Picture supply: Getty Photos

Crimson-hot progress inventory Archer Aviation (NYSE: ACHR) hit a turbulent patch yesterday (2 December), ending the day 23% decrease. But shares of the flying-taxi firm are nonetheless up 148% in simply two months!

Ought to I purchase the dip? Let’s talk about.

What’s Archer?

Archer Aviation is one in every of a handful of corporations racing to commercialise electrical vertical take-off and touchdown (eVTOL) plane. In different phrases, electrical plane able to taking off and touchdown very like helicopters, however with far much less air pollution and noise.

These air taxis are doubtlessly supreme for city areas. They might bypass congested roads, dramatically cut back journey occasions, and decrease emissions.

For instance, Archer plans a flying taxi community in Los Angeles (the place site visitors is horrendous) in early 2026 to show an hour-long floor commute into minutes within the air. How so? Properly, with no street congestion and site visitors lights to cope with, its eVTOLs can journey uninterrupted at speeds of as much as 150 mph!

The agency plans to function an Uber-like ride-hailing service, in addition to promote its plane (referred to as Midnight) to third-parties. Its preliminary order ebook now exceeds $6bn.

In September, the US’s Federal Aviation Administration (FAA) accepted eVTOLs. It was the primary new class of plane regulated by the company because the introduction of helicopters almost a century in the past.

Uncertainty has landed

The corporate is backed by Stellantis, which owns Fiat and Vauxhall. In August, it dedicated as much as $400m to scale Midnight manufacturing to 650 plane yearly at Archer’s Georgia facility via to 2030.

And this doubtless explains yesterday’s sell-off, as Stellantis CEO Carlos Tavares abruptly resigned over the weekend. The carmaker’s gross sales have been sluggish, forcing it challenge a revenue warning in September.

Tavares was supportive of Archer’s ambitions. However will the following CEO be as keen to maintain pumping cash right into a speculative eVTOL enterprise? My hunch is sure, given the numerous investments already made. However it provides uncertainty, and the market hates that.

US vs UAE

Archer ended Q3 with $502m in money. Nevertheless, it misplaced $115m within the quarter, so will clearly want additional injections of money to ramp up manufacturing of its plane. Shareholders due to this fact face the chance of dilution.

That may not matter long run, assuming the corporate can obtain industrial success. That is the place one other danger arises although, as the corporate remains to be ready to realize full certification for its plane.

It’s almost accomplished Part 3 of the FAA’s sort certification course of, whereas advancing via Part 4, the ultimate part. So it’s on observe to start working in late 2025 or early 2026.

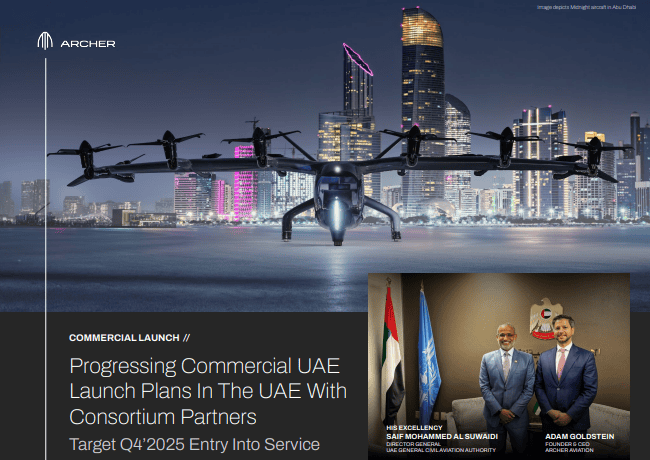

Nevertheless, the United Arab Emirates (UAE) might pip the US to launch the world’s first electrical air taxi routes. There’s a little bit of a race on between the 2 nations, and Archer goals to begin companies within the UAE in late 2025.

My transfer

To realize publicity to this trade, I’ve invested in rival Joby Aviation (backed by Uber).

| The 2 at a look | Joby Aviation | Archer Aviation |

|---|---|---|

| Based | 2009 | 2018 |

| Market cap | $5.5bn | $2.6bn |

| Money place | $710m on the finish of Q3, with an extra $722m raised since | $502m on the finish of Q3, with one other $400m on the horizon |

| Plane | One pilot and 4 passengers at speeds of as much as 200 mph | One pilot and 4 passengers at speeds of as much as 150 mph |

| Design strategy | Vertically built-in | Depends on aerospace suppliers for elements |

| Manufacturing accomplice | Toyota | Stellantis |

| Anticipated industrial launch | Late 2025 | Late 2025 |

These shares are extremely speculative and carry quite a lot of danger, so I don’t need each in my portfolio.

Nevertheless, that is additionally a doubtlessly large rising market. I’m completely satisfied to carry one long run.