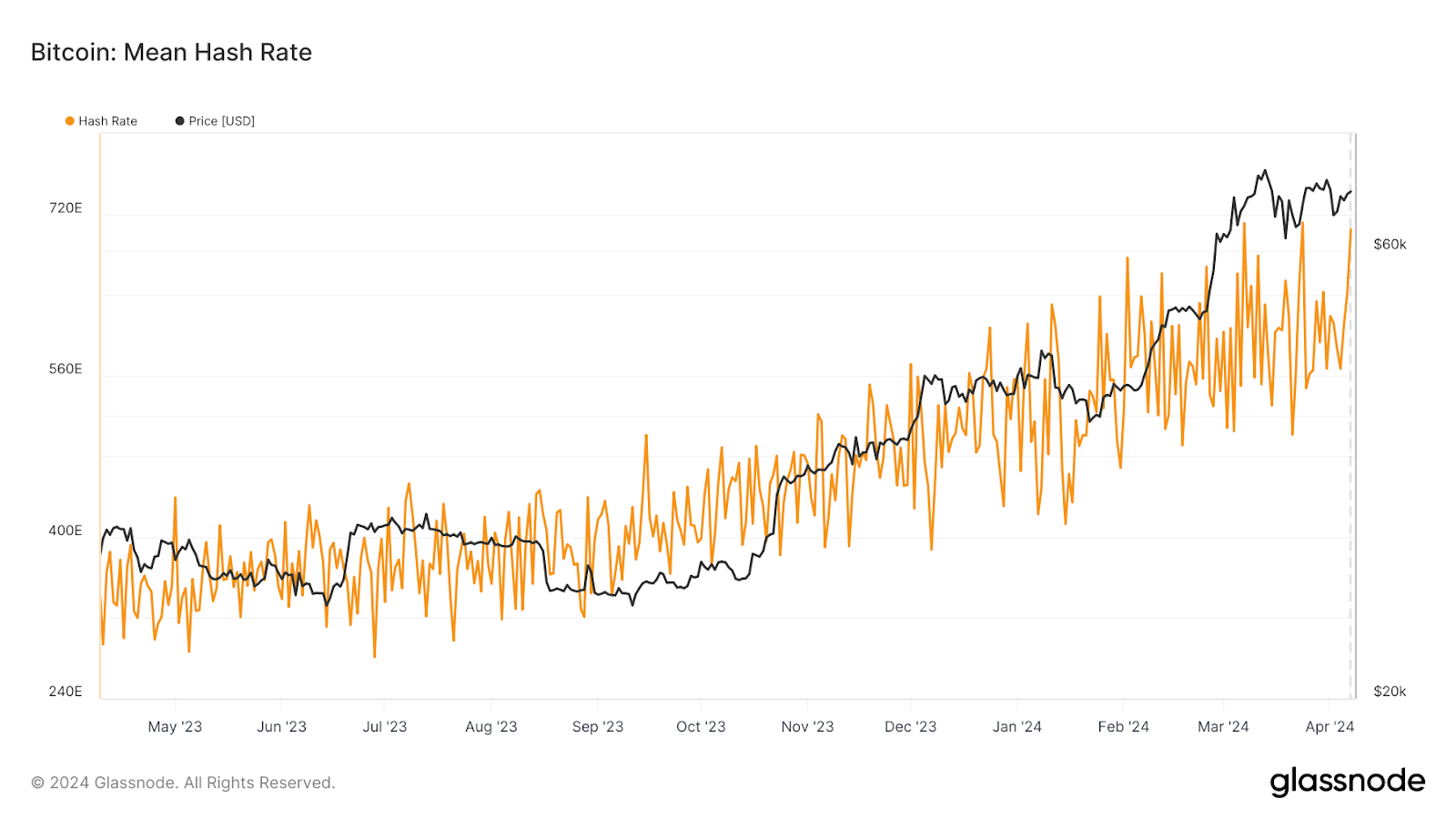

In current months, the hashrate metric of Bitcoin, which signifies the quantity of computational energy supplied by mining actions, has grown considerably, exceeding the brink of 700 EH/s shortly earlier than the fourth halving.

Up to now, regardless of some small adjustment shocks from miners, who cut back their hash price ready for the halving of the cryptographic protocol, the 7-day common hashrate is approaching new all-time highs.

Let’s see every thing intimately under.

