A rare reveal: Mining was by no means banned in China.

Sure, you learn that proper. Actually, not solely was it not banned, however Chinese language miners are main the world in revolutionary makes use of of Bitcoin mining.

However what of this Reuters report and others that claims it was banned?

Let’s have a better look.

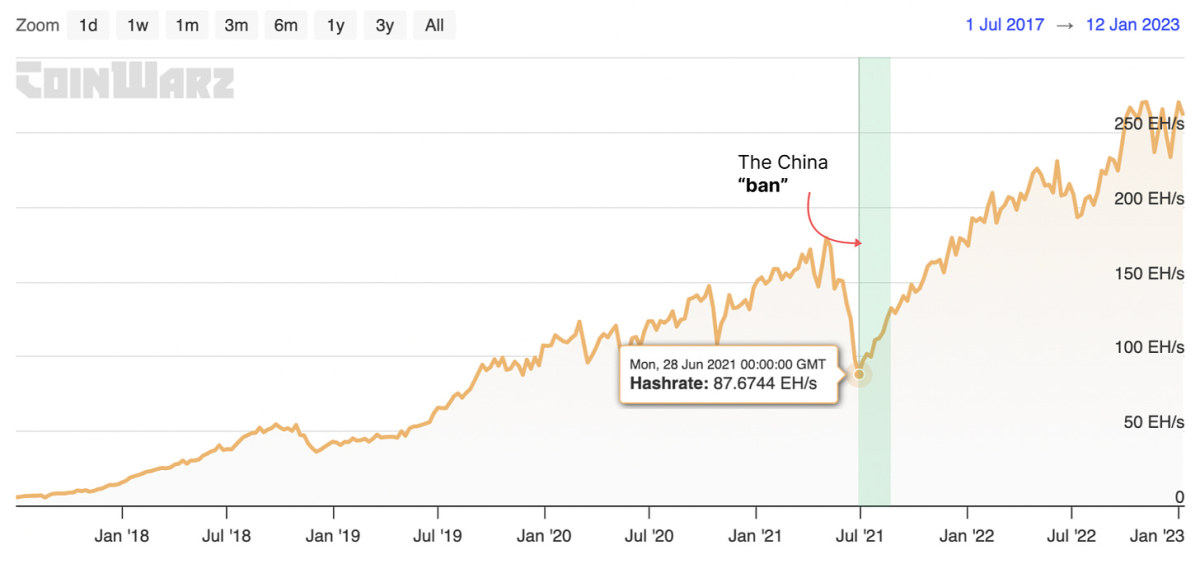

Sure, community hashrate dropped from 179.2 EH/s to 87.7 EH/s (a 51.1% drop) seemingly confirming that China banned mining.

