That are one of the best cryptos for mining with ASICs in 2024, and the way a lot can miners anticipate to earn?

The worldwide crypto mining market, which reached almost $2.93 billion in 2023, is projected to develop at a compound annual development fee (CAGR) of 12.2% and attain $8.26 billion by 2032.

A 2023 report by the Power Data Administration (EIA) highlighted that crypto miners used as a lot electrical energy as the complete nation of Australia, accounting for about 1 p.c of world electrical energy demand.

Within the U.S. alone, crypto mining operations have been liable for as much as 2.3 p.c of the nation’s complete electrical energy demand.

In the meantime, the marketplace for crypto mining has seen appreciable shifts, with the U.S. turning into a serious hub for Bitcoin (BTC) mining, internet hosting almost 38 p.c of all Bitcoin mining actions in Oct. 2023.

Including to the challenges confronted by crypto miners is a brand new proposal from President Biden’s Fiscal 12 months 2024 finances, which features a 30 p.c excise tax on electrical energy used for mining cryptocurrencies.

This transfer goals to boost about $3.5 billion over the following decade. The tax can be phased in over three years, beginning at 10 p.c within the first yr and escalating to 30 p.c thereafter.

With these issues in thoughts, let’s delve into the specifics of what makes for splendid mining circumstances and one of the best cryptocurrency for mining in 2024.

Issues to think about earlier than you begin mining crypto

Venturing into crypto mining requires a strategic strategy, given the aggressive panorama of the business.

Firstly, the selection of cryptocurrency is paramount. With 1000’s of cryptocurrencies out there, deciding on a worthwhile cryptocurrency to mine is essential.

Components such because the coin’s market stability, demand, and the complexity of mining algorithms ought to information this determination.

Power consumption and price can’t be overstated. Mining is notoriously energy-intensive, and with electrical energy costs fluctuating globally, calculating operational prices turns into important.

In the meantime, regulatory compliance and tax obligations in your jurisdiction are essential. With international locations adopting diverse stances on cryptocurrency mining—from outright bans to welcoming it with open arms—understanding and adhering to your native legal guidelines and tax rules is important to keep away from authorized pitfalls.

Lastly, {hardware} choice is one other essential consideration. The mining panorama has advanced quite a bit through the years. The selection of {hardware} impacts not solely the effectivity of your mining operations but in addition their longevity and scalability.

Kinds of mining {hardware}

Initially, mining began with central processing models (CPUs), the fundamental type of computing energy in any laptop. Whereas accessible, CPU mining is considerably much less environment friendly in comparison with newer applied sciences, making it largely out of date for aggressive mining operations.

The following leap got here with graphics processing models (GPUs), that are extra highly effective than CPUs and able to fixing advanced algorithms sooner.

GPU mining turned fashionable for its improved effectivity and skill to mine extra profitably, although it additionally requires extra power and generates extra warmth.

Area-programmable gate arrays (FPGAs) launched even higher effectivity by permitting miners to configure these chips for mining, providing higher efficiency than GPUs with out as a lot energy consumption.

FPGAs strike a steadiness between customizable {hardware} and the effectivity wanted for efficient mining, however they are often advanced to program and are sometimes dearer.

Utility-specific built-in circuits (ASICs) characterize the head of mining know-how, designed particularly for mining cryptocurrencies.

ASIC miners are the usual for skilled mining operations in 2024, significantly for mining Bitcoin, on account of their superior processing energy and power effectivity.

They provide unparalleled effectivity and pace however include the next price ticket and quickly turn out to be out of date because of the fixed evolution of mining know-how.

Finest cash to mine in 2024: ASICs-based

Bitcoin (BTC): hottest crypto to mine

As the preferred selection amongst miners, Bitcoin mining calls for vital computational energy.

