Picture supply: Aston Martin

For years, Aston Martin (LSE: AML) has had the potential makings of an excellent enterprise regardless of a lacklustre share worth: a singular model, well-heeled buyer base, and administration deal with optimising the mannequin vary for a altering market.

Regardless of all of it, Aston Martin shares have turned out to be a worth lure. The carmaker’s share worth has fallen 36% up to now this 12 months, 53% over one 12 months, and 83% over the previous 5 years.

With a quarterly buying and selling assertion launched at this time (30 April), is there any glimmer of reports that may recommend a turnaround may very well be on the playing cards that will justify a better share worth and make me contemplate investing? Or is the share nonetheless a possible worth lure?

The identical outdated issues

As I write this on Wednesday afternoon, the Aston Martin share worth is down simply 1% in the course of the day’s buying and selling. That implies the most recent set of efficiency figures from the corporate, whereas not arousing pleasure, didn’t dismay the Metropolis both.

Wholesale volumes grew 12 months on 12 months (yoy), albeit solely by 1%. The loss earlier than tax narrowed significantly, however nonetheless got here in at £80m. On income of £234m, that could be a hefty loss.

There was extra dangerous information. That income was down 13% yoy. So, given the wholesale volumes, the common promoting worth confirmed a pointy decline.

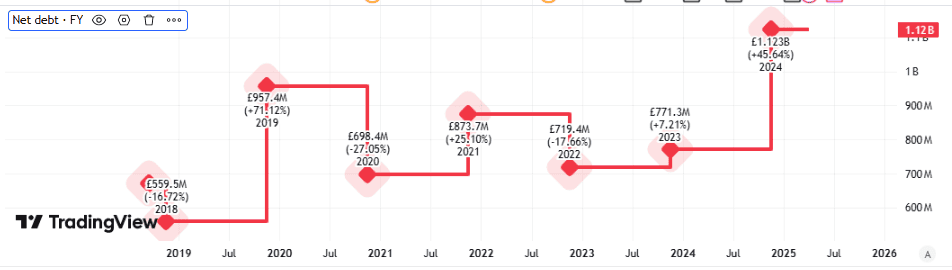

In the meantime, the enterprise has lengthy been bedevilled by working losses. Moreover, its non-operating losses like finance prices have additionally threatened its long-term viability. Within the first quarter, internet debt rose over a fifth to £1.3bn.

Created utilizing TradingView

Web debt has lengthy been a key problem for Aston Martin. It has repeatedly diluted shareholders to boost extra capital and I see a danger that might occur once more. Regardless of that, internet debt stays stubbornly excessive — and has been heading within the flawed course.

The share may find yourself going to zero

Lengthy-term issues proceed to look acquainted to me – however there are additionally some new ones for the agency to take care of.

Whereas sounding upbeat (as regular) about its near-term prospects, the closely loss-making firm repeatedly talked about the affect US tariffs and an unsure international financial outlook might have on its efficiency.

If Aston Martin actually can pull off a turnaround, its share worth must be a lot increased than it’s at this time.

Encouragingly, the corporate caught to its full-year forecast, together with optimistic adjusted EBIT (earnings earlier than curiosity and tax) for the total 12 months and optimistic free money circulation within the second half. That may make a welcome change from destructive free money circulation.

Created utilizing TradingView

I’m not persuaded, although. Gross sales volumes are flat, the corporate continues to bleed money, and it’s closely loss-making. In the meantime, its steadiness sheet goes from dangerous to worse.

If gross sales and profitability don’t enhance in some unspecified time in the future, I see a danger that debt holders take over the corporate and shareholders are worn out.

The Aston Martin share worth is in pennies and getting decrease for good purpose, as I see it. It screams potential worth lure to me, even after current falls.