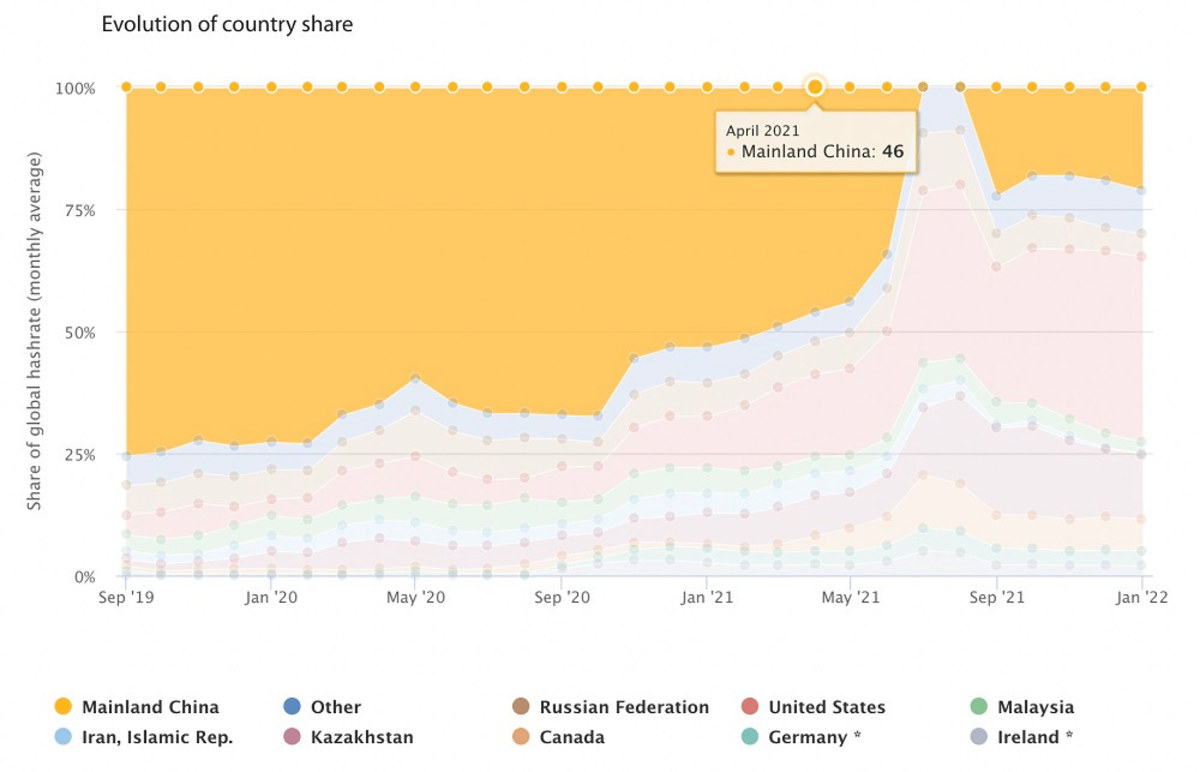

In any case, China was in response to Cambridge 46% of worldwide hashrate the month previous to the “ban” (April 2021). So the figures roughly tally up with the thesis that “mining has been banned in China.”

However there’s a giant hole on this logic. In case you are a disruptive pupil, and the principal sends you away from faculty, these “days absent from faculty” don’t imply you’ve been expelled. It might imply you’ve merely been suspended. Seems that’s precisely what occurred in China.

Right here’s how we all know.

1. Investigative reporting

Let’s begin with the mainstream information reviews.

First, NBC reported in Might 2021 that not less than some miners have been “unfazed” by the most recent “ban”.

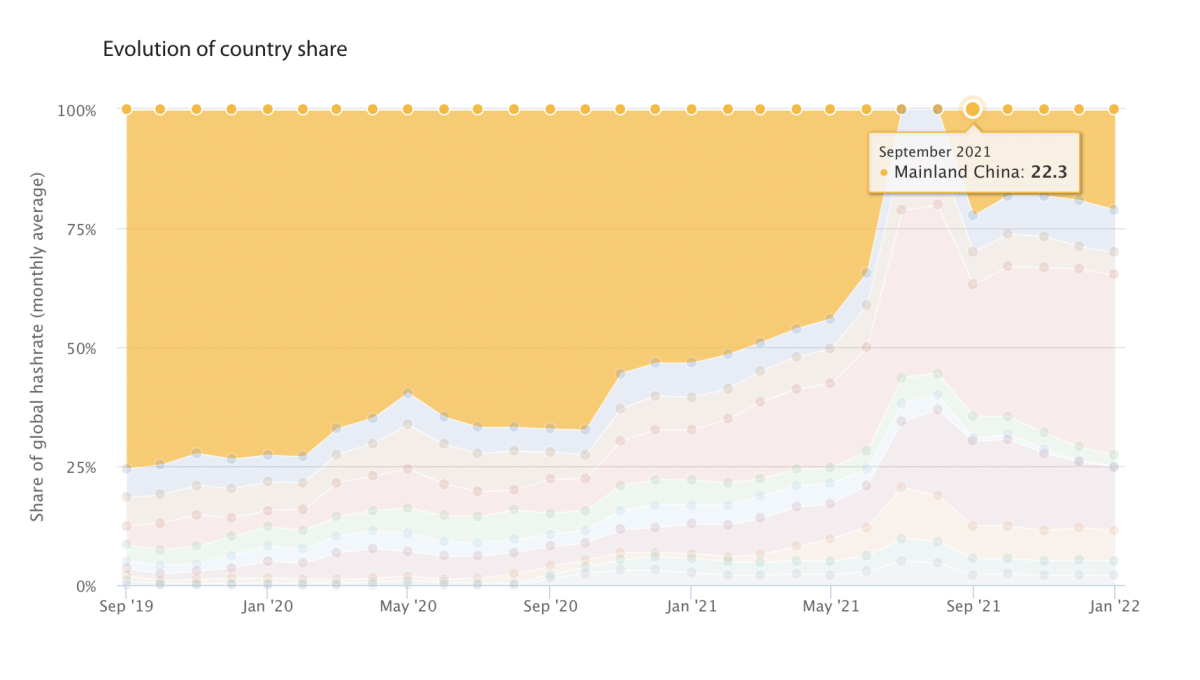

The New York Instances then reported a “ban” in China in September 2021, citing this coverage disclosure from the Chinese language Authorities (extra on that later), regardless that that very same month, publicly accessible knowledge from Cambridge confirmed that mining exercise had already bounced again to 22.3% of worldwide hashrate.