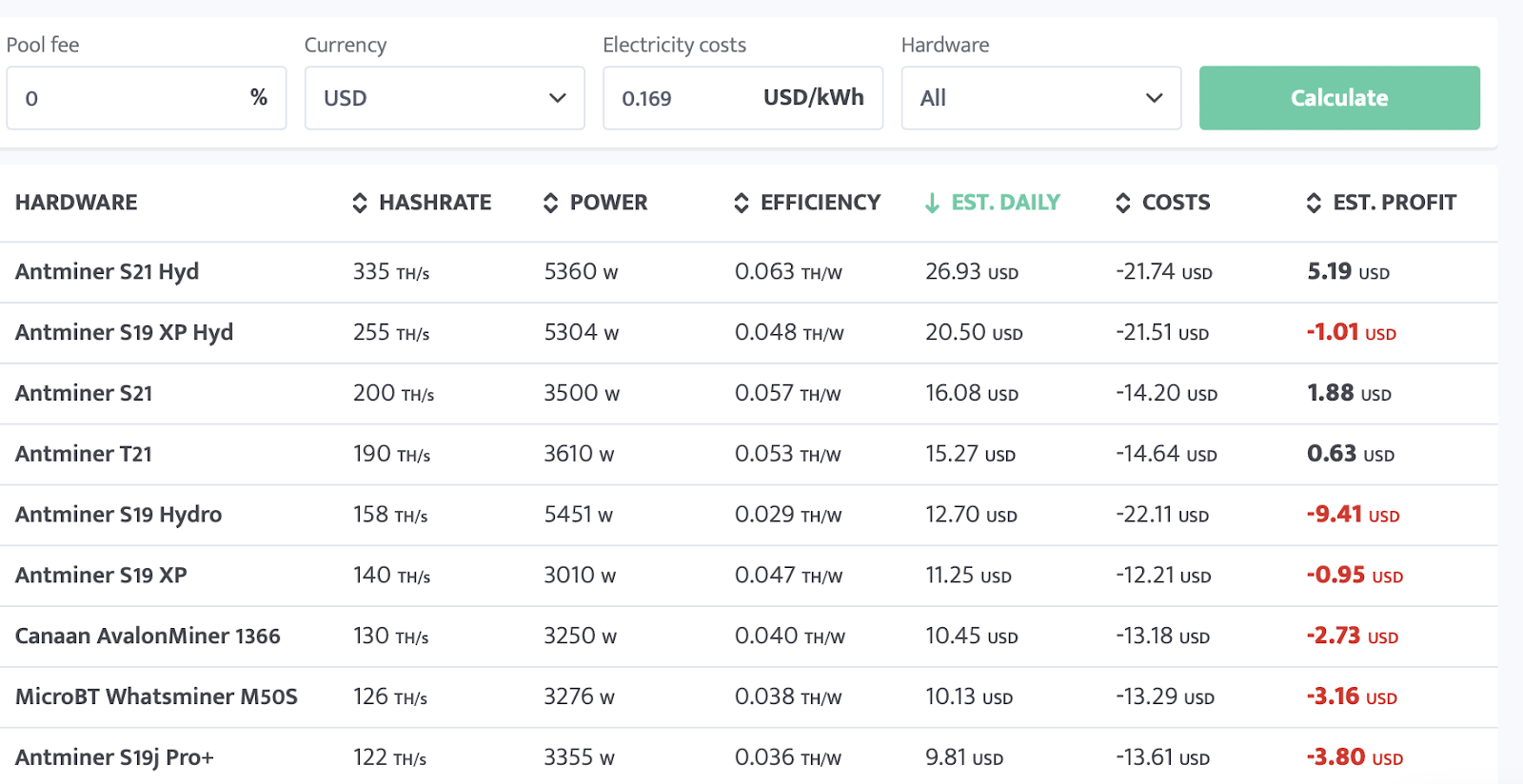

To successfully mine Bitcoin, one requires superior ASIC gear, for instance, an Antminer S21 Hyd. This is likely one of the strongest mining {hardware} out there, designed to deal with Bitcoin’s advanced mathematical puzzles.

Mining profitability, nonetheless, is just not assured and hinges on a number of elements. Utilizing the Antminer S21 Hyd for instance, miners can anticipate to generate round $26.93 in every day income.

But, this comes with a median electrical energy value of $21.74, assuming an electrical energy fee of $0.169 per kWh within the U.S. Electrical energy prices can differ broadly relying in your location, considerably impacting your backside line.

In consequence, the online every day revenue averages about $5.19, in response to information from Minerstat. From an annual perspective, using a single Antminer S21 Hyd miner might web roughly $1894 in earnings.

Bitcoin mining profitability | Supply: Minerstat

But, this determine is an estimate that assumes constant operational circumstances—a situation that hardly ever holds true given the volatility of electrical energy costs and Bitcoin’s market worth.

You must thus strategy Bitcoin mining with a steadiness of optimism and pragmatism, totally analyzing your potential funding in {hardware} and the continuing prices of electrical energy. This cautious consideration could make the distinction between a worthwhile enterprise and a expensive endeavor.

