Picture supply: The Motley Idiot

As a long-term investor, I search for shares to purchase and maintain. That doesn’t at all times occur, after all. Generally what looks like an important funding can flip bitter for some purpose and I resolve to promote it.

However ideally, I might be completely happy to take the Warren Buffett method to investing and purchase shares in excellent corporations at engaging costs, then maintain them for years, and even many years.

Defining the search space

To start, it helps to know what you might be in search of – and be prone to spot it once you see it! So once more like Buffett, I persist with my “circle of competence” when investing. In different phrases, when in search of shares to purchase, I seek for companies I can perceive and assess.

Why a aggressive benefit is vital

Inside these areas, I give attention to companies I believe have a aggressive benefit (what Buffett calls a ‘moat‘). That’s vital as a result of such a bonus will help set an organization other than its rivals, giving it pricing energy. When an organization has some energy to set its personal costs not simply observe the market stress, that may be good for income.

For example, I personal shares in Diageo (LSE: DGE). The FTSE 100 firm owns manufacturers reminiscent of Guinness and Smirnoff. That helps give it pricing energy.

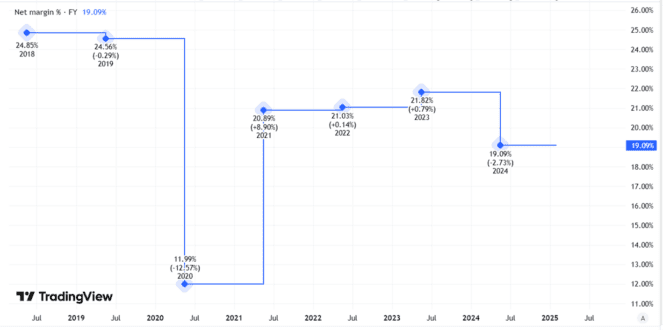

So Diageo has a internet margin of round 20%, that means that even after it pays all its prices and taxes, it nonetheless makes round 20p for every £1 of merchandise it sells.

Created utilizing TradingView

For an organization whose revenues topped £20bn final yr, that provides as much as a lot of revenue!

Determining how I can revenue

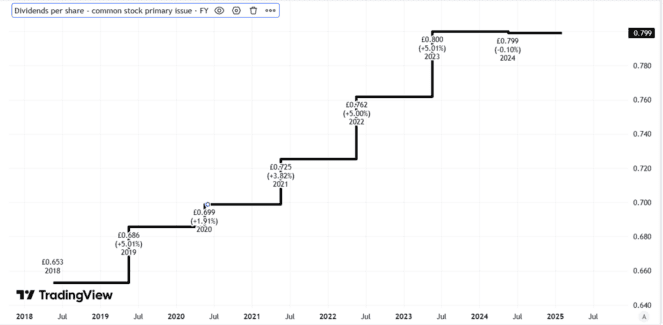

So what does Diageo do with all these income? It makes use of a few of them to pay a dividend. Certainly, Diageo is a rarity amongst FTSE 100 companies as a result of it has raised its dividend per share yearly for many years.

Created utilizing TradingView

Hopefully, that can final. However it might not as dividends are by no means assured. Diageo faces a variety of dangers that would eat into income, from weak demand in Latin America to rising ranges of teetotalism amongst youthful generations.

Dividends are just one means I would generate income from proudly owning a share although. I might additionally profit from share value development (although solely once I come to promote the shares).

Like dividends although, such development isn’t assured. Certainly, a share might fall so I find yourself shedding cash once I promote it.

Certainly, if an investor purchased Diageo shares 5 years in the past and bought them at present, they’d get again 22% lower than they paid for them. Even taking 5 years’ price of dividends under consideration, they’d nonetheless have misplaced cash general.

So when in search of shares to purchase, I at all times ask myself how I would generate income from them. If I pay greater than I believe they’re price, it hardly looks like I’m setting myself up for possible success.

As an alternative, I attempt to discover shares I should purchase for lower than I believe their long-term worth will probably be – and any dividends alongside the way in which could possibly be a welcome bonus.

That’s the reason I purchased Diageo shares for my portfolio final yr.