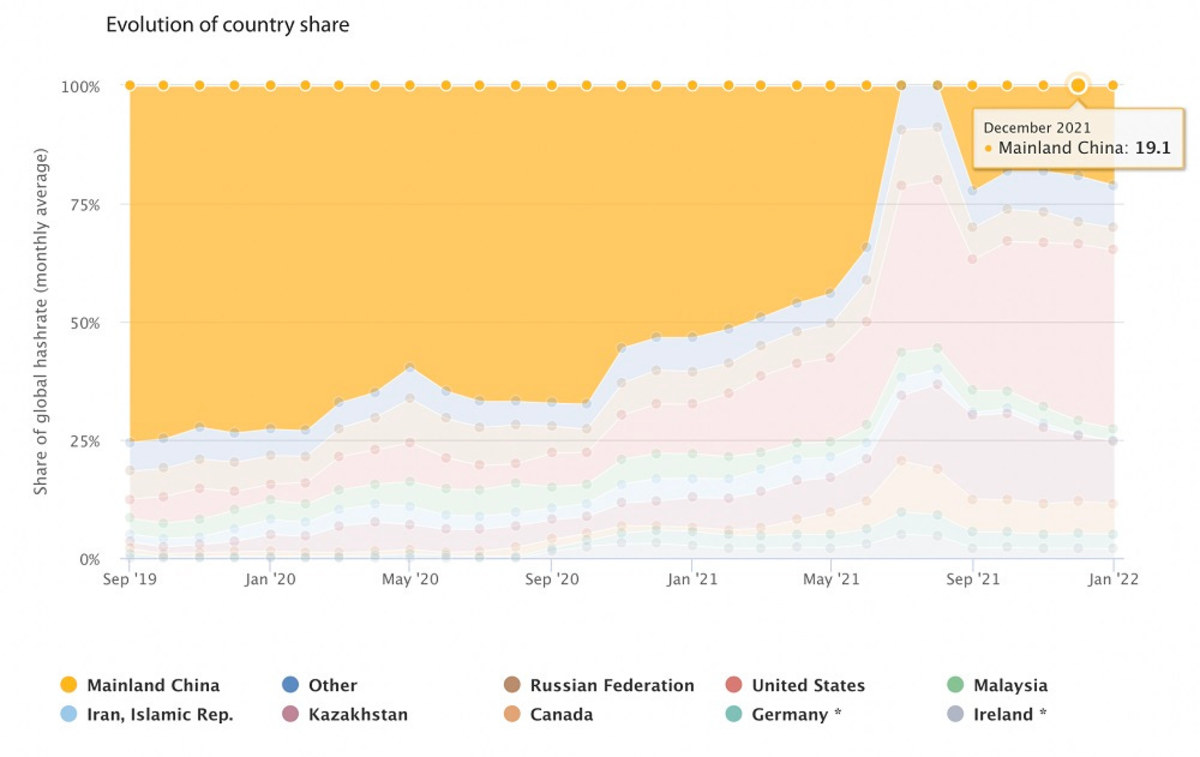

Cambridge knowledge confirmed that by Dec 2021 China was nonetheless at 19.1% of worldwide hashrate.

It wasn’t till Might 2022 that CNBC ran a full report on the numerous Bitcoin mining hashrate nonetheless working inside China, regardless that this knowledge had been publicly accessible to all media shops since September 2021.

Aside from the New York Instances piece, the proof factors to mining by no means being banned, merely suspended. Let’s look extra intently then on the New York Instances article and the doc they cite as proof for a ban.

2. Our stunning discover in Chinese language laws

After I learn the doc the New York Instances used as proof for a ban, it didn’t help their interpretation.

The Chinese language coverage doc of 24 September 2021 doesn’t legislate a ban, however quite a moratorium on the institution of any new mining websites, plus a “sign of intent” (however not a ban) to “at some stage” grandfather present mining exercise (which three years later has nonetheless not occurred).

Concerning the assertion of intention: the coverage says that bitcoin mining websites are one thing that ought to be step by step eradicated, as a result of it doesn’t help the Chinese language Authorities’s carbon impartial targets. Different causes said are that it’s simple to make use of for cash laundering and a excessive person of electrical energy.

