Picture supply: Getty Photos

When deciding which FTSE 100 shares I plan to purchase, I feel it’s a good suggestion to think about what main hedge funds are doing.

These skilled funding companies typically take giant and typically aggressive positions in shares, together with betting towards shares they anticipate to fall in worth (often known as brief promoting).

They might pack tonnes of expertise, however identical to any humble retail investor, these mighty funds don’t all the time make the precise calls. And within the case of one in all these Footsie firms, I feel they might be mistaken. However which do I feel are price contemplating in the present day?

Kingfisher

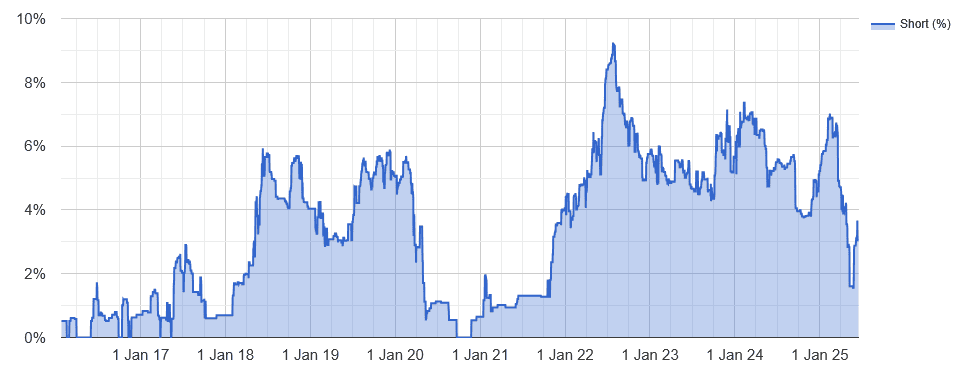

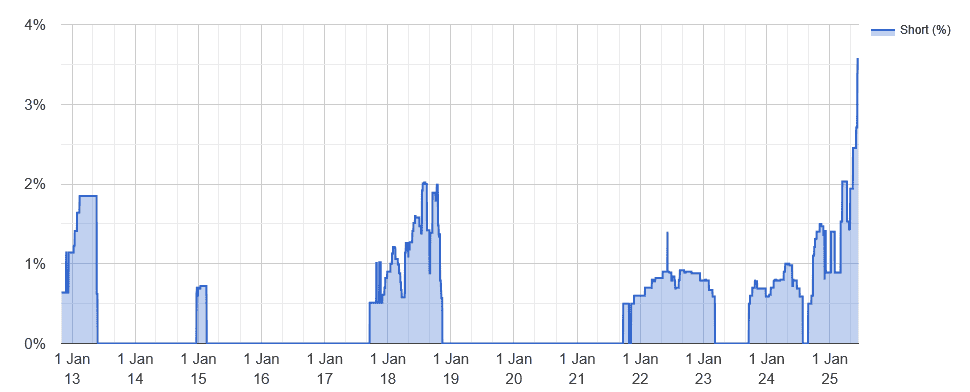

In keeping with shorttracker.co.uk, Kingfisher‘s (LSE:KGF) the third-most shorted inventory on the FTSE in the present day. Some 3.1% of its shares are shorted, putting it solely behind Sainsbury’s and WPP (LSE:WPP).

In whole, three completely different hedge funds have taken a bearish place out on the retailer.

It’s no shock to me that these institutional traders are so gloomy. Kingfisher’s been within the mire for years, pressured by weak shopper spending, growing competitors, and stress within the UK housing market. Rising labour prices and provide chain points haven’t helped issues both.

Might the B&Q proprietor be about to show the nook although? Higher-than-expected first quarter financials give trigger for some optimism –gross sales rose 2.2% within the three months to April, bucking predictions of a painful drop.

However whereas its UK operation has perked up, its French and Polish markets stay slowed down (gross sales dropped 3.2% and 1.1% within the first quarter). There’s additionally scepticism over whether or not Kingfisher can preserve the tempo up at residence because the cost-of-living disaster endures.

Given the massive dangers it poses, I feel it is a share traders could need to take into account avoiding.

WPP

As talked about, WPP’s additionally one of many FTSE 100’s most shorted shares proper now. With brief curiosity at 3.4%, and 5 funds having taken out a associated place, these establishments are literally extra bearish on the advertising and marketing big than Kingfisher.

But if I used to be given a selection, that is the blue-chip I feel traders ought to have a look at for his or her portfolios. The reality is that at present costs, I feel it’s price severe consideration by these looking for a restoration inventory.

WPP’s had a fairly depressing time of late, as ongoing financial uncertainty has seen companies trim their promoting budgets. Within the three months to March, like-for-like revenues on the agency dropped 2.7% yr on yr.

I wouldn’t be shocked if circumstances stay robust within the close to time period. Escalating commerce disputes between the US and its main buying and selling companions stay a major menace. However trying additional out, the enterprise has huge progress potential because it doubles down on digital promoting and leverages the ability of synthetic intelligence (AI). It’s spending lots of of tens of millions of kilos on this space — on platforms, instruments and workers — to drive progress right here.

At present, WPP shares commerce on a ahead price-to-earnings (P/E) ratio of 6.8 occasions. That is comfortably beneath the 10-year common of 10.7, and will present the platform for a worth rebound when market circumstances enhance. With international rates of interest falling, this will likely come prior to the market potential expects.