Kaspa (KAS): some of the worthwhile cryptocurrencies to mine

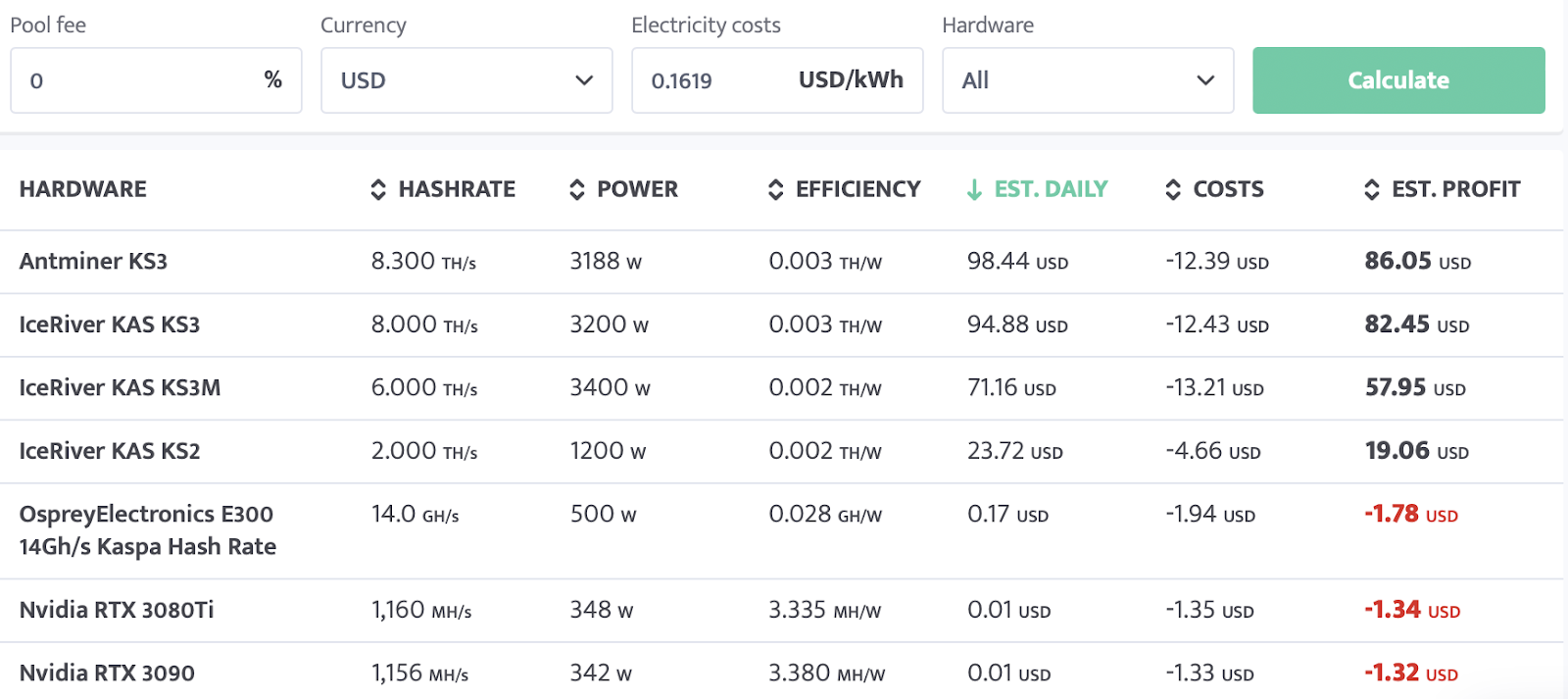

Mining Kaspa (KAS), a cryptocurrency that has been trending on Minerstat, may be significantly helpful for these seeking to maximize profitability by way of ASIC miners.

As an illustration, with the Antminer KS3, one of many main ASICs for mining Kaspa, miners can anticipate to generate a every day income of roughly $99.14.

KAS mining profitability | Supply: Minerstat

After accounting for a median electrical energy value of $12.39—based mostly on a generalized fee—the every day revenue stands at a formidable $86.05, as reported by Minerstat.

Equally, the IceRiver KAS KS3 provides a every day revenue of $82.45, whereas its counterpart, the IceRiver KAS KS3M, yields $57.95 in revenue.

Moreover, the annual revenue forecast for using an Antminer KS3, which theoretically might attain as much as $31,408, is topic to vital fluctuations.

Therefore, it’s essential to navigate these variables rigorously. You must put together for potential market shifts, regulatory adjustments, and the ever-present threat of elevated mining issue, all of which might impression the long-term viability of Kaspa’s mining operations.

