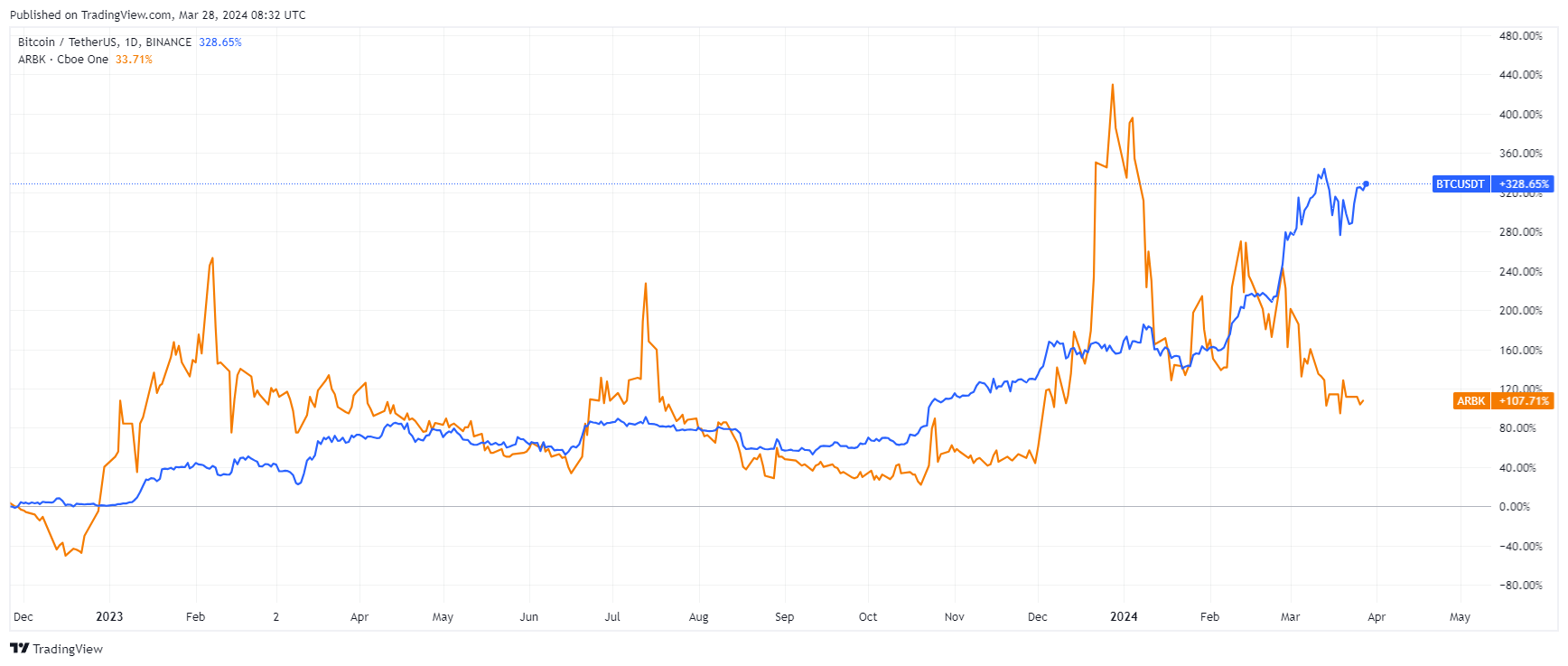

Though Bitcoin (BTC) has already gained practically 70% in 2024, shares of Argo Blockchain, a cryptocurrency mining firm publicly listed in London and the USA, are scraping the underside, falling by 55%.

The corporate’s answer to a few of its issues and shareholder discontent is promoting its knowledge heart in Mirabel, Canada. The corporate’s London department (LSE: ARB) introduced the finalization of this transfer on Thursday. On the identical time, the miner issued over 460,000 new atypical shares.

The plan to promote an information heart within the Quebec area was first introduced virtually two months in the past. The transaction, which yielded a complete consideration of $6.1 million, has enabled the corporate to scale back its debt and streamline its operations considerably.

The web proceeds from the sale had been used to repay the Mirabel Facility’s excellent mortgage of $1.4 million, with the rest being allotted to repay debt owed to Galaxy Digital Holdings, Ltd.

As of 28 March 2024, Argo’s debt stability with Galaxy is $12.8 million, representing a 63% discount from the unique stability of $35.0 million.

“The Firm continues to execute on its technique of strengthening the stability sheet and lowering non-mining working bills. The Firm decreased its debt by $12.4 million in Q1 2024,” Thomas Chippas, the Chief Govt Officer at Argo, commented on the transaction.

#ARB ARGO BLOCKCHAIN Closing on sale of Mirabel knowledge centre for a complete consideration of $6.1m

— The Dude (@Redpanda73) March 28, 2024

Along with the debt discount, Argo has relocated and deployed mining machines from the Mirabel Facility to its facility in Baie Comeau, Quebec. This consolidation is anticipated to scale back the corporate’s non-mining working bills by $0.7 million per yr, permitting for extra environment friendly use of the ability and onsite staff.

Argo Blockchain additionally introduced the issuance of 460,477 new atypical shares.

Bitcoin Winter Hits Argo

As talked about on the very starting, the worth of Bitcoin is dynamically rising in 2024. Initially, Argo Blockchain’s shares additionally rose together with it, however weaker-than-expected BTC manufacturing within the first months of the yr brought about shareholders to lose confidence within the firm. Because of this, the cryptocurrency spring within the broad market was an prolonged winter for the digital asset miner.

Within the meantime, Argo Blockchain underwent vital adjustments in its administration ranks. Seif El-Bakly stepped down as Chief Working Officer after serving as interim Chief Govt Officer from February to November 2023.

Whether or not we take a look at Argo’s shares listed in London or the USA, the charts present the identical image: a decline of about 55% for the reason that starting of the yr.

Bitcoin value (blue) goes up, whereas Argo (orange) falls. Supply: Tradingview.com

On the identical time, Marathon Digital Holdings, the most important publicly traded cryptocurrency miner, is dropping solely 6%, and Phoenix Group is gaining round 2%.