Picture supply: Getty Photographs

Investing in exchange-traded funds (ETFs) might be a good way to diversify a Shares and Shares ISA in an economical approach.

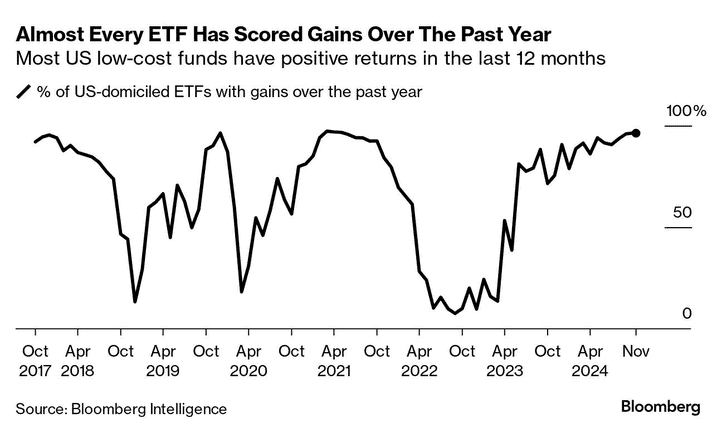

Placing cash in considered one of these monetary devices has been particularly profitable over the previous 12 months. In response to Bloomberg Intelligence evaluation, 96% of ETFs within the US have posted optimistic returns over this era, with the vast majority of merchandise delivering double-digit returns.

Bloomberg feedback: “Should you’ve put cash in an exchange-traded fund — these low-cost merchandise designed for the plenty — you’re seemingly having fun with stellar positive factors, it doesn’t matter what you’ve been betting on”.

Sturdy performers

It’s not simply US funds which have been performing strongly over the previous 12 months. A variety of London-listed ETFs I’ve purchased for my very own portfolio have delivered wholesome positive factors.

The Xtrackers MSCI World Momentum ETF, for example, has risen by precisely a 3rd since November 2023. And the HSBC S&P 500 ETF’s up 28%, bolstered by the bull run in US shares.

UK-focused funds have additionally carried out valiantly in current instances. The iShares Core FTSE 100 ETF’s up 15% since final November.

Previous efficiency isn’t any assure of future returns. And predicting how shares and funds will carry out near-term within the present geopolitical and macroeconomic panorama’s particularly robust.

However this doesn’t imply I’m not searching for extra ETFs to purchase. It’s because I make investments with a long-term view. The L&G Cyber Safety ETF’s (LSE:ISPY) a fund I believe ISA buyers like me ought to pay shut consideration to.

L&G Cyber Safety ETF

This fund — which is run by Authorized & Normal — has rocketed in worth since its launch in 2015. It’s up 24% prior to now 12 months alone.

The broader tech sector’s been powered by the excitement round synthetic intelligence (AI) over the last 12 months. This fund in the meantime, has been helped by hypothesis that AI improvement will create a brand new alternative for hackers and different cyber criminals.

Analysts at Fortune Enterprise Insights suppose the worldwide cybersecurity market will probably be price $562.7bn by 2032. That represents compound annual progress of 14.2% from in the present day’s ranges.

Investing on this L&G cybersecurity ETF could possibly be an efficient solution to capitalise on this rising market. It holds shares in additional than 30 sector gamers together with Cloudflare, Crowdstrike, Palo Alto, and Cisco Techniques.

Operational issues (like system failures and aggressive pressures) may influence the efficiency of those corporations. However by investing in a basket of those cyber companies, the influence could possibly be minimal.

A wider menace is that 90% of the fund’s earnings are reported in US {dollars}. It could possibly be extra weak to actions within the dollar than ETFs with wider forex diversification.

However on steadiness, I nonetheless anticipate the fund to maintain delivering wonderful long-term returns.