Bitcoin miners entered early 2026 in a well-known however more and more unforgiving setup: community hashrate is slipping from late-2025 highs, issue is adjusting on a delay, and energy prices stay the exhausting constraint that decides which fleets keep on-line and which go darkish.

The result’s a market that may look resilient on the floor, particularly when Bitcoin bounces, however stays fragile on the margin, the place a single issue uptick or a regional energy spike can flip “working” into “curbing” shortly.

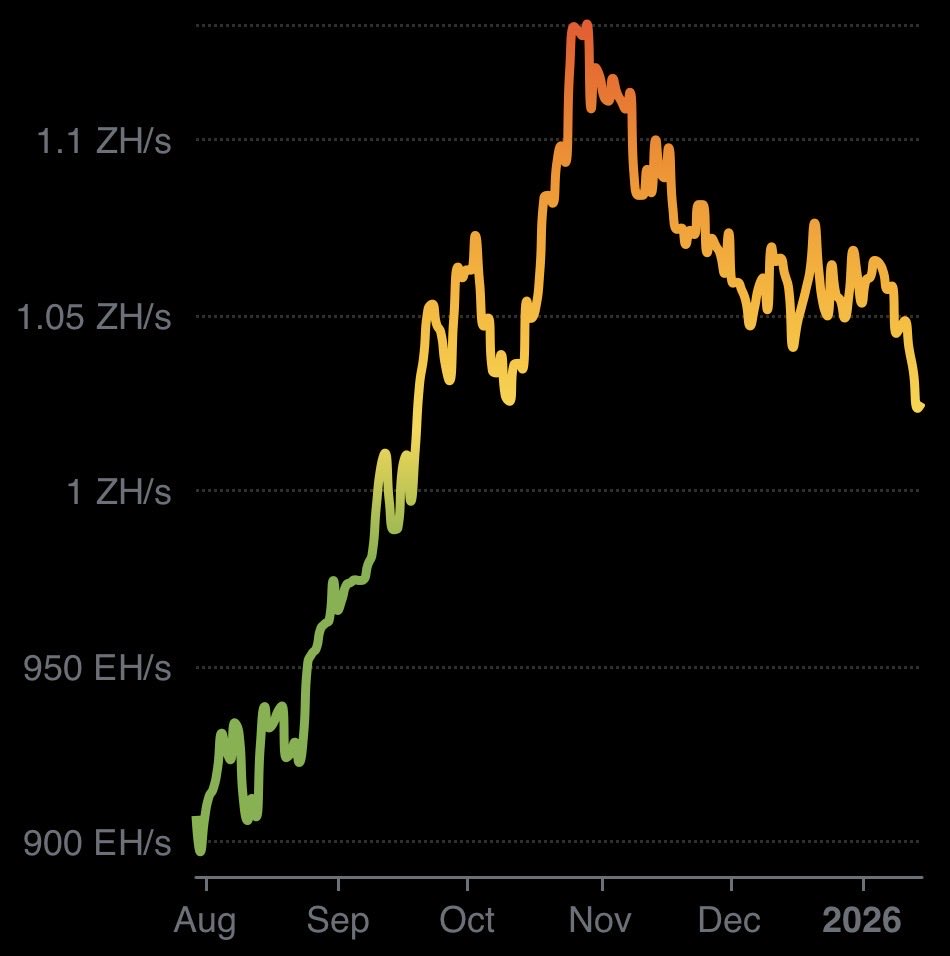

Hashrate is cooling after a late-2025 excessive

Bitcoin’s community hashrate has cooled from its late-2025 peak tempo and has not constantly returned to that stage even in periods of spot power.

JPMorgan estimated Bitcoin’s month-to-month common community hashrate rose 5% in October to 1,082 EH/s, a file month-to-month common in its sequence. November adopted with an estimated 1,074 EH/s, a modest month-over-month pullback relatively than a straight continuation.

Each day estimates since late December have been uneven, with prints swinging above and under the 1,000 EH/s threshold, in line with miners biking uptime as a substitute of increasing easily.

YCharts’ community sequence sourced from Blockchain.com confirmed each sub-1,000 EH/s readings and rebounds above that stage across the mid-January rebound.

