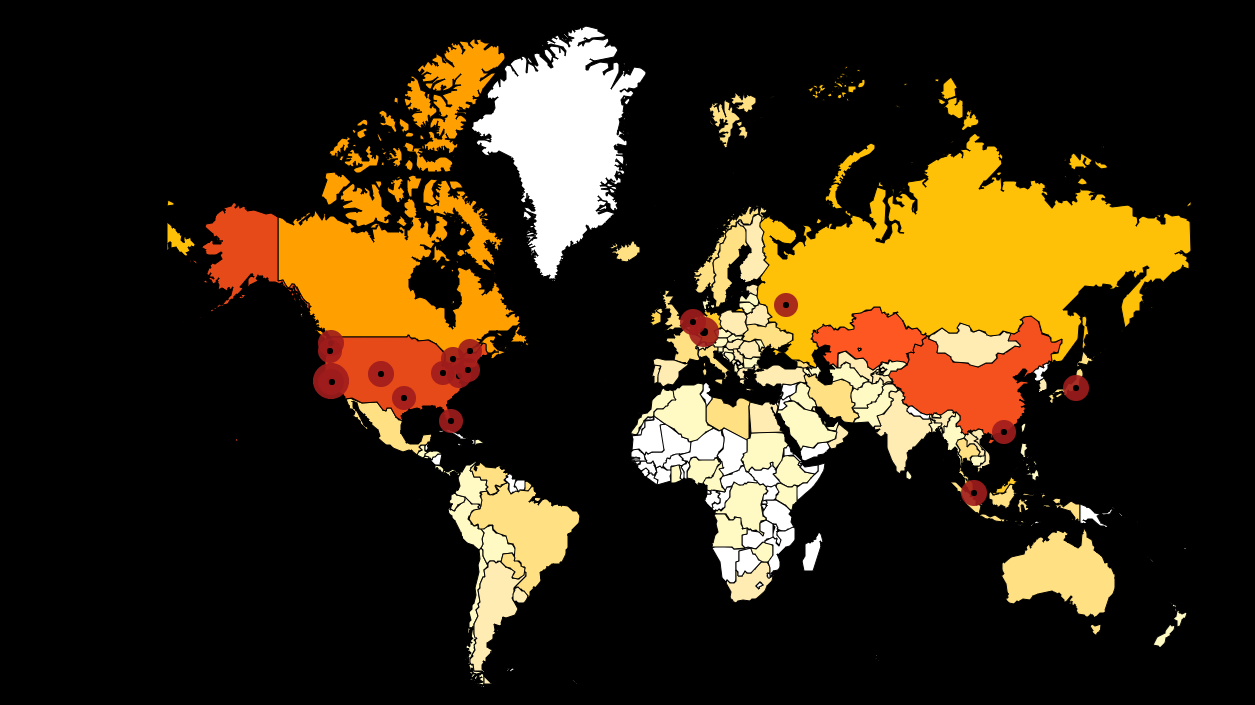

The USA stays a frontrunner each as a pool aggregator and in internet hosting native mining knowledge facilities. | Supply: Chain Bulletin

The tariff menace might profit present mining companies, particularly people who modified their gear and locked in larger hashrate. The shares of US-based mining companies have been up previously day, whereas Canaan Mining (CAN), primarily based in China, misplaced 7.2% of its value right down to $0.26.

FoundryUSA, the most important US-based mining pool, presently produces over 31% of blocks because of the influx of abroad miners, whereas additionally including its native hashrate. The Bitcoin community remains to be experiencing peak hashrate at 890 EH/s.