Picture supply: Getty Photographs

Searching for methods to generate an enormous second revenue over time? Listed below are three high tricks to contemplate for the New Yr.

1. Use an ISA and/or a SIPP

The very first thing to consider is opening an Particular person Financial savings Account (ISA). Each the Shares a Shares ISA and Lifetime ISA enable traders to purchase shares, funds, and trusts.

Traders must also take into consideration opening a Self-Invested Private Pension (SIPP), a product that enables entry to those asset lessons as properly.

These three merchandise have totally different guidelines regarding withdrawals and annual allowances. However every is value critical consideration provided that customers don’t pay a penny in capital positive factors tax or dividend tax. Over time, this will add as much as critical cash.

What’s extra, with Lifetime ISAs and SIPPs, the federal government successfully provides savers and traders cash via tax aid. This offers savers and traders with extra sources for compounding wealth in the long term.

2. Select properly

There are actually tens of 1000’s of property traders can select from at this time. Whereas overwhelming, such a broad choice presents a wealth of alternative.

Every one in every of us has totally different monetary objectives, investing types, and tolerance of threat. So there’s no blueprint as to what the right portfolio will probably be.

One good concept is to watch what different profitable traders have been shopping for and promoting. I’m a eager watcher of what ‘Sage of Omaha’ Warren Buffett‘s been buying and selling along with his Berkshire Hathaway funding agency. Given his $100bn+ fortune, his buying and selling exercise’s at all times value being attentive to.

However no matter what others are doing, what inventory ideas chances are you’ll learn, or what market developments look white sizzling, it’s vital that you just do your personal analysis earlier than shopping for and promoting any asset. Even the likes of Buffett get it improper. So pore over buying and selling statements, steadiness sheets, business studies, and different materials your self.

3. Construct a diversified portfolio

Whereas the precise property we purchase can differ markedly, constructing a diversified portfolio is a vital technique each investor ought to contemplate.

Doing this may also help cut back threat and supply a secure return throughout the financial cycle. It additionally means traders get publicity to a myriad of alternatives that may supercharge their portfolios.

This 12 months I’ve purchased an big selection of development, dividend, and worth shares like baker Greggs, insurer Aviva, drinks bottler Coca-Cola CCH, and constructing supplies provider CRH. I’ve additionally bought exchange-traded funds (ETFs) just like the Xtrackers MSCI World Momentum ETF (LSE:XDEM).

As its title implies, this fund invests in a variety of world equities, 350 in whole, with money unfold throughout large- and mid-cap firms. Huge holdings right here embrace tech shares Apple and Nvidia, though different sectors like industrials, financials, and telecoms are properly represented, offering first rate diversification.

Its concentrate on momentum shares could be a threat, as a result of these shares are usually priced primarily based on latest sturdy efficiency, which might not be sustainable. However its assortment of established heavyweight names helps soothe any fears I’ve.

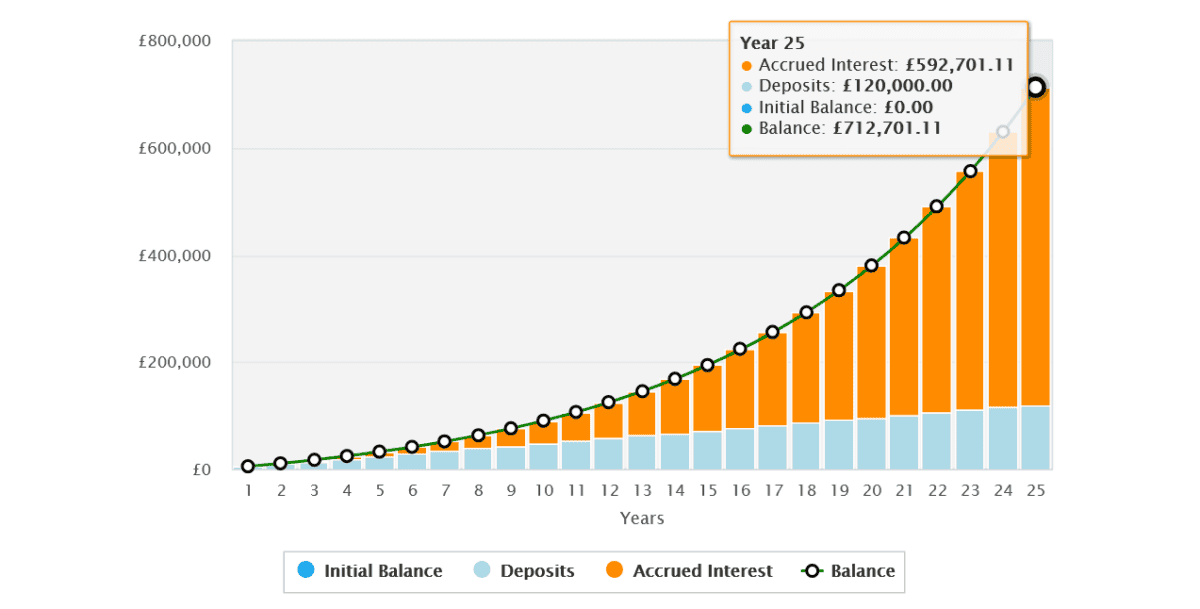

So does the fund’s strong returns, which since 2014 have averaged 11.7%. Primarily based on this efficiency, a £400 month-to-month funding right here might generate £712,701 after 25 years. This may then create an annual passive revenue of £28,508 primarily based on a 4% drawdown fee.