The Bitcoin (BTC) mining problem is projected to extend in the course of the subsequent problem adjustment scheduled for December 11, as hashprice, a important metric that measures anticipated miner profitability per unit of computing energy, sits at file lows.

Bitcoin’s subsequent mining problem adjustment is anticipated to happen at block 927,360 at about 12:09:34 AM UTC, marginally growing the issue from 149.30 trillion to 149.80 trillion, in keeping with CoinWarz.

The latest adjustment, which occurred on Thursday, decreased the issue from 152.2 trillion to 149.3 trillion, leading to a mean blocktime of about 9.97 minutes on the time of this writing, barely under the 10-minute goal.

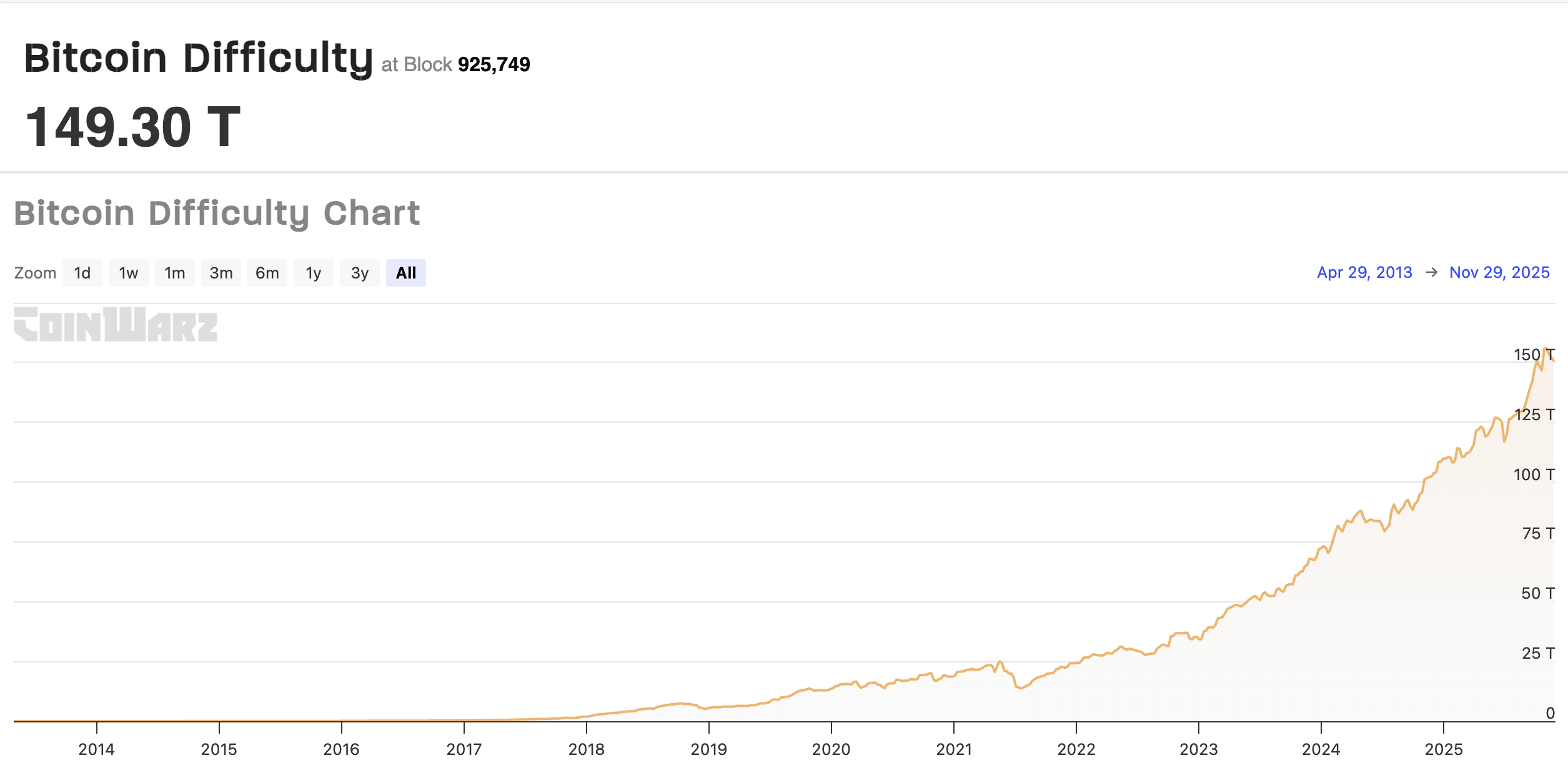

Bitcoin’s mining problem from 2014-2025. Supply: CoinWarz

Regardless of the current drop in mining problem, hashprice is hovering round $38.3 petahashes per second (PH/s) per day, in keeping with Hashrate Index, up from the file low under $35 PH/s reached on November 21.

For context, a hashprice of $40 PH/s is a break-even degree for miners and the purpose the place they have to think about de-energizing their machines or persevering with to function.

Bitcoin mining hashprice, a important metric for miner profitability, sits under the $40 mark and is hovering close to file lows. Supply: Hashrate Index

The mining trade continues to face mounting challenges, together with regulatory bans or restrictions, rising vitality prices, and geopolitical tensions between the USA and China that would disrupt important tools provide chains.

Associated: 13 years after the primary halving, Bitcoin mining appears very totally different in 2025

US probes the most important producer of crypto mining {hardware}, triggering fears of shortages

The US Division of Homeland Safety (DHS) is investigating mining {hardware} producer Bitmain, which relies in China, to find out whether or not its machines may be remotely accessed or used for espionage functions.

In 2024, US Senator Elizabeth Warren, considered one of crypto’s most vocal critics, urged that ASICs might be used for spying on US navy bases and delicate nationwide protection installations.

Bitmain is the main producer of the application-specific built-in circuits (ASICs) used to mine proof-of-work (PoW) cryptocurrencies. The corporate instructions an 80% market share, in keeping with the College of Cambridge.

Restrictions, tariffs, or sanctions imposed on the corporate by US officers might set off provide chain points for the mining trade, which is closely reliant on Bitmain.

Journal: AI might already use extra energy than Bitcoin — and it threatens Bitcoin mining