Bitcoin mining: hashrate chart constantly rising shortly earlier than the halving

The chart of Bitcoin’s complete hashrate, which exhibits the development of the full quantity of hashes per second generated by the mining operators of the cryptographic community, is about to succeed in a brand new all-time excessive.

As proven by the on-chain evaluation device Glassnode, the “Imply Hashrate” of the cryptocurrency, which is the 7-day common hashrate, is nearly at a brand new ATH totaling 704.8 EH/s.

On March seventh and March twenty fourth, the community recorded barely increased values than the present ones, which might nonetheless be damaged very quickly.

Regardless of in current days some miners have decreased their computational energy in preparation for the Bitcoin halving occasion, which as an occasion halves their earnings from fixing blocks, we are able to see how usually the hashrate continues to develop.

Simply suppose that only a yr in the past the metric was under 400 EH/s, about 40% lower than at this time.

Within the midst of the overall progress of the computational energy of the community, there are those that consider additional rising their amount of hashes, accumulating as many BTC as potential in anticipation of a future appreciation of the cryptocurrency.

For instance, the Buddhist Kingdom of Bhutan, positioned close to the japanese Himalayas, has lately deliberate to increase its mining manufacturing powered by hydroelectric vitality by 6 occasions, reaching 600 MW.

Within the particular case of this South Asian actuality, we are able to say that the presence of renewable vitality sources helps miners save some huge cash, placing them in a privileged place in comparison with all different operators who use electrical energy.

Regardless of the approaching halving of the protocol, with the manufacturing of recent BTC successfully halved, the Kingdom of Bhutan believes in the way forward for cryptocurrency and seeks to build up as a lot as potential by digital mining.

In case you’re questioning why #Bitcoin hashrate retains going up. https://t.co/UCjoYHot1n

— Samson Mow (@Excellion) April 5, 2024

11 days from the fourth Bitcoin halving

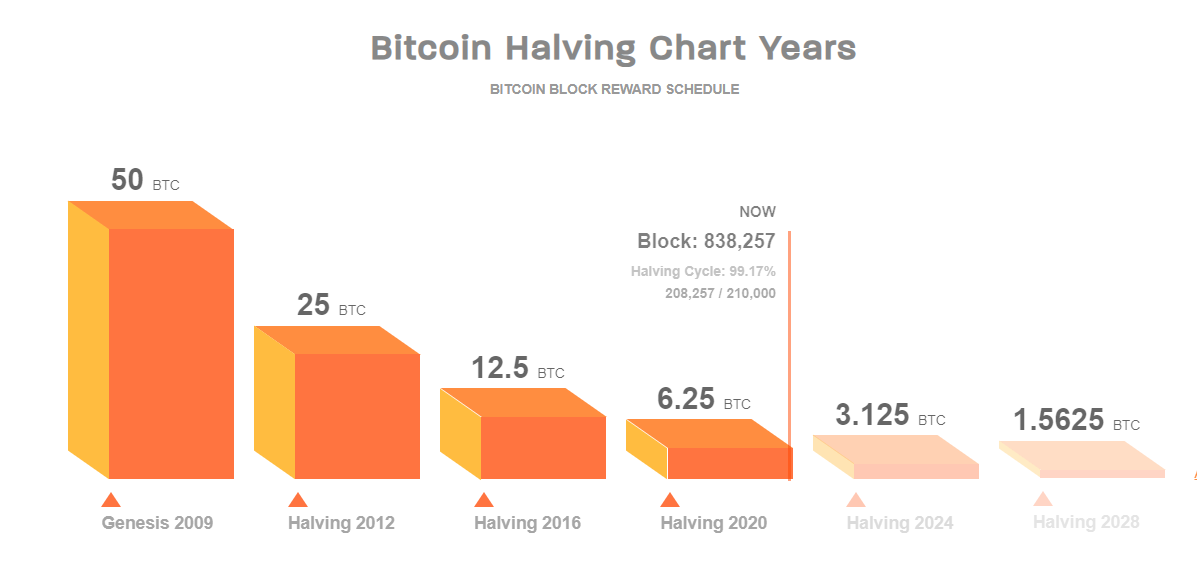

As talked about, bitcoin miners are gearing up for the fourth halving within the historical past of the decentralized protocol that may halve the block reward from the present 6.25 BTC to three.125 BTC for every solved block.

