Picture supply: Getty Pictures

At first of 2026, I believed Rolls-Royce shares had been set for a extra low-key 12 months. In any case, that they had returned 222%, 90%, and 104% respectively in 2023, 2024, and 2025.

This FTSE 100 inventory was due a breather!

However Rolls-Royce has flown out of the traps, with a 9.5% acquire, making it the sixth-best performing Footsie share to this point this 12 months.

Nevertheless, the inventory’s now buying and selling at 39 occasions 2026’s forecast earnings. At this lofty valuation, every thing must go proper this 12 months for it to maintain powering on. And that’s clearly not assured, with geopolitical tensions excessive and ongoing provide chain challenges.

As such, I see extra fascinating alternatives elsewhere out there proper now. Right here’s one in every of them.

Taking market share

On Holding (NYSE:ONON) is the Swiss agency behind the sportswear model that has taken the world by storm over the previous three years.

In 2025, the corporate expects gross sales to have risen 34% at fixed forex to round 3bn Swiss francs ($3.74bn, on the present trade price).

Contemplating the {industry} downturn that has seen Nike and different sportswear manufacturers wrestle, this can be a outstanding efficiency. It tells us that the model is taking share in a tricky market as a result of clients love the merchandise.

Premium positioning

Wall Avenue expects one other 20%+ soar in gross sales in 2026 and 2027, with a good stronger development in earnings. And this rising profitability is de facto engaging, with On positioning itself because the world’s most premium sportswear model.

Not like most different manufacturers, On doesn’t low cost, which is translating into industry-leading margins. Its Cloudmonster Hyper coach line can value as a lot as £260 a pair, whereas its Cloudboom Strike LS (LightSpray) racing sneakers go for much more.

In future, administration sees additional margin enlargement because it aggressively strikes into attire and opens extra retail shops. Attire usually carries greater gross margins than footwear, and the agency’s within the very early innings of capturing this world alternative.

What [premium] actually does, it actually units ourselves aside from the mass market the place…there’s a variety of competitors. And this permits us to truly constitution our personal path and never simply fish in the identical pond like everybody else.

CEO Martin Hoffman

Innovation-driven

After I consider my best-ever investments (significantly Nvidia, Intuitive Surgical, and Axon Enterprise), they’re extraordinarily modern firms. I see one thing related right here.

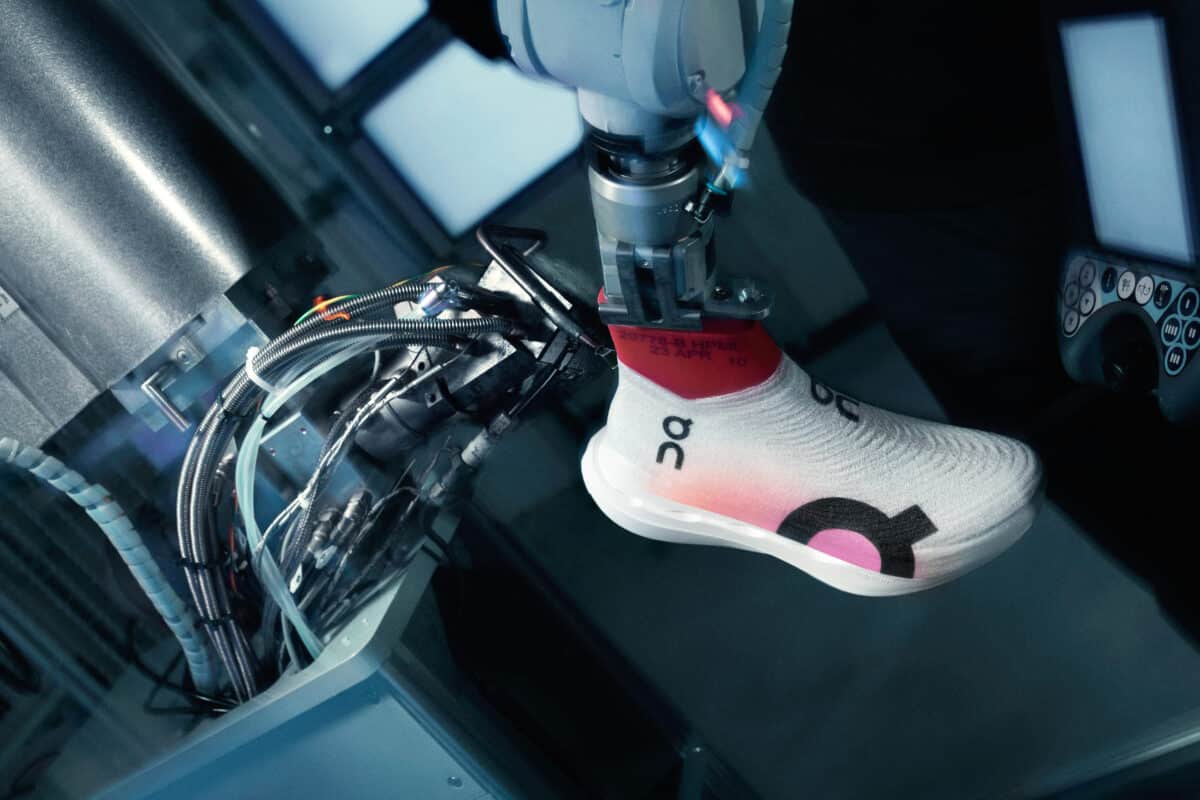

For instance, the corporate’s LightSpray expertise includes a robotic arm spraying a steady filament onto a mould. Your entire higher of the shoe is created in simply three minutes fairly than hours of handbook labour!

On plans to open robot-led factories near main retail markets fairly than completely counting on Asian manufacturing. If profitable, this is able to end in faster manufacturing, sooner delivery, much less carbon footprint, and even perhaps greater margins in future.

Valuation

One future threat I see is a drop-off in manufacturing high quality. In any case, people aren’t paying prime greenback for cool merchandise to be disillusioned, so excellence is predicted however not essentially assured.

In the meantime, Hoka gives competitors in high-end trainers.

Nonetheless, at 25 occasions 2027’s forecast earnings, I believe the inventory’s properly price contemplating. If On can develop its present 1% share of the worldwide sportswear market to three% and even 5%, there could possibly be important returns for buyers at this time.