Picture supply: Getty Pictures

One of many worst performers within the FTSE 250 not too long ago has been Watches of Switzerland Group (LSE: WOSG). Presently, the inventory’s down about 75% from its highs (set in early 2022).

Is it among the best worth shares within the index right this moment after this huge decline? Let’s talk about.

The watch market is struggling

I observe the luxurious watch market fairly carefully as I’ve an curiosity in timepieces. And I can inform you that proper now, the market isn’t doing very effectively.

In the course of the coronavirus pandemic – when folks had quite a lot of disposable revenue – everybody wished to purchase a luxurious watch. Right this moment nonetheless, it’s a really completely different story.

With rates of interest at larger ranges and pandemic financial savings lengthy gone, far fewer folks have the cash for luxurious items. And lots of of those that do would moderately spend their money on ‘experiences’ as an alternative.

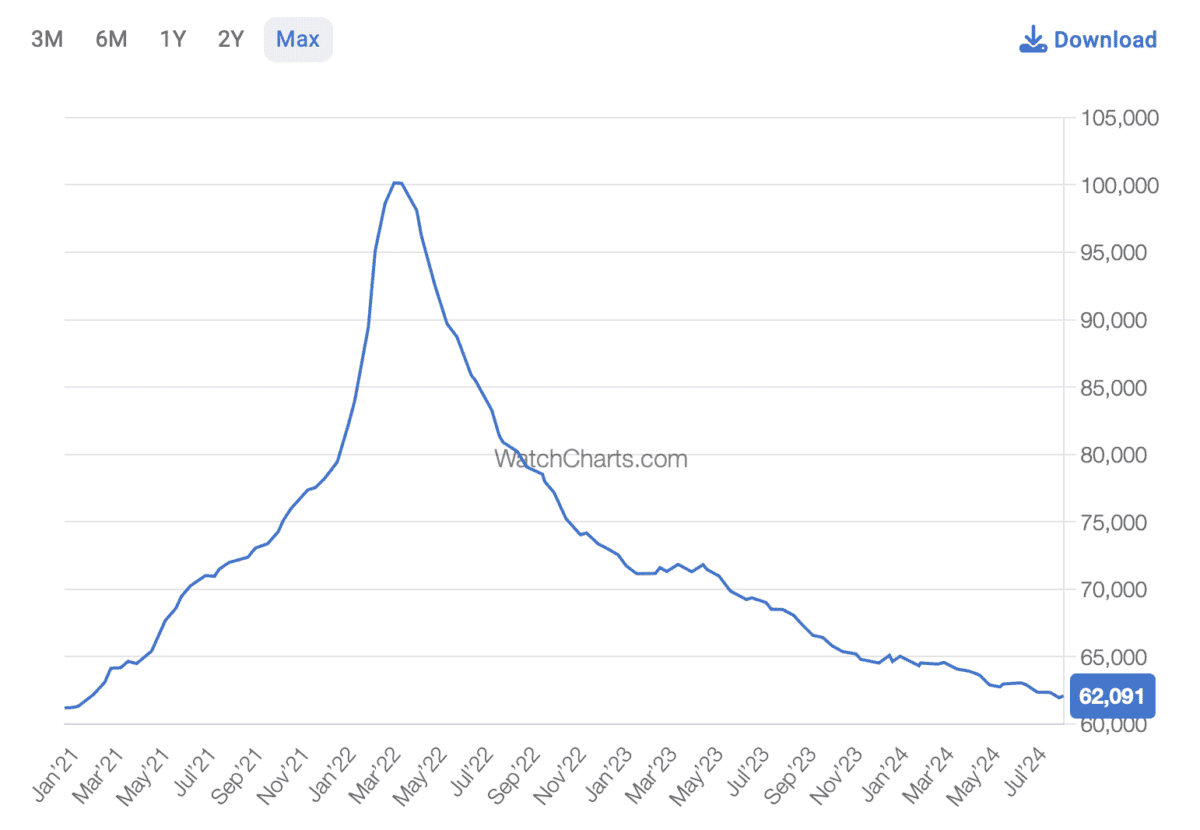

The weak point out there might be seen within the Watch Market Index – an index of 60 watches from high luxurious watch manufacturers ( indicator of secondary watch market value tendencies). Presently, this index is locked in a nasty downtrend.

Supply: WatchCharts

Very low valuation

The factor is, the present weak point in its market seems to be priced into Watches of Switzerland shares already.

Presently, the inventory has a price-to-earnings (P/E) ratio of simply 9 because the earnings per share forecast for this monetary 12 months is 42.8p. That’s an extremely low valuation.

For reference, the median P/E ratio throughout the FTSE 250 is about 13.3. So the inventory’s buying and selling at an enormous low cost to the index.

One dealer that clearly believes the inventory’s undervalued proper now could be Barclays. Again in June, it raised its value goal for Watches of Switzerland shares to 595p from 580p. That’s about 54% larger than the present share value.

Uncertainty within the close to time period

In fact, situations within the luxurious watch market might deteriorate additional, placing strain on the group’s revenues and income.

Final monetary 12 months, the corporate’s adjusted earnings per share fell 28% 12 months on 12 months. In the event that they have been to fall by one other 20-30% this monetary 12 months, the inventory’s not going to look as low cost because it does presently (proper now, analysts anticipate earnings development of 13%).

The corporate’s stated it’s cautiously optimistic in relation to the outlook for this monetary 12 months nonetheless, there aren’t any ensures the outlook will enhance.

A high worth inventory right this moment?

Personally, I’m not anticipating a rebound within the luxurious watch market within the close to time period. I feel it’s going to take some time for shopper confidence to rebound to the extent that much more persons are prepared to exit and drop hundreds of kilos on luxurious watches.

That stated, I do envisage a rebound out there at some stage (when rates of interest are a good bit decrease and folks have extra disposable revenue). So for affected person long-term buyers, I feel there might be a possibility to contemplate right here.