Picture supply: Getty Photos

Like many Britons, I got here to the realisation a while in the past that the State Pension will unlikely be sufficient to assist me retire comfortably. So by a mix of the Money ISA and Shares and Shares ISA, I’ve set about making an attempt to repair this.

This week, the Workplace for Price range Accountability (OBR) reported that State Pension spending “rose from round 2% of GDP within the mid-Twentieth century to round 5% of GDP (£138bn) at this time, and is estimated to rise additional to 7.7% of GDP by the early 2070s“.

Such development is unsustainable, and prone to lead to a) advantages that fail to maintain up with inflation, b) a gentle rise within the age at which claims could be made, or c) each.

Taking cost

I don’t learn about you, however I hope to thrive, and never simply survive, after I retire. I would like one thing to point out for having labored exhausting for many of my life.

So I’m lowering my dependence on the State Pension afterward and hope to turn out to be completely financially unbiased. A part of my technique entails usually investing in a Money ISA and Shares and Shares ISA, alongside placing cash apart in a Self-Invested Private Pension (SIPP).

Every of those merchandise permits me to construct wealth freed from tax. The financial savings I make could be appreciable over time, which I can make investments to spice up the compound development of my portfolio.

Please be aware that tax therapy relies on the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is offered for info functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation. Readers are chargeable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

My technique

That stated, the quantity I dedicate to every one differs quite a bit. Whereas a money account safeguards my capital and supplies a assured return, utilizing this alone is unlikely to assist me retire in consolation.

The numbers converse for themselves. Since 2015, the common Money ISA consumer has acquired a mean annual return of 1.2%. That’s considerably beneath the 9.6% that these proudly owning shares in an investing ISA have loved.

For that reason, I make investments round 20% of my spare money within the former, and 80% in shares, trusts and funds with the latter and thru my SIPP.

Like most individuals, the quantity I make investments varies from month to month. But when I can obtain the identical returns of the final decade, a £500 month-to-month funding break up throughout these strains will — after 30 years — give me a sizeable pension pot of £873,872.

Speaking trusts

I personal a diversified vary of belongings in my Shares and Shares ISA and SIPP. And extra lately, I’ve been focusing on funding trusts to unfold danger whereas nonetheless focusing on mighty returns.

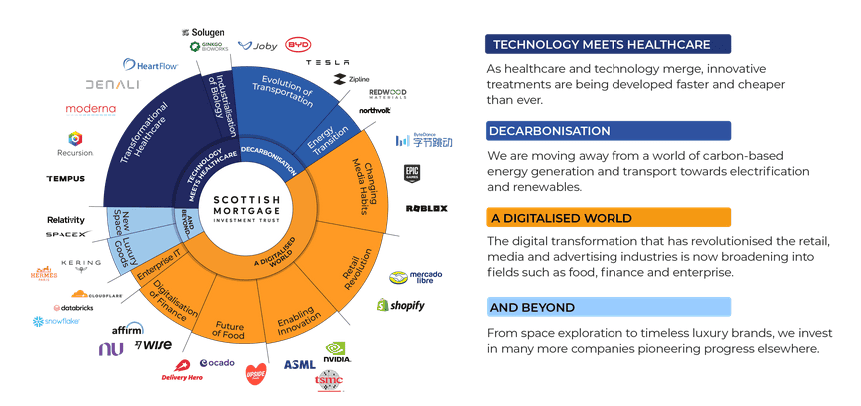

Scottish Mortgage Funding Belief (LSE:SMT) is one I’m contemplating at this time. Whereas its identify could recommend in any other case, this monetary automobile focuses mainly on expertise shares. It’s a method that leaves it susceptible throughout financial downturns, however which I’m assured additionally supplies important long-term development potential.

As you possibly can see, the fund invests in corporations (95 in all) which might be nicely positioned to capitalise on a number of ‘megatrends’.These embrace business heavyweights akin to Nvidia, BYD and Shopify, which have market main positions and robust information of innovation. Nevertheless it additionally holds shares in a variety of smaller, personal corporations that would ship superior development from this level on.

Since 2015, the fund’s offered a mean annual return of 14.6%. I really feel it may very well be an incredible portfolio addition to assist me retire in consolation.