The controversy over cryptocurrencies’ environmental impression has intensified as governments, firms, and traders concentrate on Environmental, Social, and Governance (ESG) issues. Bitcoin, the world’s most distinguished cryptocurrency, is main the criticism, recognized for its energy-intensive Proof-of-Work (PoW) consensus mechanism.

Whereas improvements are rising throughout the crypto {industry} to deal with environmental issues, Bitcoin’s contribution to world carbon emissions stays a significant level of rivalry.

Bitcoin’s Environmental Drawback

Bitcoin’s PoW mechanism depends on miners fixing complicated cryptographic issues, consuming huge quantities of computational energy and power.

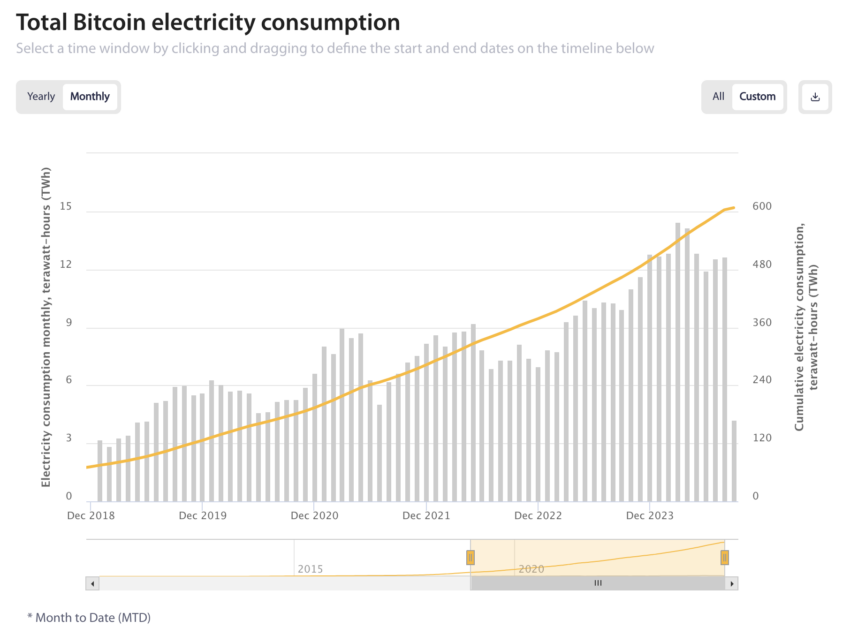

In response to estimates from the College of Cambridge, Bitcoin’s annual power consumption rivals that of complete nations equivalent to Argentina or Norway. Furthermore, Bitcoin’s environmental footprint is exacerbated in areas the place mining operations are powered by non-renewable power sources.

“Bitcoin mining could also be accountable for 65.4 megatonnes of CO2 (MtCO2) per yr, which is akin to country-level emissions in Greece (56.6 MtCO2 in 2019) and represents 0.19% of world emissions,” a report titled Revisiting Bitcoin’s Carbon Footprint learn.

Bitcoin Electrical energy Consumption. Supply: College of Cambridge

Critics argue that this consumption is disproportionate and unsustainable, particularly in mild of world local weather commitments. Whereas different cryptocurrencies are exploring eco-friendly mechanisms, Bitcoin’s gradual adaptation to such applied sciences has raised issues.

“All people acknowledges Bitcoin is environmentally unhealthy, however any massive modifications to Bitcoin protocol have been very unsuccessful as a result of you might want to get all of the miners to agree on that,” Hanna Halaburda, Affiliate Professor of Info at NYU Stern College of Enterprise, mentioned.

If environmental sustainability turns into a core expectation of traders and regulators, Bitcoin might quickly face growing strain to improve.

A Inexperienced Shift in Crypto

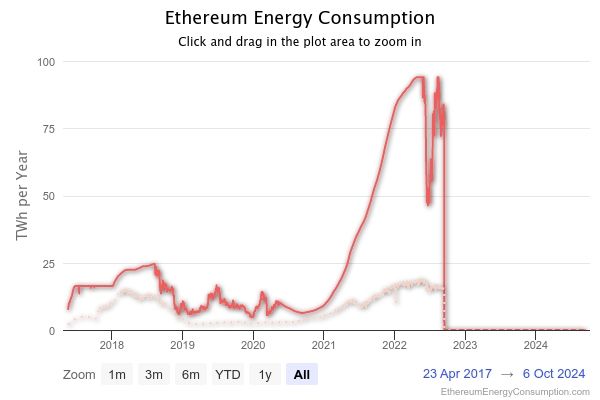

In distinction to Bitcoin, different blockchain platforms have already taken steps to scale back their environmental impression. Ethereum, as an illustration, made headlines in 2022 with its shift from PoW to Proof-of-Stake (PoS), chopping its power consumption by over 99%. PoS replaces energy-hungry mining with validators who lock up tokens as collateral to safe the community.

This transformation set a precedent for the {industry}, exhibiting that eco-friendly upgrades are doable even in established networks.

Learn extra: Proof of Work and Proof of Stake Defined

Ethereum Vitality Consumption. Supply: Digiconomist

Different platforms like Hedera, Cardano, and Tezos additionally boast PoS mechanisms and are more and more specializing in sustainability. Hedera’s involvement in carbon offsetting initiatives and its collaboration with the World Blockchain Enterprise Council (GBBC) to advertise environmental requirements are additional steps towards decreasing blockchain’s ecological footprint.

