Picture supply: Rolls-Royce plc

Engine-builder Rolls-Royce Holdings (LSE:RR.) has been one of many FTSE 100‘s finest performing shares following the pandemic. At 427.5p per share, it’s risen a shocking 335% in worth up to now two years alone.

On this article I’m contemplating whether or not the corporate’s shares nonetheless supply respectable worth following their electrifying rise. Let’s check out the charts!

Earnings

There are two strategies I’ll use to measure Rolls-Royce’s share worth relative to predicted earnings: the price-to-earnings (P/E) ratio and the price-to-earnings development (PEG) ratio.

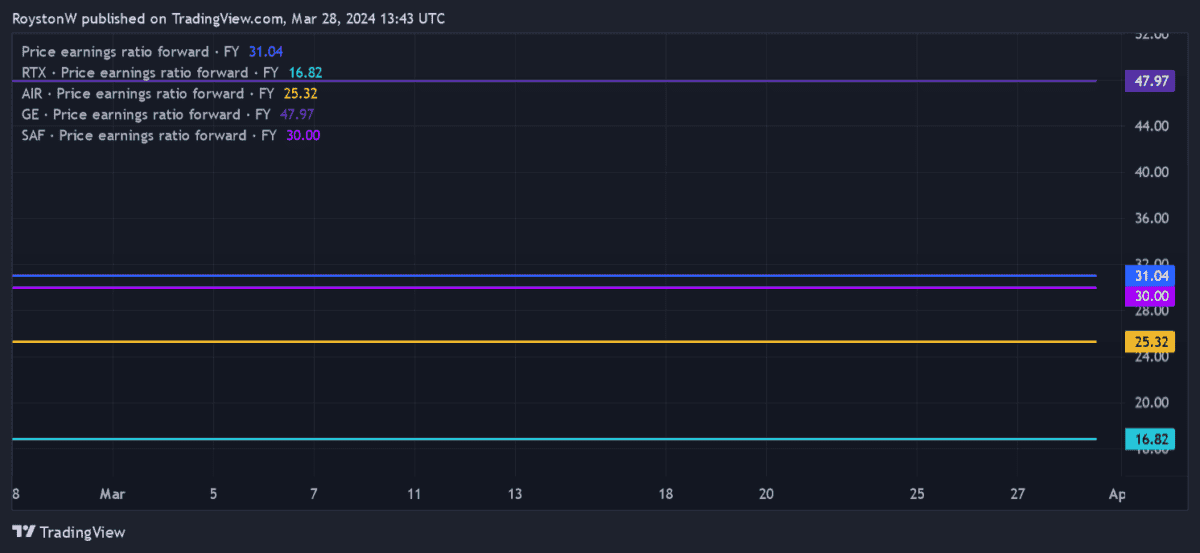

The P/E ratio is probably the most extensively used metric, and for this monetary yr Rolls trades on a ratio of 31 instances. This seems to be costly in comparison with the broader FTSE 100, whose ahead common is available in at 10.5 instances.

I additionally wish to see how the engineer measures up in comparison with the broader aerospace and defence industries. As you’ll be able to see, Common Electrical — which makes greater than half of the world’s plane engines — trades on a a lot greater P/E ratio of 48 instances.

Rolls shares, nevertheless, are costlier utilizing this metric than these of — in descending order — Safran, Airbus, and RTX Company (which owns engine-maker Pratt & Whitney).

However what in regards to the firm’s PEG ratio? Does the agency supply engaging worth utilizing this earnings-related metric?

Metropolis analysts assume earnings will soar 23% in 2024, leaving the enterprise buying and selling on a ratio of 1.3. At a couple of, this additionally suggests the aerospace large is buying and selling at a premium.

Gross sales

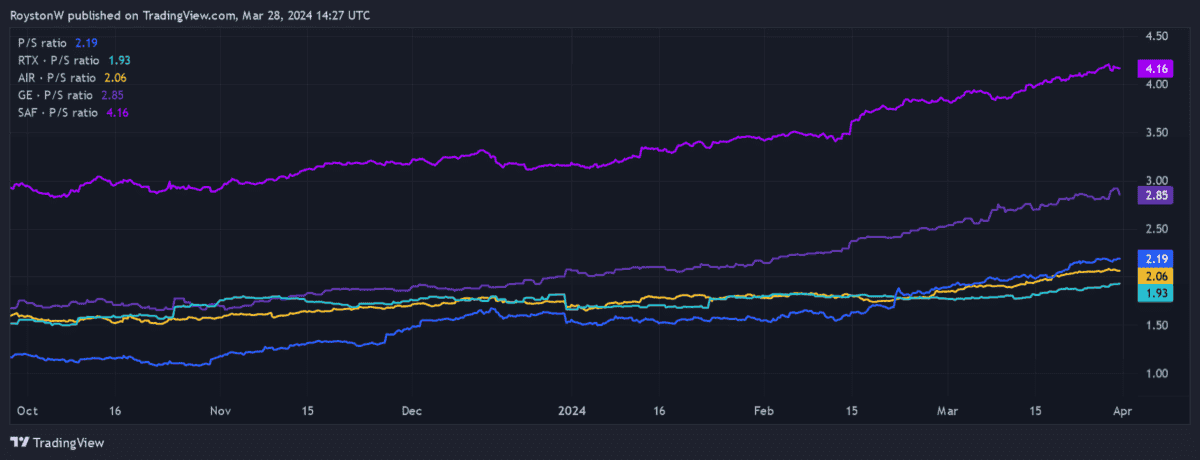

The following step is to gauge the worth of Rolls-Royce shares in relation to its revenues utilizing the price-to-sales (P/S) ratio.

Because the chart exhibits, every of the trade’s main gamers is buying and selling at a premium to their gross sales technology, with Rolls sitting in the course of the pack. These are, in descending order, Safran, Common Electrical, Rolls, Airbus, and RTX.

With Rolls, traders are at present keen to pay $2.19 for each greenback of the corporate’s gross sales income.

Dividends

The final step is to contemplate Rolls’ worth in relation to predicted dividends. The engine-builder hasn’t delivered any money rewards because the onset of the pandemic. And Metropolis analysts are break up on when they may seemingly return because the enterprise rebuilds its stability sheet and seeks to reclaim its investment-grade standing.

That mentioned, dividend forecasts throughout all brokers with scores on the inventory produce a ahead yield of 0.6%. To place that in context, the FTSE 100 common sits means forward at 3.7%.

Moreover, Rolls’s dividend yield additionally falls effectively in need of the remainder of the trade, because the desk under exhibits.

| Inventory | Ahead dividend yield |

|---|---|

| Common Electrical | 2.2% |

| Airbus | 1.4% |

| Safran | 1.6% |

| RTX | 2.7% |

Ought to I purchase Rolls shares?

The sky continues to be the restrict with regards to Rolls-Royce’s share worth. Whereas it seems to be costly, I wouldn’t be shocked to see the engineer proceed hovering given the resilience of the worldwide airline trade.

However that doesn’t imply I’ll purchase the corporate for my portfolio. At present costs, there’s little worth available right here, in my view. In reality, its excessive earnings ratios particularly depart it in peril of a share worth correction if information circulation all of a sudden disappoints.

That is definitely a risk in my view, given the delicate state of the world financial system and the potential for a recent downturn throughout its cyclical finish markets.