Cultural components not taken under consideration by the New York Instances

In China, it is not uncommon that coverage says one factor, however what’s applied may be very completely different

As a normal rule, within the extra developed cities, the letter of the legislation shall be carried out actually. Nevertheless, in smaller cities and areas, that is seldom the case.

For instance, formally in China there’s a coverage the place all banks should by legislation scale back the steps their prospects undergo to get any authorized licensed paperwork.

Nevertheless, in most cities, personal banks do not observe the regulation, the alternative is practised. For instance, if a guardian or partner dies and it’s essential get the leftover quantity of their checking account, the financial institution can say “your demise certificates will not be sufficient”. There have been circumstances of the bereaved needing to carry the useless physique to the financial institution to show it. I child you not.

Extra developed cities will observe the letter of the legislation. However in China, most mining exercise is now taking place in Interior Mongolia, removed from the big developed cities. In these areas what issues culturally will not be the federal government rules however your community. In case you have the proper community you are able to do “this and that” to go across the laws.

So in abstract:

1. Mining was by no means banned, quite there was a moratorium on new mining and unfriendly overtures about grandfathering present mining amenities in some unspecified time in the future.

2. Fossil gasoline use was the said main motive (although we all know from inside sources inside the Communist get together that whereas this was undoubtedly an element, capital management was the first motive). Vitality coverage knowledgeable Magdalena Gronowska has cross-validated this.

3. Aside from coal-based mining, the moratorium was by no means applied within the extra secluded areas. There, new mining exercise has come on-line.

4. The New York Instances didn’t precisely painting the Chinese language coverage doc, lacked an appreciation of cultural components that rendered even the moratorium one thing that will not be broadly enforced, and did not cross-check publicly accessible hashrate information which might have informed them that mining exercise was nonetheless occurring on a big scale in China.

This might not be the primary time there was a discrepancy between what’s reported and what truly occurred in Bitcoin mining ban tales. Information reviews of “bans” in Paraguay (it wasn’t, it was a clamp-down on power-theft), and New York (it wasn’t, it was a two yr moratorium solely on new fossil-fuel based mostly mining) have been equally overstated.

Then simply this month, quite a few media shops even inside the crypto-community reported that Venezuela had banned bitcoin mining “to guard the power-grid”, even referring to the federal government’s motion as “an anti-corruption initiative.”

Nevertheless, it seems the supply of energy outages have been attributable to widespread corruption (theft of energy inside authorities) that led to the effectively documented case of Venezuela’s State Owned vitality firm PDVSA being unable to ship sufficient energy to stabilize their very own grid. For context: Venezuela is tied for second worst out of 180 nations on Transparency Worldwide’s corruption index, over time trending extra corrupt not much less.

However again to China. Sebastian Gouspillou, CEO of BigBlock who’s skilled in mining issues in China, gave permission for us to incorporate his personal tackle this: “They minimize the mining after which began it once more after a number of weeks. However not in every single place; solely the place it was helpful.”

3. Interviews with gamers within the bitcoin mining trade

In whole, we talked to 4 unbiased mining organizations working in China (HashX_Mining, and three others who wished to stay nameless). What’s fascinating is that none of them say they’re “risking all of it” as a CNBC information article dramatically prompt, however quite are actively inspired by Chinese language authorities to assist clear up completely different vitality challenges.

We found that Bitcoin mining will not be solely occurring in China, however miners are actively utilizing the constructive environmental externalities of Bitcoin mining, significantly warmth recycling and stranded renewable vitality monetization.

For context, the primary reported examples of warmth recycling from Bitcoin mining have been in Canada as early as 2018. Since then, warmth recycling has emerged as a significant approach that Bitcoin mining (mainly an electrical resistance heater that mines Bitcoin) can reduce the necessity for fossil gasoline heating. China has joined the warmth recycling get together.

One mining distributor confirmed: “With the downturn within the Chinese language financial system, some heavy trade has left Interior Mongolia and Xinjing province. In consequence, there’s usually an oversupply of electrical energy.” Chinese language authorities have invited Bitcoin mining corporations to fill the void, to cease renewable vitality being wasted.

These Bitcoin mining operations in Interior Mongolia are sometimes solely 200-500 miners (~1 MW), and all utilizing both hydro, wind or photo voltaic vitality.

Consider Interior Mongolia because the Texas of China. Like Texas it had a fossil gasoline previous, however is now pushing for renewable vitality options sooner than another a part of the nation (reportedly 57% of the nation’s wind farms). And like Texas it has wanted and needed Bitcoin mining to assist monetize wasted renewable vitality and counterbalance renewable intermittency.

