Picture supply: Getty Photos

The FTSE 100‘s among the best locations in my view to purchase passive earnings shares. The UK’s blue-chip share index is filled with shares whose sturdy steadiness sheets, market-leading positions and numerous income streams make them nice candidates for long-lasting dividend earnings.

The Footsie‘s loved sturdy good points over the past 12 months. This has in flip pulled the index’s ahead dividend yield down to three.2%. That’s on the decrease finish of the 3-4% long-term common traders have loved.

However that’s nonetheless far greater than different international share indices. And what’s extra, traders can nonetheless get far greater yields than this by choosing some selection particular person shares.

Right here, I’ll present you the way traders might make a £1,000 month-to-month passive earnings with a portfolio of FTSE-listed dividend shares.

A 5-star portfolio

At the moment, among the FTSE 100’s highest dividend shares function within the monetary providers sector. The three I’m selecting for our mini portfolio are Authorized & Common (LSE:LGEN), Phoenix Group and Aviva.

Authorized & Common shares at the moment provide the best dividend yield amongst this grouping, at 9%. Phoenix follows scorching on its heels with an 8.5% yield. Aviva’s decrease however nonetheless provides a tasty 5.5%.

Every of those companies are market leaders and generate substantial quantities of money they’ll distribute to shareholders. In addition they have wonderful long-term progress potential as ageing populations and rising engagement in monetary planning drive product demand.

The opposite corporations our five-share dividend portfolio are packaging producer Mondi — which stands to achieve from the e-commerce increase — and defensive share Nationwide Grid. These shares yield 6.1% and 5.5% respectively.

Heroic efficiency

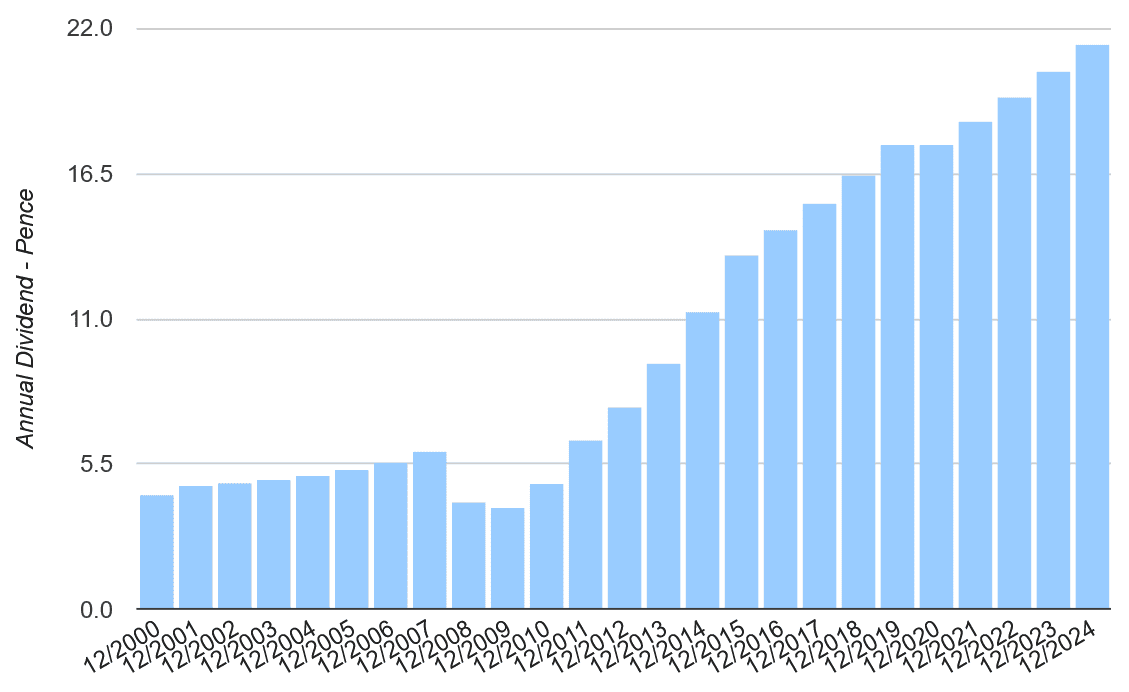

Authorized & Common’s one of many FTSE 100’s true dividend heroes, in my opinion. And that’s not simply due to its huge, near-double-digit dividend yield.

It’s raised annual dividends nearly yearly because the Nice Monetary Disaster. The one exception was in 2020 when it froze dividends in the course of the pandemic. And even then, it carried out higher than many different blue-chips that slashed or cancelled dividends.

Like different monetary providers suppliers, earnings are extremely delicate to broader financial circumstances. And proper now the outlook stays unsure as inflation rises and the financial system splutters.

Encouragingly nonetheless, Authorized & Common has demonstrated resilience on this atmosphere, with underlying working revenue climbing 6% within the first half It’s additionally nicely capitalised to assist it climate any volatility and hold paying massive and rising dividends. Its Solvency II ratio was 217% as of June.

A prime FTSE portfolio

In fact, there are threats going through every of the 5 dividend shares I’ve chosen. Dividends at Aviva and Phoenix might disappoint if client spending weakens. They might too at Mondi, which can be weak to commerce tariffs. Nationwide Grid’s dividends could come below strain if capital expenditure balloons.

However I nonetheless suppose the common 6.9% dividend yield makes this mini portfolio value consideration. A £174,000 fund, with equal sums invested throughout the 5 shares, this might generate a month-to-month passive earnings of £1,000.

That’s not a small sum. However somebody might hit this goal with a £500 month-to-month funding in simply over 15 years, assuming a mean annual return of 8%.