Picture supply: Getty Photographs

The FTSE 250 stays filled with good reductions as we transfer into the festive season. The inventory market volatility we’ve skilled in current weeks has seen much more prime firms transfer into discount basement territory.

Take the next FTSE 250 shares: QinetiQ (LSE:QQ.), Softcat (LSE:SCT), and TBC Financial institution (LSE:TBCG). Every now trades on a rock-bottom earnings a number of following heavy value falls.

May they rebound in December?

Defence discount

UK defence shares like QinetiQ have fallen sharply in current days. The prospect of peace in Ukraine can be welcome after years of bloodshed. However it might have important influence on protection sector income if gross sales stoop afterwards.

Information of a ceasefire might trigger defence contractors to fall additional. Nevertheless, the possibilities of a peace deal being struck — or holding out after any ceasefire — stay unsure. The failure of a US-brokered deal might have the alternative impact and immediate shares to rally.

The low valuation on QinetQ shares specifically could assist it to rebound on this occasion. A 16% share value drop over the past month leaves it on a ahead price-to-earnings (P/E) ratio of simply 13.7 occasions. This is without doubt one of the lowest multiples throughout the European defence sector.

QinetiQ’s share value additionally instructions a P/E-to-growth (PEG) ratio of 0.8. A studying beneath 1 implies a share goes mega low cost.

Tech star

Fears of an AI bubble have unfold throughout the broader tech sector in current weeks. Info expertise supplier Softcat has sunk 13% as traders have lowered or closed out positions.

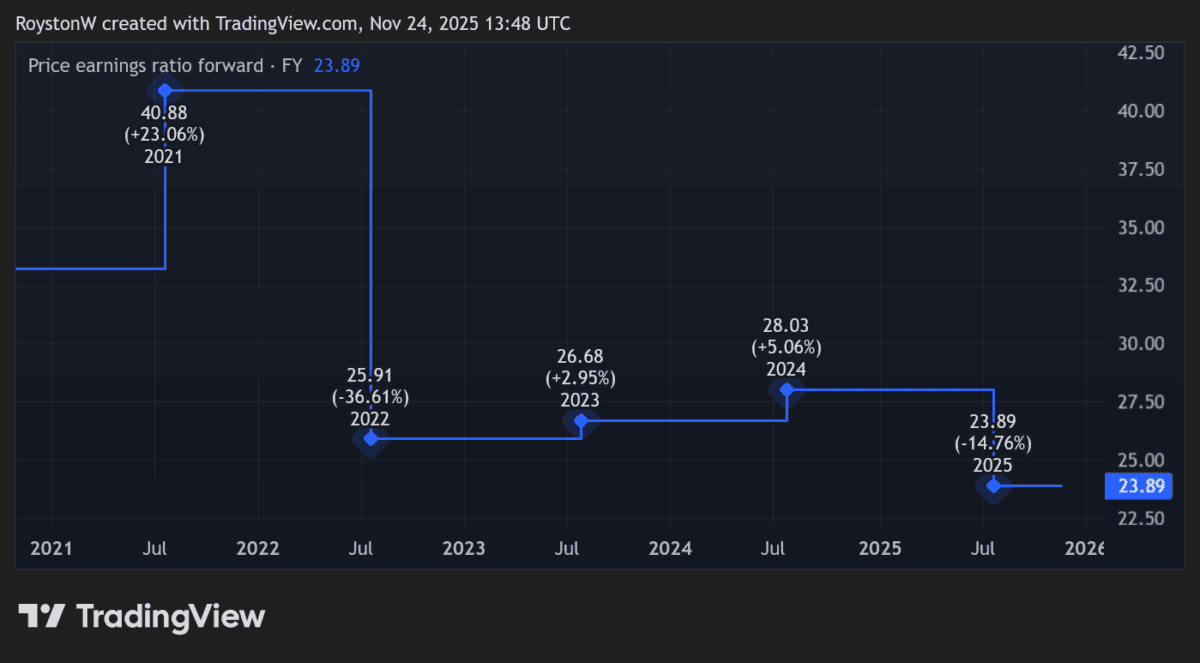

It’s a decline I believe deserves critical consideration from discount hunters. The enterprise trades on a ahead P/E ratio of 19.7 occasions.

Because the chart reveals, that is traditionally a rock-bottom ranking for Softcat shares.

My view is that worries over the AI sector have been overblown, as Nvidia‘s blowout outcomes final week confirmed. I’m backing Softcat to rebound when market sentiment stabilises.

Over the long-term, I’m assured the corporate might surge in worth as growing digitalisation drives gross sales. That’s regardless of the specter of rising prices and competitors from US tech shares. Softcat’s share value has rocketed 410% since November 2020.

Discount financial institution

TBC Financial institution has lengthy been probably the most eye-catching FTSE 250 worth shares. Having declined 10% over the past month, it’s now a discount I believe deserves critical consideration from traders.

Its ahead P/E ratio is 5.4 occasions. That makes it the most affordable UK-listed financial institution share, properly behind the likes of Lloyds (11.9 occasions) and HSBC (9.8 occasions), as an illustration.

Moreover, a 6.6% dividend yield for this 12 months is without doubt one of the sector’s highest.

The financial institution’s shares have dropped after it stated full-year income will undershoot prior forecasts. Present issues embrace regulatory adjustments which have launched a cap on microloans, a key marketplace for the corporate.

But I believe the market has overreacted to the information. Buying and selling stays robust, as Georgia’s booming financial system drives monetary companies demand. And the enterprise is accelerating its shift from microloans to areas like SME lending to beat its current travails.

I believe TBC might spring again as traders get up to its distinctive all-round worth