Following September’s hunch to its lowest income of the 12 months, bitcoin miners had a worthwhile October, recording a 25.05% income enhance.

Bitcoin Mining’s October Comeback

On Oct. 31, one petahash per second (PH/s) of computing energy was valued at $54.52 per PH/s, the best hashprice in 30 days. As of at the moment, nonetheless, the spot market hashprice stands at roughly $46.55 per PH/s after bitcoin slipped under $70,000 to the $69,400 vary. Information additionally reveals that on Oct. 17, hashprice edged previous the $53 mark as effectively.

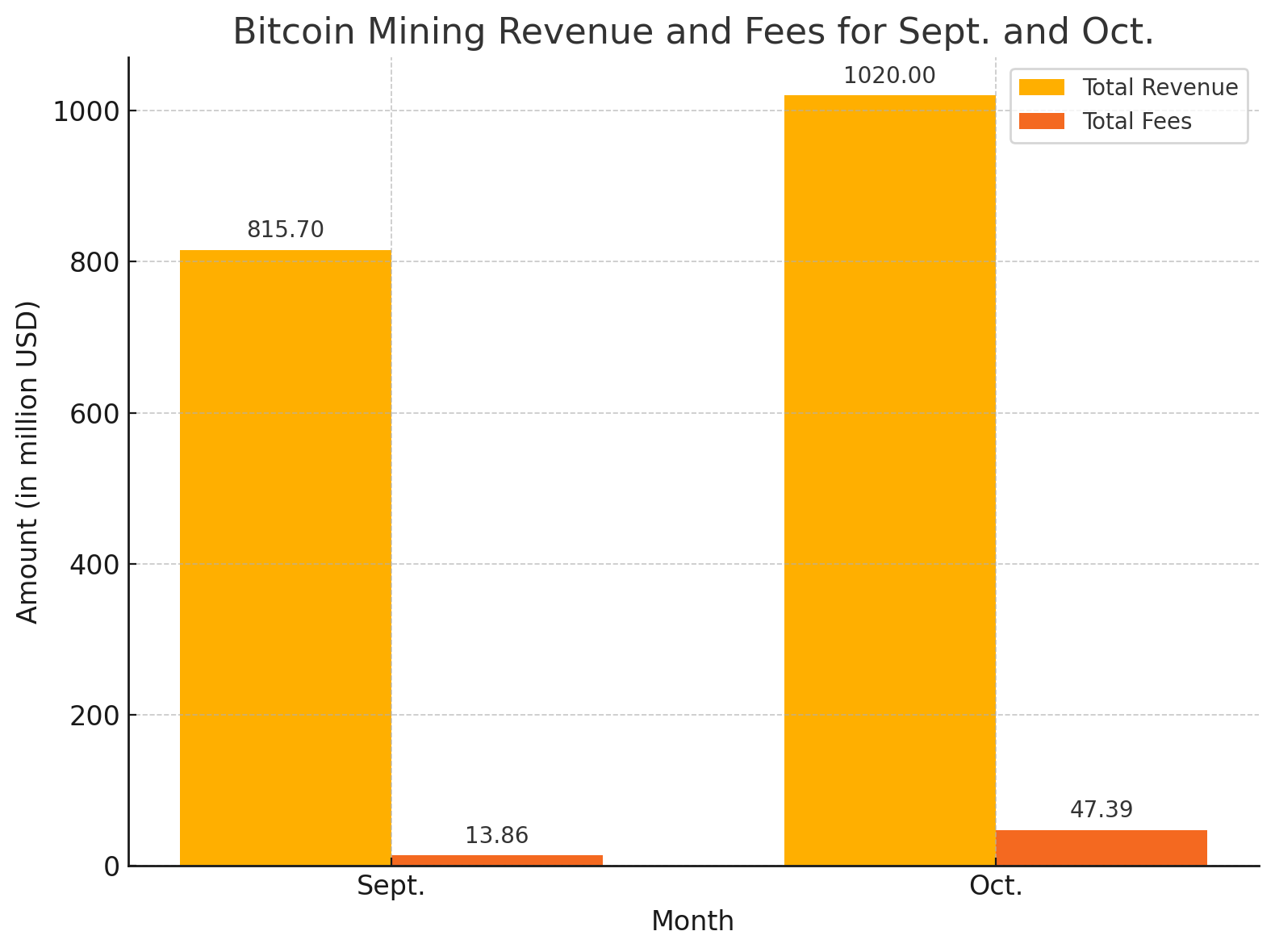

In complete, bitcoin miners earned 25.05% extra in October in comparison with September. That month, miners generated $815.7 million from charges and bitcoin’s subsidy mixed. October noticed a bounce to $1.02 billion in income, with $975.22 million from block rewards and $47.39 million from onchain charges.

The leap from September’s $13.86 million in onchain charges to October’s $47.39 million marks a 241.91% development. On the identical time, bitcoin’s complete computational energy is at an all-time excessive. Stats from Nov. 1, 2024, present Bitcoin’s seven-day easy transferring common (SMA) hashrate at a whopping 765 exahash per second (EH/s).

Present block intervals are transferring sooner than the standard 10-minute common, sitting at 9 minutes and 18 seconds. This sooner tempo factors towards a possible 7.5% bounce in problem, with an replace anticipated round Nov. 4, 2024, as greater than 340 blocks stay to be mined earlier than the retarget.

As October closed with bitcoin miners seeing a robust income enhance and rising hashrates, the mining sector now faces each potential challenges and alternatives. With computational energy at unprecedented ranges and faster block intervals, an issue enhance seems imminent—setting the stage for a brand new part within the community’s evolution come early November.