Picture supply: Getty Photographs

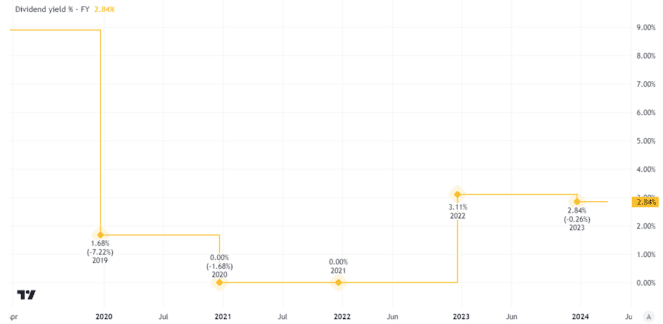

Over the previous few years, shares In power firm Centrica (LSE: CNA) have moved round loads. In slightly below 4 years, the value has quadrupled. The Centrica dividend has been rising, rising by a 3rd final 12 months.

The present dividend yield is round 3%. If I had purchased the shares for pennies again in 2020 although, my funding would now be yielding over 9%.

Such is the ability of a low share worth. Not solely can it enhance, it may possibly additionally imply a greater future yield than shopping for the identical shares at a better worth.

Dividend motion

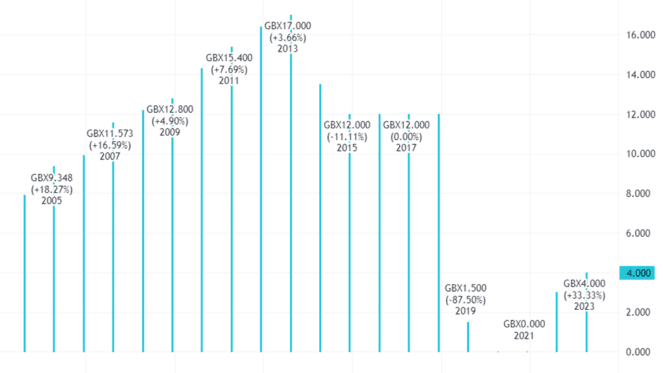

The Centrica dividend has been inconsistent although. We noticed good progress final 12 months, however after a interval the place there was no shareholder payout.

Even after final 12 months’s robust progress, the present annual Centrica dividend of 4p per share is nowhere close to what it was. It’s not at even 1 / 4 of what it was simply over a decade in the past.

Dramatically completely different enterprise

Why would dividends transfer round a lot? Some firms produce secure or usually rising revenue and money flows. That helps them fund dividend progress. Shares like Diageo and Spirax-Sarco have raised their annual dividends for many years.

Not all companies have such traits. So whereas international oil and gasoline big Exxon has raised its annual dividend for many years, many power companies have cyclical earnings. Excessive power costs can result in booming income, whereas a weak market can see earnings plummet.

Centrica has not solely needed to cope with power market worth cycles. It’s closely uncovered to part of the power market that has seen long-term structural demand falls, specifically gasoline.

Authorities statisticians estimate that between 2005 and 2022, UK gasoline consumption fell 32.9% in complete. It had been falling earlier than that interval and stays in decline.

However some giant enterprise gross sales over the previous few years imply that Centrica is a unique enterprise to what it was.

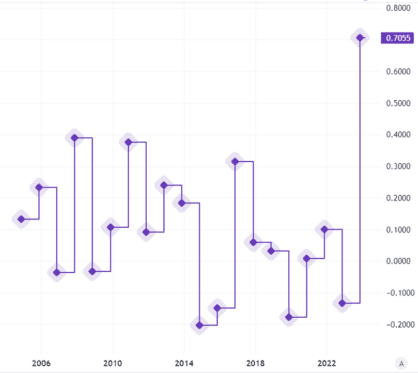

All of that has led the corporate’s earnings per share to maneuver round considerably.

Robust stability sheet

That issues as a result of earnings and money flows are central to what occurs to the Centrica dividend.

The asset gross sales, mixed with excessive power costs, have been a boon for the British Gasoline proprietor’s stability sheet. It ended final 12 months with internet money of £2.8bn, in comparison with £1.2bn on the similar level the prior 12 months.

However though Centrica boosted its dividend, it additionally spent £1bn final 12 months shopping for again shares. So growing the dividend is just one of its money spending priorities.

Dividend prospects

The FTSE 100 agency does have a progressive dividend coverage, which means that it goals to extend the payout yearly.

In apply, although, that may finally depend upon enterprise efficiency.

Centrica is concentrating on a dividend that’s round half of earnings per share. Such earnings, as we noticed above, have moved round loads up to now and will achieve this in future.

Its put in buyer base, robust manufacturers and excessive power costs are all working within the agency’s favour for now. I do count on the Centrica dividend to continue to grow in years to come back.

However I don’t just like the dangers within the enterprise, particularly its robust reliance on promoting a commodity power that’s seeing long-term demand falls. I’ve no plans to purchase the shares.