Which means that miners, excluding transaction charges earnings, earned precisely half when it comes to satoshi.

This mechanism helps cut back the emission of recent cash, pushing up the value of the cryptographic asset if there is identical pre-halving demand in the marketplace.

On the time of writing the article there are about 11 days, or relatively 1,743 blocks, left till the a lot anticipated halving that may happen precisely at block peak 840,000.

The anticipated time is roughly at 07:30 pm UTC, however it could differ barely if the common decision time of the miners had been to alter in nowadays.

In preparation for the community’s halving, many firms that supply providers associated to the world of Bitcoin mining are pondering of modern options to reduce the financial influence of the discount in block reward on their funds.

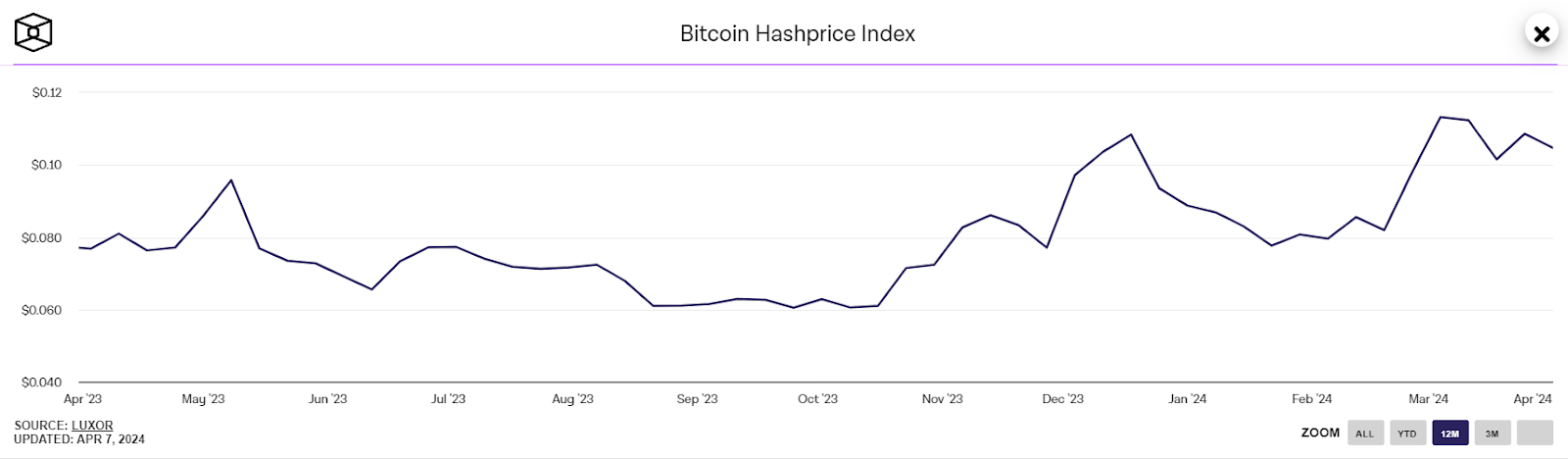

One in all these, Luxor Expertise lately collaborated with the cryptographic derivatives firm Bitnomial to attempt to supply a type of hedging to miners as a way to cowl the danger of halving revenues.

The concept is predicated on the creation of an ETF futures based mostly on the value of the community’s hash (hashprice), in order that miners can quick the instrument with a portion of their earnings.

The product shall be regulated on the inventory change relatively than in OTC kinds, making certain extra liquidity and higher safety for operators concerned within the shopping for and promoting of this asset.

Hashprice noticed a -9% decline over the previous 2 days.

Hashprice might go even decrease heading into the halving.

Nevertheless, #Bitcoin miners utilizing Luxor’s Hashrate Ahead Market are protected towards quick time period volatility. 🛡️⛏️ pic.twitter.com/sdpAih6CFD

— Luxor Expertise 🟧⛏️ (@LuxorTechnology) April 2, 2024

Past all these hedging methods to scale back the danger of mining consultants, we level out that precisely one yr in the past the hashprice (1 TH/s) was about 0.07 {dollars} whereas at this time it stands at 0.1 {dollars}.

Which means that regardless of the rise in hashrate and competitors throughout the community, miners are nonetheless capable of be worthwhile and perform their actions with out notably fearing the appearance of the halving.