Picture supply: Getty Photos

Nvidia (NASDAQ: NVDA) inventory has misplaced a little bit of its shine in current months. Since peaking at $149 in early January, it has dropped 33% to only underneath $100 (as I kind).

That stated, the Nvidia share worth is ready to open round 5% increased right this moment (23 April). The rationale? Soothing phrases round China tariffs from President Trump, who has additionally distanced himself from the notion of eradicating the US Federal Reserve chair. The entire US inventory market is able to leap increased right this moment.

Sadly, a de-escalation within the US-China commerce struggle is unlikely to result in Nvidia being allowed to export its dumbed-down H20 AI accelerators to China. The 2 superpowers are nonetheless locked in a battle for international supremacy, with AI know-how on the forefront of that.

On 15 April, Nvidia introduced that it expects to take a cost of as much as $5.5bn on this quarter as a result of export restrictions. In gentle of this, I feel it’s value having a look on the newest Nvidia development and share worth targets.

Progress forecasts

Let’s begin with Q1 this 12 months, which is because of be reported in the direction of the top of Might. Proper now, analysts count on the semiconductor colossus to generate earnings per share (EPS) of $0.89. That’s down barely from current forecasts.

Having stated that, this determine would nonetheless be 46% increased than the EPS of $0.61 achieved in Q1 final 12 months.

When it comes to income, Nvidia is forecast to publish $43.1bn (65% year-on-year development). For context, that might be roughly 51% greater than the agency’s whole 2023 monetary 12 months (spanning most of 2022, earlier than ChatGPT was launched).

In different phrases, Nvidia is now making considerably extra per quarter than it was making per 12 months simply a few years again!

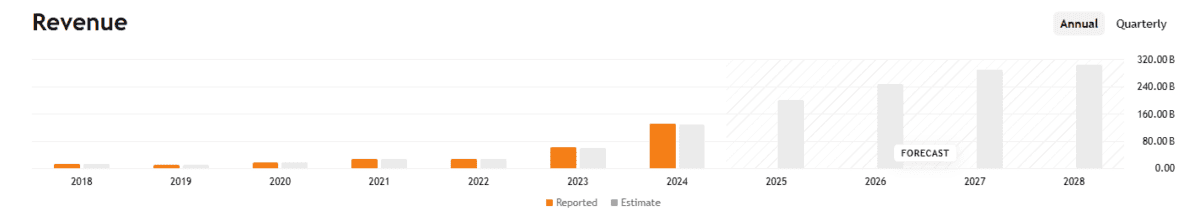

Turning to the total 12 months, analysts at the moment see income surging 54% to $201bn, with EPS of $4.43 (48% development). Then income is forecast to leap above $300bn by FY29. Hardly pedestrian!

Share worth goal

Do not forget that these figures are forecast even when AI-related gross sales to China are progressively being choked off. The thoughts boggles to suppose how briskly Nvidia could be rising if it was free to promote its strongest AI chips to Alibaba, Tencent, Baidu, ByteDance, and the remainder.

On this situation, you would need to assume excessive double-digit development for years on finish, in all probability placing the agency’s market cap considerably increased than its present $2.4trn.

Alas for shareholders, the Chinese language AI sector is now turning to Huawei as Nvidia exits the AI market altogether. This problem, mixed with tariffs and the danger that US tech giants might decrease their AI-related spending, has damage sentiment for Nvidia shares.

In response, many analyst groups have lately been reducing their worth targets. Financial institution of America Securities, for instance, has diminished its goal from $200 to $160.

The present consensus amongst Wall Avenue analysts is $164 — roughly 66% increased than the present degree.

Based mostly on this 12 months’s EPS estimate, the inventory’s forward-looking price-to-earnings (P/E) ratio is simply 23. That is forecast to fall to a bit underneath 18 by subsequent 12 months.

Nvidia doesn’t come with out danger, together with rising competitors and provide chain uncertainties associated to the brewing commerce struggle. However at its present valuation, I feel it’s value contemplating for long-term traders.