Picture supply: Getty Photographs

Dividend buyers must be cautious with banking shares. The prospect of falling rates of interest is an actual threat, however not all FTSE 100 banks are the identical.

Barclays (LSE:BARC) is exclusive in combining a robust retail presence with a worldwide funding banking operation. And the inventory can be fascinating from a dividend perspective.

Dividends

Proper now, Barclays shares include a 2.2% dividend yield. In comparison with Lloyds Banking Group (3.95%) or NatWest Group (4.42%), that’s not notably eye-catching.

By way of dividends, nonetheless, there’s much more to Barclays than meets the attention. In February 2024, the corporate introduced a particular method to shareholder returns.

As a substitute of accelerating its dividend, the financial institution elected to deal with share buybacks. Consequently, the dividend per share has elevated, however solely as a result of variety of shares coming down.

This implies a extra modest dividend yield, nevertheless it ought to – if issues go effectively – end in stronger progress going ahead. And that is actually what analysts are anticipating.

Outlook

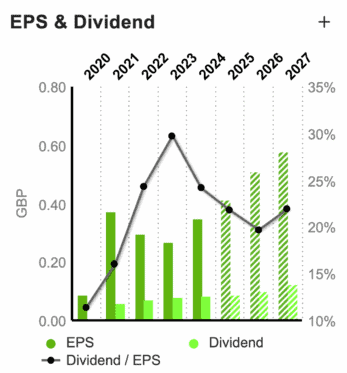

In 2025, Barclays is predicted to return 0.902p per share in dividends. That’s 7% larger than the earlier yr, however the forecast is for issues to kick on considerably in 2026 and past.

The newest numbers I can discover have the dividend rising to 10.06p per share in 2026, earlier than rocketing to 12.65p in 2027. That means a 3.28% return based mostly on the present share value.

By way of annual progress, that’s an 11.5% improve adopted by a 27.5% increase. These are will increase that even a number of the UK’s high progress shares would see as greater than respectable.

Dividend buyers, nonetheless, would possibly query how reasonable that is. If the whole distribution stays the identical, these progress assumptions put quite a lot of expectation on the share buyback programme.

Share buybacks

Final February, Barclays introduced plans to return £10bn to shareholders by the top of 2026. And it’s over midway by way of that programme, with £3.75bn getting used for share buybacks.

In doing so, the financial institution has decreased its share rely by greater than 11%. That is why the dividend per share has elevated even with Barclays returning the identical amount of money general.

With the agency now having a market worth of round £55bn, nonetheless, it could take so much to carry down the variety of shares excellent by one other 10%. And that is value being attentive to.

The Barclays share value has greater than doubled for the reason that agency first outlined its technique. And this reduces the impression of utilizing money for share buybacks on the general share rely in an enormous manner.

Dividend progress

With the inventory buying and selling beneath ebook worth, share buybacks ought to increase the worth of Barclays shares. However I believe buyers must be reasonable concerning the future.

It could take so much for repurchases alone to generate dividend progress of 11.5% after which 27.5%. And there’s additionally a threat that inflation would possibly make rates of interest fall extra slowly than anticipated.

In that scenario, funding banking exercise may not take off in the way in which some analysts expect. That will make the financial institution’s distinctive construction a weak spot, not a energy.

Completely different buyers justifiably have completely different priorities. However from a passive earnings perspective, I believe there are higher decisions than Barclays to think about proper now.