So why did China droop mining operations within the first place, and why are those they let again principally smaller and renewable vitality based mostly?

Capital controls

Massive scale bitcoin mining was problematic for China. It supplied a solution to get cash out of China. Massive operations turned Yuan into Bitcoin, then Bitcoin into USD. A second motive, however not as necessary: giant operations have been usually utilizing coal factories. This endangered the federal government’s emission targets.

The unique miner suspension represented an opportunity to clamp down on capital flows out of the Yuan. By permitting mining corporations with 200-500 models to monetize wasted renewable vitality, it helps China stabilize grids and monetize wasted renewable vitality with out the hazard of enormous capital outflows.

Particular thanks once more to Dan Leslie from @HashX_Mining, Sebastian Gouspillou, CEO of Massive Block, Magdalena Gronowska, accomplice at Metamesh and two Chinese language nationals who wished to stay unnamed in compiling this particular report.

——-

Extra Context

(Non-compulsory particulars we are able to add in if of curiosity to write down up one thing extra in-depth. Alternatively if we need to hold it tightly targeted on the “ban that wasn’t”, we are able to depart all this out)

Different reveals from our interviews with Chinese language mining corporations.

- Whereas lots of hashrate migrated to different international locations (US initially, Ethiopia extra just lately), lots of new hashrate has additionally come into China because the China “ban”

- No offgrid coal-based mining happens any extra. It’s too simple to identify, it competes for baseload vitality and interferes with Central Govt’s emission targets. This has brought about a major discount of the emission depth of Chinese language mining post-”ban”.

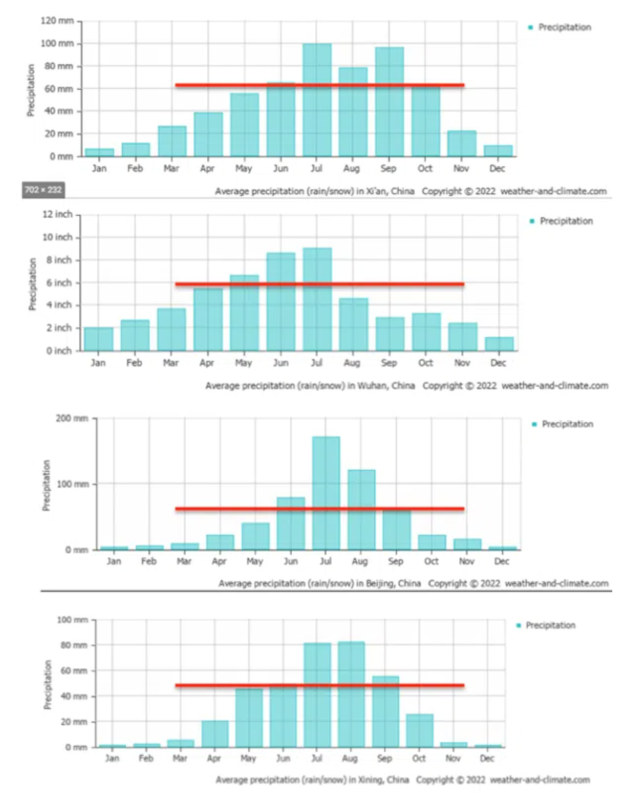

- Mining is usually hydro, micro-hydro (significantly within the moist season). The areas above the crimson line are very moist months for 4 areas: Xi’an, Wuhan, Bejing and Xining, the place hydro turns into extremely low cost.

However we additionally uncovered lots of ongrid mining and, extra surprisingly, lots of retail ongrid mining.

- Retail ongrid miners mine at a loss, as a result of they pay, effectively, retail electrical energy charges. Why would they mine at a loss? Easy: to get cash out of China, or out of the Yuan into USD. They convert Chinese language Yuan for ASICS and electrical energy which creates BTC, which will get transformed into USD. Many retail miners are joyful to take the profitability hit merely to have a solution to convert Yuan to USD.

- Native provincial govt usually helps what Central Govt doesn’t, as a result of it is economically advantageous to take action. We heard multiple story the place the provincial govt gave an efficient “licence to mine” in return for the rights to make use of their recycled warmth.

For instance, one 13 MW mining operation, an instance of that new hashrate, works in tandem with the Provincial Govt. They purchase electrical energy from them and in return the govt. will get the proper to make use of their recycled warmth at no cost. As a result of 95% of the vitality from Bitcoin mining is disbursed by means of warmth, that is virtually as efficient as getting heating at no cost. What do they use that (free) warmth for? Heating water for fish farms.

It is a visitor publish by Daniel Batten. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.