In an unique interview with BeInCrypto, Wes Geisenberger, Vice President of Sustainability and ESG at HBAR, famous the significance of the GBBC InterWork Alliance’s Carbon Emission Token (CET) Process Pressure. This job pressure, developed to deal with carbon accounting at a technical degree, helps firms navigate these rules.

“The CET is a constructive contribution, very a lot pushed by the modifications coming from governments and corporates on the lookout for options to credibly tackle their environmental impression,” Geisenberger mentioned.

This sort of technical improvement highlights the rising intersection of blockchain and environmental governance. The crypto {industry} is more and more collaborating with authorities our bodies and worldwide organizations to search out options that meet regulatory expectations whereas leveraging blockchain’s potential to innovate.

Traders are Paying Consideration

Investor sentiment is more and more aligned with world ESG priorities. Local weather-conscious traders are urging industries, together with crypto, to take accountability for his or her environmental impression. In response, some blockchain ecosystems are main climate-focused efforts, each by way of technological innovation and by funding sustainable initiatives.

In response to Geisenberger, the HBAR Basis’s Sustainable Influence Fund is among the first grant-based funds geared toward selling blockchain’s position in sustainability. This fund helps initiatives just like the Hedera Guardian, a public ledger platform designed to enhance transparency in carbon credit score markets.

By enabling establishments and startups to trace and confirm their carbon-offsetting efforts, Hedera has proven how blockchains can facilitate accountable environmental practices.

“The Hedera Guardian has already onboarded 500 million metric tonnes of carbon credit. We see these instruments serving to reply challenges to allow outcomes to measure our planet’s externalities and provides company to people taking part in environmental and biodiversity initiatives to higher hint flows of funds again to the group,” Geisenberger defined.

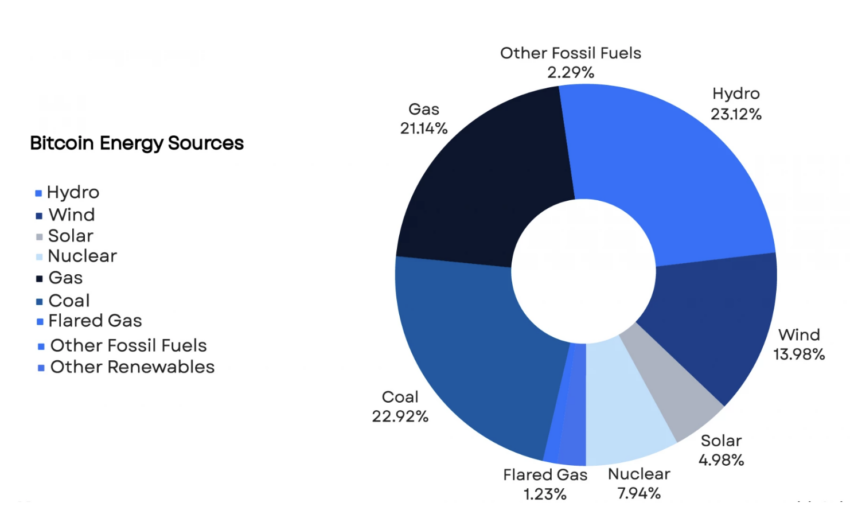

Regardless of these constructive developments within the broader blockchain ecosystem, Bitcoin’s reliance on PoW stays unchanged. Bitcoin advocates argue that its decentralized nature and security measures are unparalleled and that any shift in its consensus mechanism might jeopardize its integrity. They level to Bitcoin miners’ adoption of renewable power as a doable resolution to its environmental challenges.

Some mining operations are certainly migrating to areas with plentiful hydroelectric, wind, and solar energy. Nonetheless, these efforts are nonetheless piecemeal and lack industry-wide coordination.

“Numerous Bitcoin mining firms have arrange their contracts with renewable power firms. The argument is that having these mining amenities as purchasers implies that when there’s an oversupply of power, it could really make it extra worthwhile for the renewable power vegetation,” Halaburda added.

Learn extra: 5 Greatest Platforms To Purchase Bitcoin Mining Shares After 2024 Halving

Bitcoin Vitality Sources. Supply: EZ Blockchain

The query, then, is whether or not Bitcoin will be capable of evolve in an more and more ESG-driven world. The {industry}’s concentrate on renewable power and carbon offsetting initiatives affords some hope, however it might not be sufficient if regulatory frameworks impose stricter environmental necessities.

Challenges in Standardizing ESG Metrics

Whereas some crypto platforms have made strides towards sustainability, the problem of standardizing ESG metrics throughout the {industry} persists. Blockchain expertise’s decentralized and sometimes opaque nature complicates the duty of measuring environmental impression constantly and comparably.

Efforts just like the CET protocol are serving to to fill this hole, however broader industry-wide adoption is important for significant change. With out standardization, it stays troublesome to gauge which platforms are really sustainable and that are counting on surface-level commitments.

There’s additionally the problem of balancing the pursuits of traders, customers, and environmental advocates, every of whom has completely different expectations relating to the way forward for blockchain expertise.

As rules tighten and the worldwide push for sustainability accelerates, Bitcoin’s environmental footprint will doubtless turn into tougher to disregard. The crypto {industry} has demonstrated that it could actually innovate and adapt, however Bitcoin, as the unique and most influential cryptocurrency, faces an uphill battle. It might in the end require both an improve in its consensus mechanism or a major funding in renewable power options.