The Bitcoin (BTC) mining issue hit an all-time excessive of 127.6 trillion this week, however is projected to drop throughout the subsequent issue adjustment on August 9.

Mining issue is anticipated to fall by about 3% to 123.7 trillion within the subsequent adjustment interval, and the present common block time is about 10 minutes and 20 seconds, in accordance with CoinWarz.

Knowledge from CryptoQuant exhibits that the mining issue fell in June, with a pointy drop-off on the finish of month and the primary two weeks of July, when issue fell to 116.9 trillion. Nevertheless, the issue degree resumed its long-term uptrend within the latter half of July.

Bitcoin mining issue, and the community’s hashrate — the whole computing energy dedicated to securing the community — is central to miner profitability and sustaining Bitcoin’s excessive stock-to-flow ratio, which protects BTC’s value from overproduction.

Bitcoin mining issue hits a brand new all-time excessive and has been steadily rising over time. Supply: CryptoQuant

Associated: Solo Bitcoin miner scores $373,000 block reward

Bitcoin’s issue adjustment and the stock-to-flow ratio

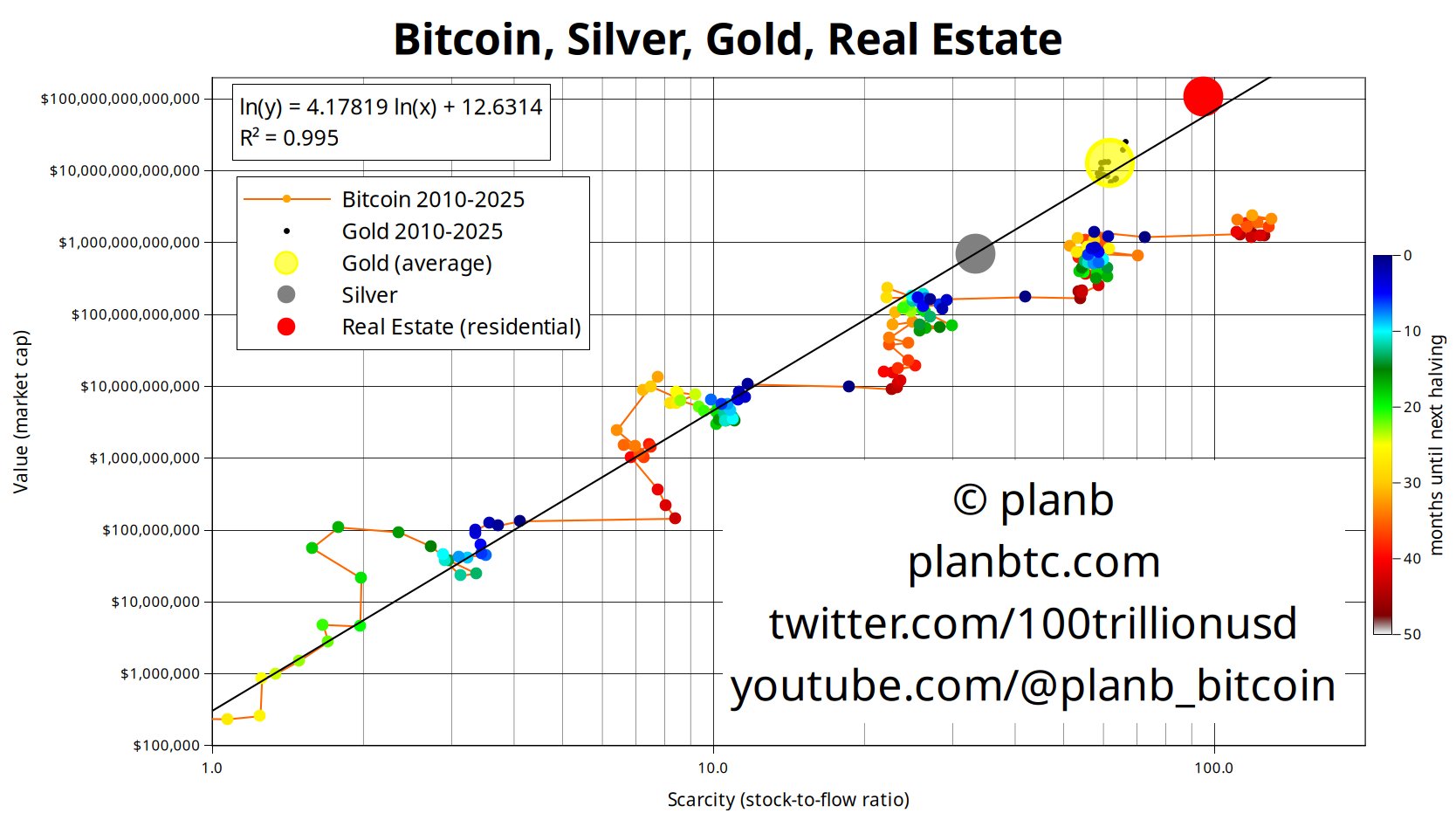

Inventory-to-flow ratio measures the whole accessible provide of a monetary asset or commodity towards the newly created provide added by miners or commodity producers.

The upper the ratio, the extra resilient the asset or commodity is to cost modifications attributable to overproduction; the decrease the ratio, the extra the asset or commodity will probably be impacted by new provide.

This ratio is partially why silver was demonetized by gold. Silver has a decrease stock-to-flow ratio than gold. Rising silver costs appeal to miners and producers to create extra provide, which floods the market with new silver and depresses costs.

Bitcoin has the next stock-to-flow ratio than gold, with about 94% of BTC’s 21 million provide already mined and circulating within the markets. Gold, compared, has no arduous provide cap and an inflation charge of about 2% per 12 months.

Evaluating Bitcoin’s stock-to-flow ratio with gold, silver, and residential actual property. Supply: PlanB

“Gold shortage, the stock-to-flow ratio, is about 60. Bitcoin’s shortage is about 120. So, bitcoin is 2x scarcer than gold,” in accordance with PlanB, the creator of the Bitcoin stock-to-flow value evaluation mannequin.

The issue adjustment makes Bitcoin’s value inelastic to manufacturing, which is saved proportional to the whole computing energy deployed by miners.

Adjusting issue prevents overproduction and subsequent value collapses attributable to new provide being dumped in the marketplace in massive portions over a brief time frame.

The Bitcoin community’s hashrate represents the whole quantity of computing energy deployed to safe the community. Supply: CryptoQuant

As extra computing energy is deployed to safe the Bitcoin community, the issue rises to match the brand new computing assets, retaining block manufacturing as near the protocol’s 10-minute goal as doable.

Conversely, if computing energy drops, the community issue adjusts down to make sure new blocks are mined at a gentle tempo of about 10 minutes.

Journal: Bitcoin vs. the quantum laptop menace: Timeline and options (2025–2035)