Momentum indicators are additionally holding up. The Relative Power Index (RSI) is sitting at 69, close to overbought ranges however nonetheless pointing to continued curiosity from bulls. A latest bullish cross within the transferring averages helps the potential for extra upside within the close to time period. These indicators mirror power fairly than exhaustion at this stage.

- Miners are slowly shifting cash to exchanges, hinting at nerves over extra draw back strikes.

- The value nonetheless holds inside a bullish chart setup, however a clear break above $105K is required for a carry.

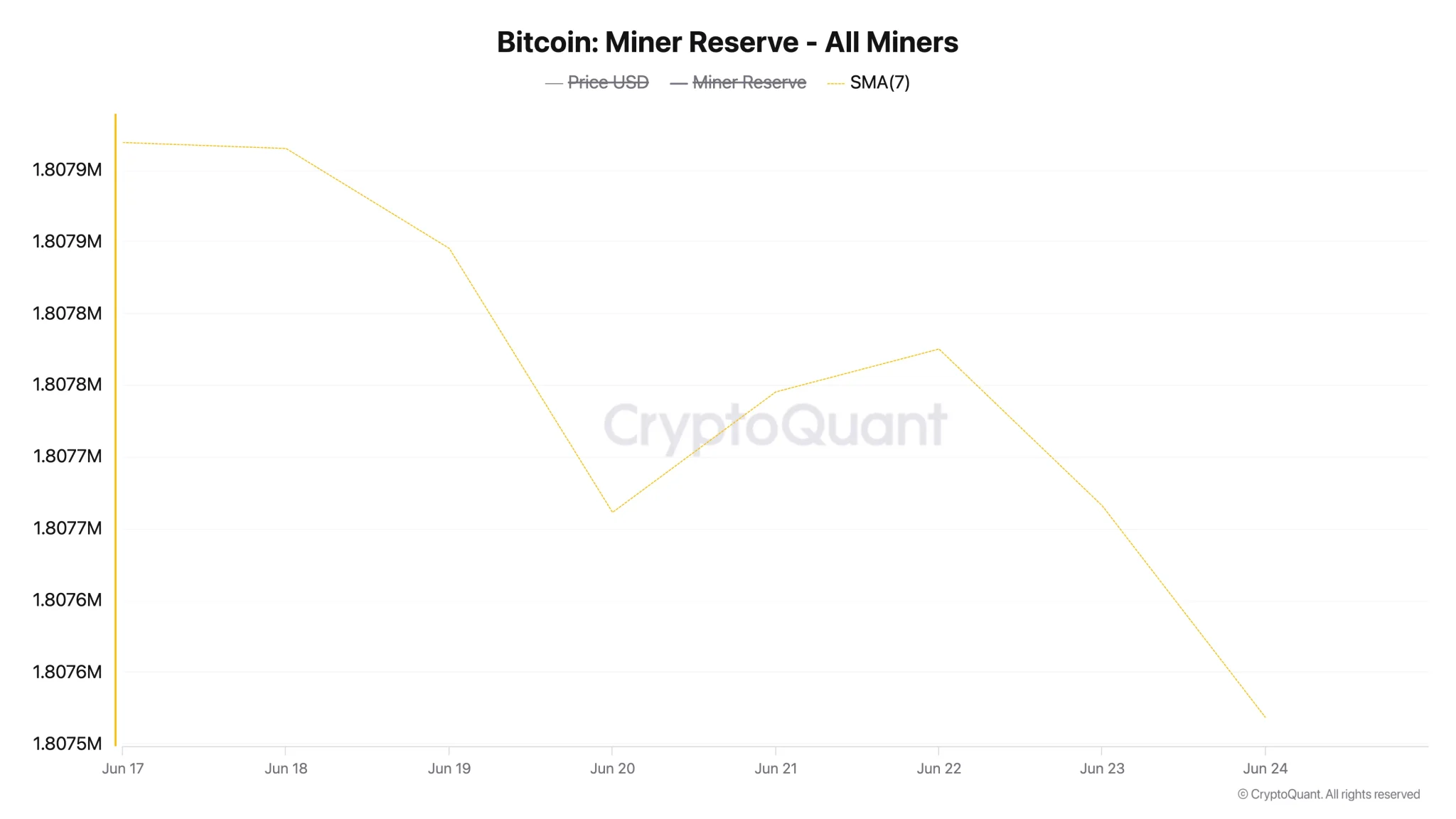

Bitcoin miners seem like exhibiting restraint, trimming their publicity and probably bracing for broader market weak point. The miner reserve, which tracks how a lot Bitcoin miners are holding, dropped barely by 0.022% over the previous week on a 7-day common. Although small, this transformation means that some miners are leaning towards promoting.

This shift factors to declining confidence, particularly after Bitcoin dipped under the $100,000 degree over the last two buying and selling classes. That value has served as a psychological line for a lot of, and falling via it could sign rising uncertainty throughout the market.

Supply: CryptoQuant

Including weight to this sentiment is the sharp 55% spike within the Miners’ Place Index (MPI) inside three days. This metric compares the quantity of Bitcoin miners ship to exchanges towards their one-year common. A rising MPI usually signifies that miners are transferring extra of their holdings to exchanges, usually an indication that they intend to promote.

Market Pressure Mounts as Bitcoin Miners Again Away

The latest pattern within the MPI suggests elevated promoting exercise, signaling that miners have gotten much less assured in Bitcoin’s short-term efficiency. The shift of cash from wallets to exchanges signifies a perception that costs could drop additional or fail to achieve upward traction for now.

Nevertheless, some analysts maintain a unique view. CryptooELITES expressed agency optimism, saying,

In case you assume a rally isn’t coming for Bitcoin, you then most likely don’t know something in any respect.

One other market watcher, Analyst Jelle, believes that Bitcoin stays in a bullish pennant sample. He said that preliminary breakouts from such a setup are sometimes misleading. In line with him, as soon as the value reclaims power and breaks above $110,000, “this flies lots larger.”

#Bitcoin is again within the bullish pennant!

Often with these patterns, the primary breakout is a pretend – and when value reverses, the true breakout is simply across the nook.

Break above $110k and this flies lots larger.

Let’s examine 👀 pic.twitter.com/TiSlKCUR8i

— Jelle (@CryptoJelleNL) June 24, 2025

Cup-and-Deal with Targets $144K—Key Breakout Close to

Bitcoin is at the moment exhibiting a cup-and-handle sample on the day by day chart, a setup that merchants usually affiliate with a attainable upward transfer. The value is buying and selling inside the deal with portion, with resistance sitting at $105,000. This degree additionally aligns with the 50-day easy transferring common. An in depth above it might open the best way to $109,000, which represents the neckline of the sample.

Breaking $109,000 with robust quantity might open the trail to retesting the Might 23 excessive of $112,000. If Bitcoin closes above that, merchants would begin anticipating the complete goal of the cup sample at $144,000—a degree roughly 37% above present costs.

Supply: TradingView