Sprint (DASH): privacy-focused crypto to mine

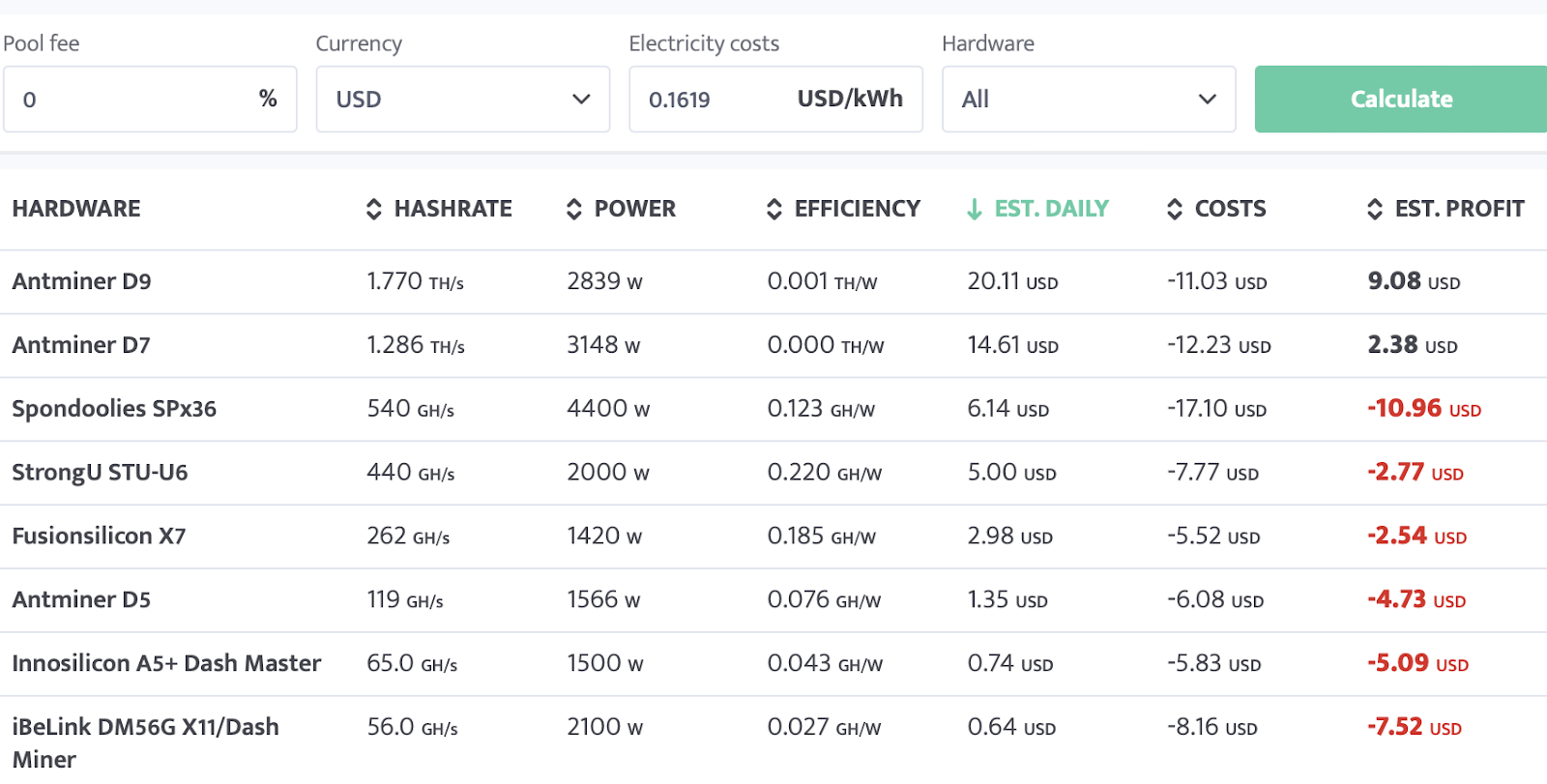

Mining Sprint (DASH), a cryptocurrency identified for its emphasis on privateness and quick transactions, additionally depends on ASIC miners on account of their effectivity and processing energy.

When working an Antminer D9 for Sprint mining, the every day income potential stands at roughly $20.11. Nonetheless, this revenue is offset by electrical energy prices, which common $11.03 every day, resulting in a web revenue of round $9.08 per day, in response to Minerstat information.

Compared, a much less highly effective ASIC just like the Antminer D7 yields a considerably decrease every day revenue of $2.38.

The profitability of mining Sprint with an Antminer D9 or any mining {hardware} is topic to quite a few variables. Annual earnings, which might probably attain $3314 with an Antminer D9, are influenced by fluctuating electrical energy costs, adjustments in Sprint’s market worth, and changes in mining issue.

Key issues earlier than deciding on the highest crypto to mine

Do not forget that the profitability of mining any cryptocurrency is closely influenced by electrical energy, {hardware}, and upkeep prices (if any), which differ broadly throughout the globe.

Whereas the calculations offered are based mostly on common electrical energy charges within the U.S., international locations like Eire, with larger electrical energy prices (roughly $0.52 per kWh), or Iran, the place electrical energy could also be sponsored for low-income residents, will see totally different revenue margins.

Moreover, the unstable nature of cryptocurrency costs, mining issue, and market demand can all considerably impression your potential earnings.

Adjustments in these elements can both improve or diminish the profitability of your mining operation in a single day. Due to this fact, it’s essential for miners to watch these variables and constantly regulate their mining methods accordingly.