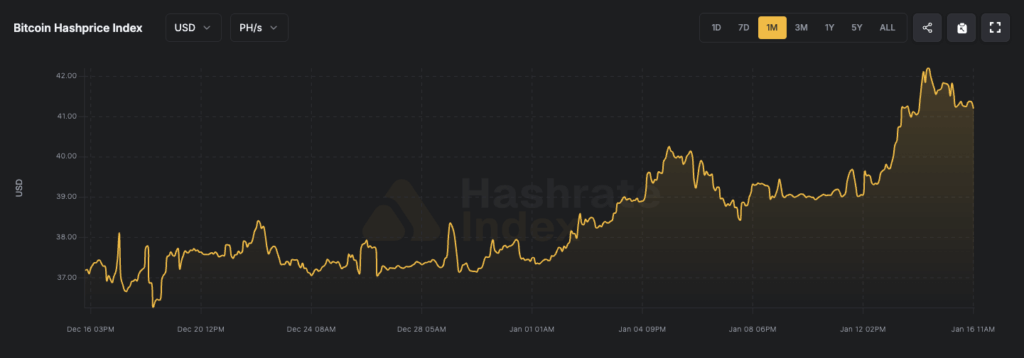

Hashprice, not Bitcoin value alone, is driving shutdown choices

Miner conduct hinges much less on spot Bitcoin and extra on hashprice, the anticipated every day income earned per unit of hashrate. That’s the metric that determines whether or not the least environment friendly rigs can run with out bleeding money.

In Luxor’s weekly replace dated Jan. 12, USD hashprice slipped week over week from $40.23 to $39.53 per PH/s/day, a stage described as “near, or at, breakeven for a lot of miners.”

In different phrases: the community can keep unstable even throughout a spot rebound as a result of miner profitability can stay compressed.

Luxor additionally reported Bitcoin fell 2.9% final week to about $91,132 as hashprice tightened, rising stress on miners whose price base doesn’t transfer with spot BTC.

In the identical replace, Luxor’s 7-day easy transferring common for hashrate fell 2.8% from 1,054 EH/s to 1,024 EH/s.

Late-2025 context issues. Luxor’s analysis arm beforehand recorded issue hitting an all-time excessive after an Oct. 29 constructive adjustment of 6.31% that lifted issue to 155.97T.

Hashprice then weakened in November as charges and value did not offset the upper issue, with Hashrate Index information exhibiting hashprice falling to an all-time low close to $36 per PH/day.

The market has moved above that trough into early 2026, however not by a lot. That’s why the hashrate restoration since October has been uneven: many operators are hovering across the level the place “on” and “off” are separated by a skinny power-cost unfold.

A fast actuality test on the machine stage

The sensitivity turns into clearer whenever you translate hashprice into per-rig income and examine it with electrical energy price.

Bitmain lists the Antminer S19j Professional at 92 TH/s and a pair of,714 watts, whereas its S21 itemizing reveals 200 TH/s and three,500 watts.

The desk under makes use of a hashprice enter of $38.2 per PH/s/day, roughly according to Luxor’s cited six-month ahead common.

For energy, it makes use of the U.S. Vitality Data Administration’s September 2025 industrial common electrical energy value of 9.02 cents/kWh as a delivered-price benchmark. Wholesale costs might be decrease (or greater), however miners’ all-in price is dependent upon contracts, congestion, charges, and curtailment phrases.

The implication isn’t that each miner is unprofitable, many have much better energy charges, demand response income, and operational effectivity.

The purpose is that the marginal miner drives churn, and at these hashprice ranges, marginal fleets more and more behave like versatile load relatively than “at all times on” infrastructure.

Issue is the lagging lever that may blindside miners

Issue adjusts solely each 2,016 blocks (roughly each two weeks), which implies it doesn’t reply immediately to identify BTC or hashrate swings.

That lag can power miners to soak up weak hashprice situations for a complete epoch earlier than the protocol recalibrates, compressing margins throughout drawdowns and delaying the profitability rebound some operators anticipate to reach instantly.

That timing threat is why miners can get blindsided by issue: a fleet can look viable on a BTC rally, solely to be squeezed when issue rises into the subsequent window and the anticipated per-hash income fails to comply with.

Early January issue information has additionally been reported down 1.20% to 146.4T within the first adjustment of 2026. Projections level to a Jan. 22 adjustment doubtlessly rising towards ~148.20T.

Ahead pricing suggests restricted aid until one thing modifications.

