Inventory change market idea, Hand dealer contact on digital pill with graphs evaluation candle line on the desk in workplace, diagrams on display.

The FTSE 250 generally is a excellent spot to go looking for progress shares. Comprising a whole bunch of prime corporations, this index of UK mid-cap shares offers diversified publicity throughout a variety of industries.

Traders have to be aware that progress shares will be risky when financial circumstances worsen. What’s extra, the FTSE 250 can be full of companies which might be depending on a robust British financial system, creating some geographical threat.

Nonetheless, traders can goal to handle this threat by constructing a broad portfolio than covers completely different areas, industries, and sub-sectors. With a whole bunch of shares to select from, that is effectively inside attain.

A diversified portfolio

However what may a diversified portfolio like this seem like? I believe a basket of 15-20 shares offers a great way to steadiness threat and supply publicity to completely different progress alternatives.

Right here’s one potential lineup of prime shares:

| FTSE 250 inventory | Sector | Most important areas |

|---|---|---|

| Softcat (LSE:SCT) | IT providers | UK |

| TBC Financial institution Group | Banking | Georgia, Uzbekistan |

| Bloomsbury Publishing | Publishing | UK, US |

| QinetiQ Group | Defence | UK, US |

| Hochschild Mining | Mining | Brazil, Peru, Argentina |

| Allianz Know-how Belief | Funding trusts | US |

| Spectris | Digital and electrical gear | US, China, Germany |

| Bakkavor Group | Meals manufacturing | UK, US, China |

| Chemring | Defence | UK, US, Mainland Europe |

| Bellway | Housebuilding | UK |

| Gamma Communications | Telecommunications | UK, Mainland Europe |

| Senior | Aerospace | UK, US |

| Baillie Gifford US Development Belief | Funding trusts | US |

| AJ Bell | Monetary providers | UK |

| Oxford Nanopore Applied sciences | Prescribed drugs and biotechnology | International |

This assortment of 15 shares covers a variety of actions, from making sandwiches and producing explosives to digging for gold and growing on-line safety. Although there’s a clear UK bias, lots of the portfolio’s holdings has substantial operations in different developed areas and fast-growing rising markets, too.

Due to the inclusion of funding trusts, our basket has publicity to 190 corporations in whole. Tech-heavy trusts Allianz Know-how Belief and Baillie Gifford US Development Belief additionally embrace many high-performing US shares like Nvidia, Microsoft, Meta, Amazon, and Cloudflare.

Gentle energy

This excessive focus of know-how shares leaves it susceptible to cyclical slowdowns. I believe it additionally means the belief enjoys big long-term progress potential due to booming markets like synthetic intelligence (AI), cloud computing, robotics, and on-line procuring.

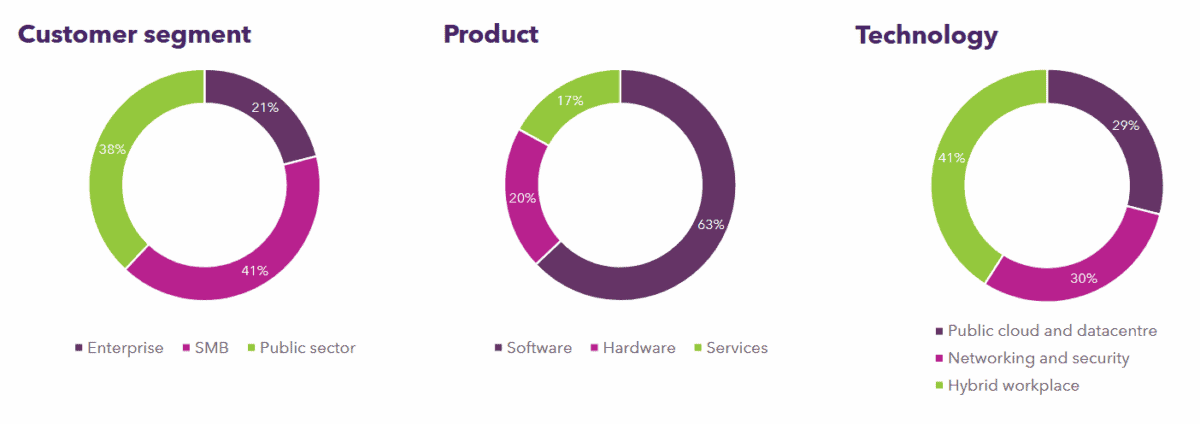

Trying nearer to residence, Softcat is a FTSE 250 share that’s collaborating within the booming digital financial system. And because the graphic beneath reveals, it does so in a extremely diversified method:

This method has appreciable benefits, together with enhancing cross-selling alternatives, lowering dependence on one phase or buyer sort to drive revenues, and boosting buyer retention.

It’s a mannequin that’s proved extremely profitable. Softcat’s working earnings have elevated at a compound annual progress fee (CAGR) of 15.8% over the past decade.

Income can nonetheless dip when financial circumstances worsen and companies trim spending. However the firm’s latest resilience suggests it has the instruments to climate the worst of any downturn. Revenues and working revenue rose 16.8% and 10.4% respectively within the six months to January.

With money and money equivalents of £141m, Softcat has appreciable scope to speculate for progress as effectively. On steadiness, I believe it could possibly be the most effective UK progress shares to contemplate.