Luxor stated the ahead market is pricing a median hashprice of $38.19 over the subsequent six months. With spot hashprice round $39.53, that curve implies restricted near-term aid until one of many main drivers shifts: greater BTC, greater charges, easing issue, or cheaper energy.

The rising sample is a type of community whiplash: hashrate softens when hashprice compresses, issue lags the change, and miners are compelled to eat weaker economics for a full epoch earlier than protocol-level aid arrives.

A spot rally, such because the latest climb to $97,000, can masks stress quickly, but when the subsequent issue window lands greater than operators modeled, the squeeze can return shortly.

Energy prices are the place the squeeze concentrates

If hashprice tells miners what the community is paying, electrical energy determines what the real-world operator can maintain.

Luxor’s roundup translated compute income into implied income per MWh throughout fleet-efficiency tiers:

That ladder issues as a result of electrical energy pricing doesn’t clear evenly throughout areas or contract sorts.

The Worldwide Vitality Company cited U.S. wholesale electrical energy costs averaging round $48/MWh within the first half of 2025, whereas the European Union averaged about $90/MWh.

The IEA additionally cited EU 2026 electrical energy futures round $80/MWh.

Wholesale benchmarks don’t map 1:1 to delivered industrial charges, however they assist body route and volatility by area.

For miners working in Luxor’s 25–38 J/TH tier, implied compute income close to $51/MWh means many websites might be pushed to curtailment shortly if delivered vitality prices rise, if hedges are unfavorable, or if native congestion and costs widen the all-in value.

Damaging pricing provides one other layer: it might reward versatile load and punish inflexible procurement.

The IEA stated unfavourable costs have gotten extra frequent in Europe, with the share of negative-price hours reaching 8–9% in H1 2025 in nations corresponding to Germany, the Netherlands, and Spain.

That setting favors miners that may ramp up and down quickly, seize demand response funds, or run behind-the-meter technology.

Operators with out that flexibility can face greater efficient prices in tight intervals even when headline wholesale costs soften.

Texas stays a key mining jurisdiction, and a coverage wildcard

Texas stays one of the crucial vital jurisdictions to look at as a result of grid coverage and interconnection competitors form the economics of huge mining hundreds.

Texas legislation Senate Invoice 6 permits ERCOT to order sure giant electrical energy customers to close down or use backup technology throughout emergencies.

Reporting on the invoice stated this is applicable to new giant a great deal of 75 MW or extra connecting after Dec. 31, 2025, whereas present amenities are exempt.

In the meantime, ERCOT’s load request pipeline exceeded 230 GW in 2025, with greater than 70% tied to information facilities, in keeping with reporting on the queue.

The Worldwide Vitality Company has additionally flagged information facilities as a serious driver of electrical energy demand progress by way of 2026.

For Bitcoin miners, that mixture raises the worth of present interconnections and secure contracts, and may make enlargement meaningfully more durable until curtailment phrases and grid entry are negotiated early.

What to look at subsequent

- The subsequent one to 2 issue epochs: Issue’s lag can both relieve the squeeze (if it eases) or intensify it (if it rises whereas hashprice stays flat).

- Hashprice stability: Luxor’s $39–$40 per PH/s/day zone is close to breakeven for a lot of miners, and the ahead curve close to $38 suggests little margin for error.

- Energy volatility: Fleets within the 25–38 J/TH tier are notably uncovered if delivered prices strategy or exceed implied compute income per MWh, or if native foundation threat widens all-in pricing.

- ERCOT curtailment threat: Emergency authority underneath SB 6 may translate into abrupt, event-driven hashrate dips impartial of Bitcoin value.

- Knowledge middle competitors: Continued grid demand progress could constrain miners’ entry to the lowest-cost capability and reinforce regional divergence in profitability.

For now, the measurable baseline is a spot hashprice Luxor positioned at $39.53 per PH/s/day, alongside a weekly Bitcoin decline to round $91,132 and a 7-day hashrate common all the way down to 1,024 EH/s.

That mixture units the reference level because the community approaches the subsequent issue window, the place miners will once more determine whether or not to run, curtail, or look ahead to a recalibration that arrives solely after the protocol’s built-in delay.

And with JPMorgan’s 1,082 EH/s October month-to-month benchmark nonetheless standing as a latest file in its sequence, the subsequent key query is easy:

Can miner economics help sufficient sustained uptime to climb again towards that tempo, or will issue lag and energy constraints maintain the community in stop-start mode even when BTC stays robust?